In the minutes of the May 3-4 FOMC minutes, Fed said, “most participants judged that 50 basis point increases in the target range would likely be appropriate at the next couple of meetings”. That is in-line with market expectations, and other communications from Fed officials, that the plan is set for 50bps hike per meeting for June and July at least.

Also, it’s noted, “at present, participants judged that it was important to move expeditiously to a more neutral monetary policy stance. They also noted that a restrictive stance of policy may well become appropriate depending on the evolving economic outlook and the risks to the outlook.”

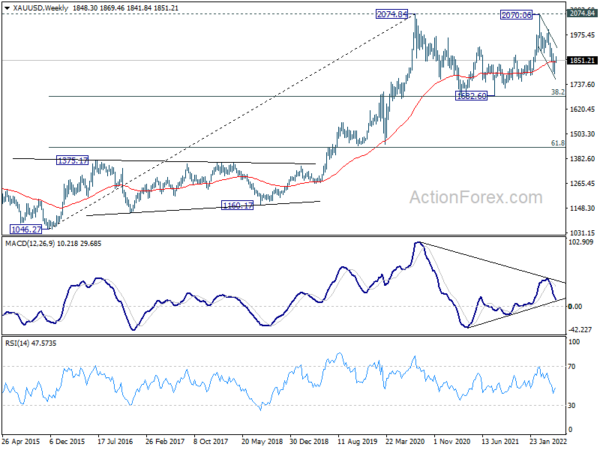

Gold dips mildly after FOMC minutes, as recovery from 1786.65 lost momentum. For now, further rise could still be as long as 1833.22 minor support holds. Above 1869.46 will resume the rebound to channel resistance a around 1926. However, break of 1833.22 should resume the whole fall from 2070.06 high through 1786.65.

Overall, there is no change in the view that fall from 2070.06 is the third leg of the consolidation pattern from 2074.84. Deeper decline would be seen as the recovery completes, towards 1682.60 support.