Dollar is maintaining most of the post-FOMC gains against other major currencies. But it’s turning softer against Euro and Sterling today. Better than expected job data provides no inspiration to the greenback. While developments in USD/CHF and USD/JPY are bullish, GBP/USD shows the Pound is still having an upper hand against Dollar. EUR/USD is staying well above 1.1822 support zone and maintaining near term bullishness too. Nonetheless, it’s the selloff in Aussie and Kiwi that catches most eyes. RBA Governor Philip Lowe’s comments suggest that he’s in no hurry to follow other central banks in tightening. But the main driver is S&P’s downgrade of China’s sovereign credit rating.

S&P lowered China rating to A+

S&P Global Ratings lowered China’s sovereign credit rating by one step to A+, down from AA-. That’s the first rating cut since 1999. S&P warned that "China’s prolonged period of strong credit growth has increased its economic and financial risks." And, "although this credit growth had contributed to strong real gross domestic product growth and higher asset prices, we believe it has also diminished financial stability to some extent." That’s the second downgrade by major rating agencies this year. Moody’s downgraded China from Aa3 to A1 earlier in May. The Finance Minister has yet to respond yet. Some economists noted that time impact of the downgrade on China will be limited. That’s due to the low reliance on external funding, due to huge domestic savings and tight capital account control.

RBA Lowe in no hurry to hike

RBA Governor Philip Lowe said today that "some normalization of monetary conditions globally should be seen as a positive development, although it does carry risks. It is a sign that economic growth in advanced economies has become self-sustaining, rather than just being dependent on monetary stimulus." However, he emphasized that "a rise in global interest rates has no automatic implications for us here in Australia." Though, "an increase in global interest rates would, over time, be expected to flow through to us, just as the lower interest rates have." But, "our flexible exchange rate though gives us considerable independence regarding the timing as to when this might happen." The comments suggest that RBA is in no hurry to follow other central banks to raise interest rates.

ECB growth yet to translate into inflation

ECB monthly bulletin noted that "ongoing economic expansion provides confidence that inflation will gradually head to levels in line with its inflation aim". However, it has yet to "translate sufficiently into stronger inflation dynamics." And therefore, "a very substantial degree of monetary accommodation is still needed for underlying inflation pressures to gradually build up and support headline inflation." Nonetheless, ECB sounded upbeat on employment as "the swift decline in euro area unemployment is particularly encouraging against a background of increasing labour supply." ECB is widely expected to announce some sort of recalibration of monetary policy in October. There will be a number of occasions in the coming data for officials to express their stance and arguments. President Mario Draghi will speak today. Executive Board members will Vitor Constancio, Peter Praet, Benoit Coeure, Sabine Lautenschlaeger and Yves Mersch will all speak at multiple events around Europe.

BoJ Kuroda left door open for further easing

BoJ Governor Haruhiko Kuroda said in the post meeting press conference that the central bank will "patiently continue accommodative monetary policy to achieve 2 percent inflation." And he pledged to "adjust policy as needed looking at economic, price and financial developments. He also kept the door open for "further monetary easing steps if necessary." On some recent topics, Kuroda said that "it’s inappropriate to alter or abandon our 2 percent inflation target." Meanwhile, BOJ policymakers are "carefully watching progress on fiscal discipline as it would affect not just fiscal policy but monetary policy." It’s reported earlier this week that Japan Prime Minister Shinzo Abe will dissolve the parliament later this month and call for a snap election in October. And Abe will push back the timing of primary budget surplus by a few years, from fiscal 2020 to later in the decade.

BoJ left monetary policy unchanged today as widely expected. Short term policy interest is kept at -0.1%. And the central bank will continue to dive 10 year JGB rate at around 0%. Annual pace of monetary base expansion is kept at JPY 80T under the yield curve control framework. The biggest surprise for the decision is that new comer Goushi Kataoka dissented as he believed that "monetary easing effects gained from the current yield curve were not enough for 2 percent inflation to be achieved around fiscal 2019". And Kataoka also "opposed the description on the outlook for the CPI" as " possibility of the rate of change increasing toward 2 percent from 2018 onward was low at this point."

But after all, Kataoka’s dovish voice is indeed not much of a surprise. He has been considered a vocal, firm advocate of aggressive monetary easing. And he’s believed to be brought in by Prime Minister Shinzo Abe to replace the relatively hawkish voice of former policymaker Takahide Kiuchi and Takehiro Sato. One could even argue that it’s actually a surprise that Kataoka is not dovish enough to push for rate cut of expanding the QQE program.

Fed still on course for a December hike

Yesterday, Fed finally made formal announcement that it would begin normalizing the balance sheet in October. As indicated in June, the process does not involve active selling of securities, but a passive run-off of its holdings. The policy rate also stayed unchanged at 1-1.25%. The overall tone of the statement and the press conference came in more hawkish than expected. Despite downward revision in the core CPI for this year, the staff upgraded the economic growth outlook and downgraded the unemployment rate forecast.

The median dot plot continued to project one more rate hike this year, followed by three more increases in 2018. As CME’s 30-day Fed funds futures suggested, bets for a December hike markedly jumped to 73.4% from 57.7% in the prior day. The overall tone signaled that the Fed is committed to carry on the rate hike schedule (three increases for 2017) as indicated earlier this year. Barring a ‘material’ change in the economic outlook, the Fed should implement its rate hike and balance sheet normalization policies any planned. More in Fed To Reduce Balance Sheet From October, Committed To One More Rate Hike This Year.

More on FOMC:

- FOMC Review: Unchanged Hiking Signals As QT Is Set To Begin Next Month

- FOMC: Gauging Normality For Investors: Real Rates Positive

- Fed Announces Tapering But No Rate Hike; Unchanged Dots Seen as Hawkish

- FOMC Leaves Rates Unchanged and Sticks to its Plans to Gradually Unwind Balance Sheet

On the data front

US Initial jobless claims dropped -23k to 259k in the week ended September 16, much lower than expectation of 302k. That’s the 133 straight weeks of sub-300k reading. Continuing claims rose 44k to 1.98m in the week ended September 9. Philly Fed business outlook improved strongly to 23.8, up from 18.9 and beat expectation of 17.5. House price index rose 0.2% mom in July. Canada wholesales rose 1.5% mom in July. UK public sector borrowing rose to GBP 5.1b in August. Swiss trade surplus narrowed to CHF 3.17b in August. New Zealand GDP grew 0.8% qoq in Q2, in line with expectation. Japan all industry index dropped -0.1% mom in July.

AUD/USD Mid-Day Outlook

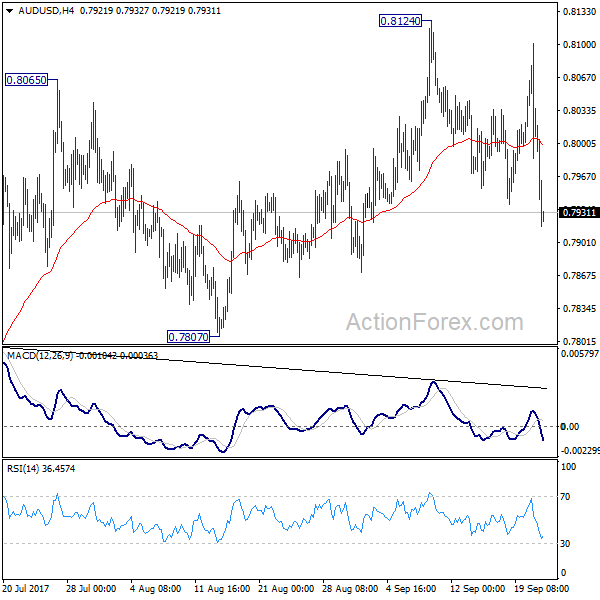

Daily Pivots: (S1) 0.7976; (P) 0.8039; (R1) 0.8093; More…

AUD/USD drops sharply to as low as 0.7917 so far today. But it’s still staying in range of 0.7807/8124. Intraday bias remains neutral first. Deeper fall cannot be ruled out. But still, with 0.7807 support intact, near term outlook stays bearish and another rise is expected. Break of 0.8124 will turn bias to the upside and target 100% projection of 0.6826 to 0.7833 from 0.7328 at 0.8335 next. However, considering bearish divergence condition in 4 hour MACD, firm break of 0.7807 will indicate near term reversal and turn bias back to the downside for 0.7328 key support.

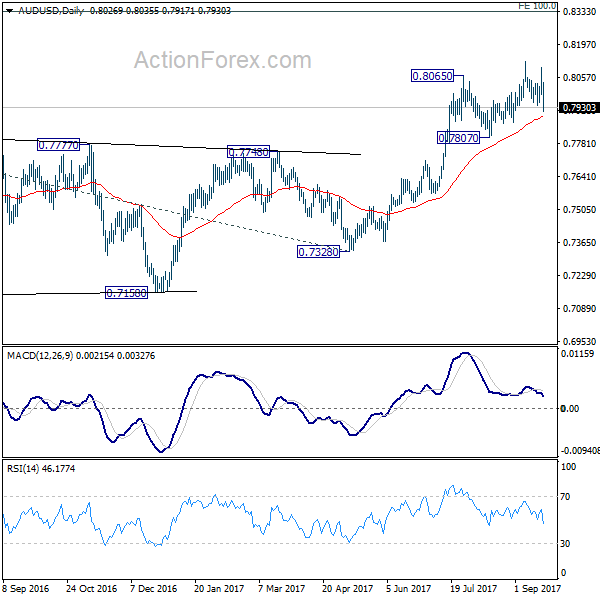

In the bigger picture, rise from 0.6826 medium term bottom is still in progress. At this point, there is no confirmation of trend reversal yet and we’ll continue to treat such rebound as a corrective pattern. But in any case, break of 55 month EMA (now at 0.8090) will target 38.2% retracement of 1.1079 to 0.6826 at 0.8451. Break of 0.7807 support is needed to to be the first sign of completion of the rebound. Otherwise, further rise is now in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| JPY | BoJ Monetary Policy Statement | |||||

| 22:45 | NZD | GDP Q/Q Q2 | 0.80% | 0.80% | 0.50% | 0.60% |

| 04:30 | JPY | All Industry Activity Index M/M Jul | -0.10% | -0.10% | 0.40% | 0.20% |

| 05:45 | CHF | SECO Economic Forecasts | ||||

| 06:00 | CHF | Trade Balance (CHF) Aug | 3.17B | 2.41B | 3.51B | 3.49B |

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 08:30 | GBP | Public Sector Net Borrowing (GBP) Aug | 5.1B | 6.5B | -0.8B | |

| 12:30 | CAD | Wholesale Sales M/M Jul | 1.50% | -0.90% | -0.50% | -0.60% |

| 12:30 | USD | Initial Jobless Claims (SEP 16) | 259K | 302K | 284K | 282K |

| 12:30 | USD | Philadelphia Fed Business Outlook Sep | 23.8 | 17.5 | 18.9 | |

| 13:00 | USD | House Price Index M/M Jul | 0.20% | 0.40% | 0.10% | |

| 14:00 | EUR | Eurozone Consumer Confidence Sep A | -1.5 | -1.5 | ||

| 14:00 | USD | Leading Indicators Aug | 0.20% | 0.30% | ||

| 14:30 | USD | Natural Gas Storage | 91B |