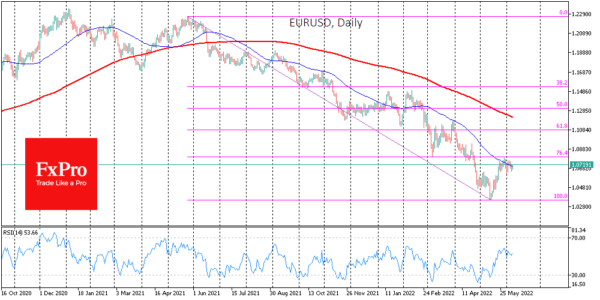

The single currency returned under 1.0700 after three days of decline. Late last month, EURUSD failed to consolidate above the 50-day moving average, confirming the prevalence of the downtrend.

The bounce in the pair in the second half of last month should be seen as a technical correction after accumulated oversold conditions after 12 months of a downtrend. That bounce lost its strength on the approach of the 50-day moving average and near the 76.4% Fibonacci retracement line. Such shallow corrections are characteristic of strong trending markets, setting up for a further leg down.

The EURUSD is in a reduced volatility mode waiting for another ECB decision tomorrow. Earlier, in AUD and NZD examples, we saw that raising the rate by 50 points does not guarantee a surge in the currency, even if the decision was more hawkish than the markets expected.

The lull in the euro could be a case of waiting and looking for a suitable excuse to resume a selloff in EURUSD, and the ECB meeting followed by a press conference looks like a pretty significant one.

The market is prepared that the ECB will not change policy now but will signal a rate hike at the end of July and complete its QE purchases by the end of this month. On the fundamental analysis side, this stance is much softer than competitors, continuing to put pressure on the euro.

Helping the euro not to repeat the fate of the yen tomorrow might be the unexpected resolve of the ECB and a higher speed of monetary policy normalisation compared to the US. The euro zone’s monetary authorities are bound by the region’s weak macroeconomic performance and high debt burdens in several countries.

Europe finds itself somewhere in the middle between the US and Japan regarding the balance of economic growth and the ability to digest rate hikes. The single currency could find itself in its dynamics against the dollar and yen somewhere between these poles.