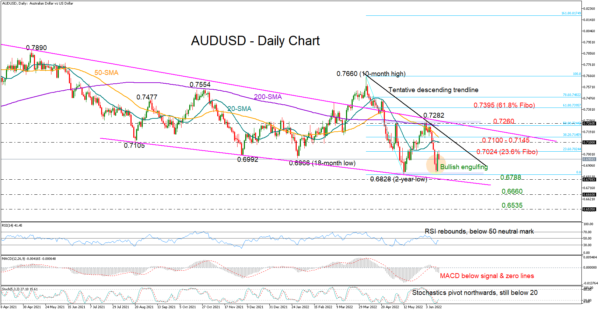

AUDUSD has not successfully entered the 0.7000 zone yet despite its impressive post-FOMC rally, which lifted the price by almost 2.0% to 0.7034.

The 23.6% Fibonacci retracement of the 0.7660 – 0.6828 downleg was another struggle yesterday at 0.7024, though the latest big green candlestick seems to be part of a bullish engulfing pattern: an encouraging sign that the rebound could gain more legs in the near term. The upside reversal in the RSI and the Stochastics is sending positive vibes as well, though traders may retain some caution as the indicators remain within the bearish area, while the MACD continues to point downwards.

A clear close above the 0.7000 – 0.7024 bar could initially pause within the 0.7100 – 0.7145 region, where the 20- and 50-day SMAs and the 38.2% Fibonacci level are located. Running higher, the bulls will push for a break above the 200-day SMA and the upper boundary of the bearish channel at 0.7260. The 50% Fibonacci is also in the same neighborhood; therefore, any violation at this point is expected to drive the price straight up to the 61.8% Fibonacci of 0.7395.

Otherwise, a downside reversal may retest the floor around the 2-year low of 0.6826 ahead of the channel’s bottom line seen at 0.6788. A decisive step lower may promote an extension towards the familiar barricade of 0.6660, which had been strongly rejecting upside and downside moves during the 2019 – 2020 period. In case the latter fails to hold, the next stop could be near the 0.6535 mark last seen in May 2020.

In brief, Wednesday’s bounce in AUDUSD has raised the odds for further improvement. A close above 0.7000 could bolster buying interest.