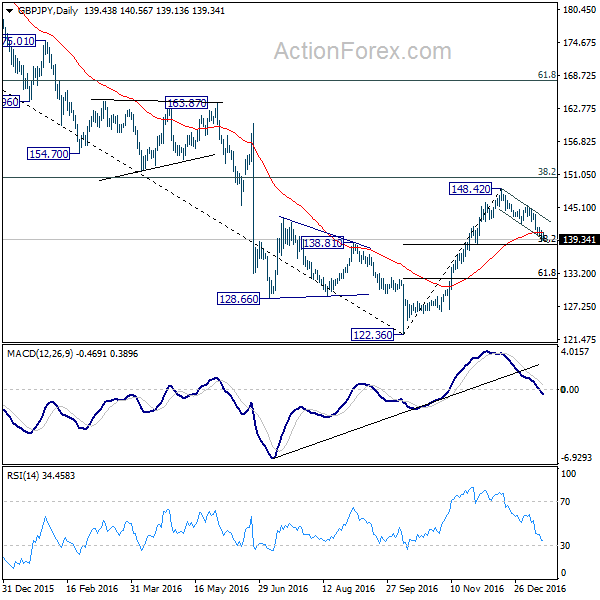

GBP/JPY’s fall from 148.42 resumed last week and initial bias stays on the downside this week for 38.2% retracement of 122.36 to 148.42 at 138.46. Sustained trading below 138.46 will affirm the case that corrective rise from 122.36 has completed at 148.42 already. In that case, deeper fall should be seen to 61.8% retracement at 132.31 and below. On the upside, break of 142.16 support turned resistance will turn bias to the upside for 145.38 resistance and above.

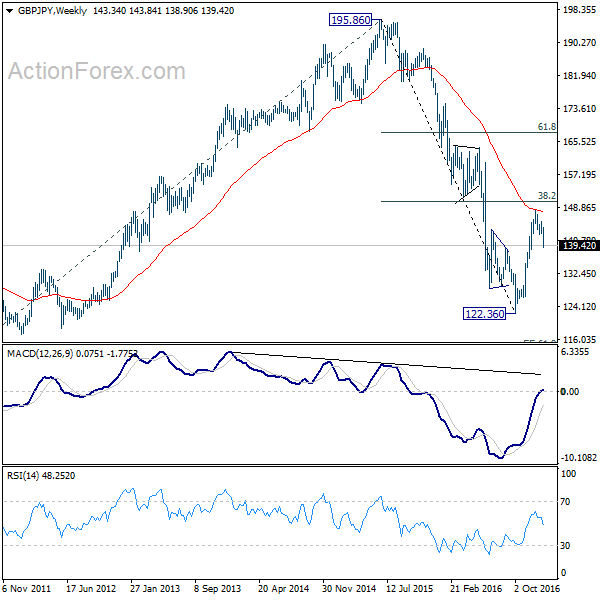

In the bigger picture, price actions from 122.36 medium term bottom are seen as developing into a corrective pattern. Upside is so far limited by 38.2% retracement of 195.86 to 122.36 at 150.4 for setting the medium term range. At this point, we don’t expect a break of 122.36 in near term and the corrective pattern would extend for a while.

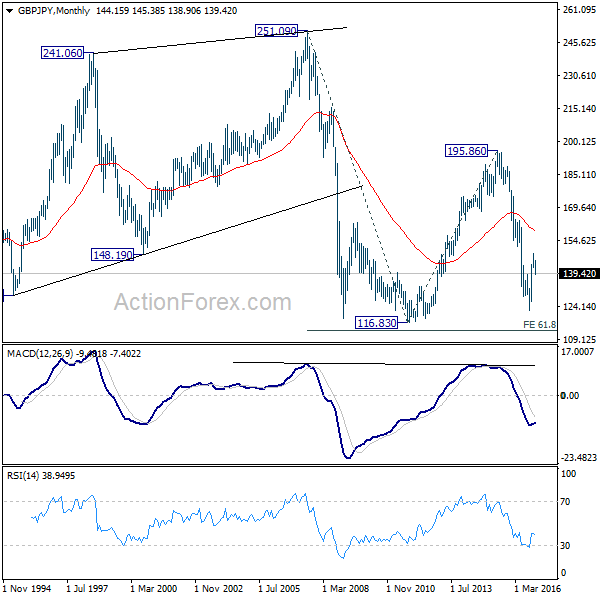

In the longer term picture, while price actions from 122.36 would develop into a medium term correction, fall from 195.86 is still seen as resuming the down trend from 251.09 (2007 high). Hence, after the correction from 122.36 completes we’d expect another fall through 116.83 low.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box