The Eurozone’s flash estimates for May inflation are scheduled to be released on Tuesday (09:00 GMT) as the European Central Bank ponders how quickly to exit negative rates. The June 9 policy meeting is fast approaching and with some Governing Council members arguing for a 50 basis point rate hike, the data could influence how speedily the ECB moves to normalize policy. It could also be important for the euro, which has rebounded impressively against the US dollar but may struggle to make additional gains without fresh impetus.

Inflation to accelerate again in May

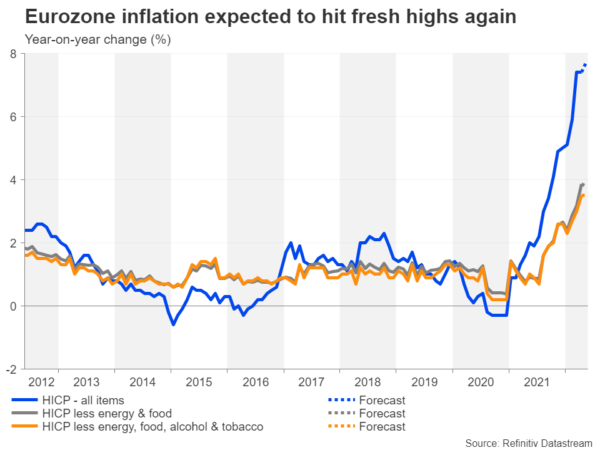

There can be no doubt the ECB is behind the curve when it comes to taming inflation as euro area prices are rising at a record pace, and even underlying measures of inflation have jumped well above the 2% target. Like the Fed, the ECB had hopes that the surge in prices, driven mostly by supply constraints and the energy crisis, would subside after a few months. But that hasn’t happened. The harmonised index of consumer prices (HICP) stood at 7.4% higher in April compared to a year ago. Although this was unchanged from the prior month, headline inflation is expected to have accelerated again in May. It’s forecast to edge up to 7.7% in the flash estimate.

The core measures of inflation remain a lot lower but they are without a doubt also spiralling higher, casting doubt on President Christine Lagarde’s long held argument that the inflation problem in the Eurozone is mainly an energy one. However, there might be some signs of moderation in the pace of increase in May. HICP excluding food and energy hit 3.9% y/y in April and is forecast to have dipped slightly to 3.8% in May. When excluding alcohol and tobacco as well, HICP is expected to have stayed unchanged at 3.5% y/y.

It’s the 25 bps vs 50 bps question

In recent weeks, key ECB officials have been busy publicly airing their views on when and how the central bank should halt its asset purchases and begin raising rates. Although there seems to be some difference of opinions, policymakers appear to have largely converged towards the idea of completely ending QE in early July and hiking rates later that month. The only remaining niggle between some policymakers is whether or not the ECB should opt for a 25-bps rate rise or a more aggressive 50-bps one.

The latter option is unlikely. However, the fact that some Governing Council members are pushing for this suggests that bigger-sized rate increases could be on the cards later in the year, especially if inflation keeps shooting higher. At the moment, the probability of a 50-bps move in money markets is quite low, but the odds could pick up substantially if Tuesday’s inflation data is a lot stronger than anticipated.

Euro rebound gaining traction

This would of course provide another tailwind for the euro, which has already gathered quite a bit of positive momentum on the back of all the rate hike talk. The timing of the ECB’s liftoff has coincided with growing speculation that inflation in the US is peaking and that the Fed may subsequently pause its tightening cycle later in the year, and this is bolstering the euro/dollar dynamic in the euro’s favour.

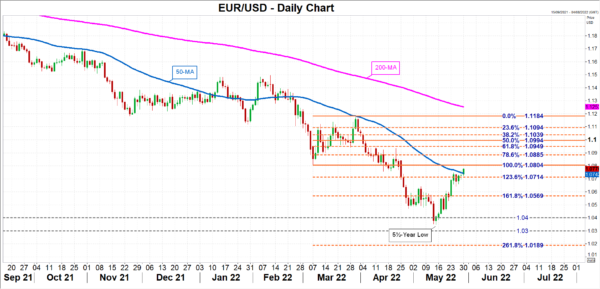

The single currency is currently attempting to break above its 50-day moving average and has scaled a fresh one-month high of $1.0779. However, the $1.08 region slightly above might prove to be a tougher resistance point for the pair so a strong set of inflation numbers could help it to overcome this barrier. Further up, the next major obstacle for euro/dollar is the 61.8% Fibonacci retracement of March upleg at $1.0949.

If, though, the euro rally begins to lose steam, a pullback towards the 161.8% Fibonacci extension of $1.0569 is probable. A drop below this level, however, could pave the way for a re-test of the almost 5½-year trough of $1.0348 set on May 13.

In the somewhat bigger picture, the euro should remain supported as the focus for the ECB shifts towards tightening and as investors pare back some of their more aggressive bets for Fed rate hikes. But the bullish bias is at risk of faltering if Eurozone growth data, which for the time being is holding up surprisingly well, starts to turn south in the coming weeks.