Overall market sentiment is positive in the market today, even though trading is subdued with some European countries on holiday. Sterling is trading higher with commodity currencies. On the other hand, Swiss Franc is is the weakest one, followed by Yen and Dollar. Euro is mixed for now. In other markets, Gold is struggling in tight range while WTI crude oil is still gyrating around 120 handle.

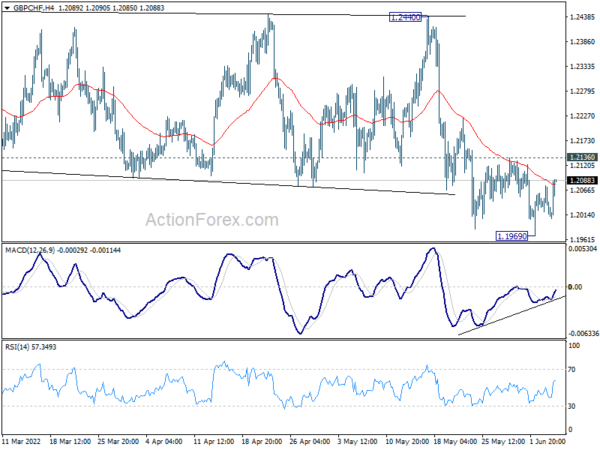

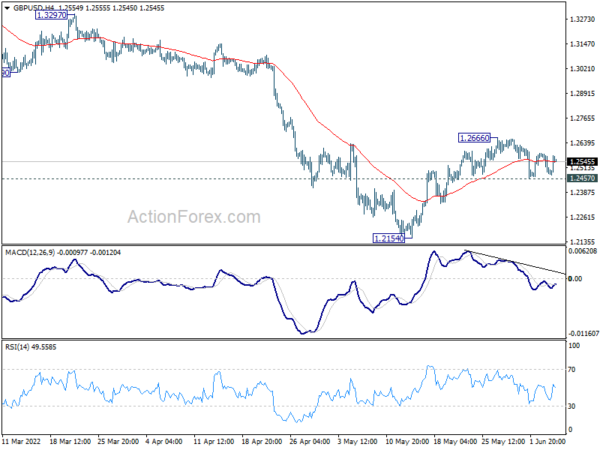

Technically, however, the upside momentum in Sterling is not too convincing, however, except versus Yen. At least, GBP/USD will have to break through 1.2666 minor resistance to resume the the rebound from 1.2154 to be a sign of sustainable buying. Or, GBP/CHF will have to break through 1.2136 minor resistance to confirm short term bottoming at 1.1969.

In Europe, at the time of writing, FTSE is up 1.30%. DAX is up 1.33%. CAC is up 1.32%. Germany 10-year yield is down -0.0003 at 1.279. Earlier in Asia, Nikkei rose 0.56%. Hong Kong HSI rose 2.71%. China Shanghai SSE rose 1.28%. Japan 10-year JGB yield rose 0.0092 to 0.246.

Nikkei hits 2-mth high, ready to extend near term up trend

Riding on broadly positive risk sentiment, Japan’s stock indexes surged to highest level in over two months. Topix finished 0.31% higher while Nikkei rose 0.56%. Among the gainers, air and land transportation shares are lifted by optimism that tourism is coming back to Japan.

Based on current momentum, Nikkei should be ready to resume the whole rebound from 24681.74. 28338.81 resistance is the first test, and break will target 100% projection of 24681.74 to 28338.81 from 25688.10 at 29345.17. For now, it’s still too early to call for long term up trend resumption in the index. 30k handle could still present huge psychological resistance. But in any case, further rally will remain in favor as long as 27251.24 minor support holds.

Meanwhile, it should also be noted that the long term outlook in Nikkei is staying bullish, despite the correction that lasted one and half year. It’s holding comfortably above 24129.34 structural resistance, as well as 55 month EMA. Both are keeping the up trend from 6994.89 (2008 low) intact.

Kuroda: BoJ takes a strong stance on continuing with monetary easing

BoJ Governor Haruhiko Kuroda said in a speech that the economy is “still on its way to recovery from the pandemic and has been under downward pressure from the income side due to rising commodity prices”. In this situation, “monetary tightening is not at all a suitable measure”.

He added that the top priority is to “persistently continue with the current aggressive monetary easing centered on yield curve control”. And, unlike other central banks, BoJ has noted faced the “the trade-off between economic stability and price stability”. Hence, it’s “certainly possible for the Bank to continue stimulating aggregate demand from the financial side.”

He concluded that BoJ “will take a strong stance on continuing with monetary easing, in that it will provide a macroeconomic environment where wages are likely to increase so that the rise in inflation expectations and changes in the tolerance of price rises — which have started to be seen recently — will lead to sustained inflation.”

China Caixin PMI services rose to 41.4 in May, composite rose to 42.2

China Caixin PMI Services rose form 36.2 to 41.4 in May, but missed expectation of 47.3. Caixin said services activity fell at softer, but still sharp rate amid COVID-19 restrictions. Drop in overall new work moderated. Input cost inflation eased to nine-month low. PMI Composite rose from 37.2 to 42.2.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Overall, in May, local Covid outbreaks continued and manufacturing and services activity improved slightly, but continued to contract, with services hit harder. Demand was slightly stronger than supply. The fallout from the epidemic on market supply and demand has been transmitted to the labor market, which is deteriorating at a faster pace in both the manufacturing and services sectors. Disrupted supply chains and longer logistics delivery times have yet to improve. Businesses remained under great cost pressure.”

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2455; (P) 1.2522; (R1) 1.2559; More…

GBP/USD is staying in tight range below 1.2666 and intraday bias remains neutral. On the downside, break of 1.2457 minor support will suggest that rebound from 1.2154 has completed. Intraday bias will be back on the downside for resting this low. On the upside, above 1.2666 will target 55 day EMA (now at 1.2722) and above.

In the bigger picture, fall from 1.4248 (2018 high) could be a leg inside the pattern from 1.1409 (2020 low), or resuming the longer term down trend. Deeper decline is expected as long as 1.2999 support turned resistance holds. On resumption, next target is 1.1409 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:00 | AUD | TD Securities Inflation M/M May | 1.10% | -0.10% | ||

| 01:45 | CNY | Caixin Services PMI May | 41.4 | 47.3 | 36.2 |