EUR/USD

The common European currency recovered some of its recent losses against the dollar, and during the early hours of today`s trading, the pair is about to test the resistance zone at 1.0896. A successful breach for the bulls could easily lead to a continuous recovery towards the target at 1.0940. If the bears re-enter the market, then a successful attack on the support zone at 1.0850, followed by a violation of the zone at 1.0811, could lead to more losses and could strengthen the negative expectations for the future path of the EUR/USD. Today, the most important news for investors is the announcement of the European Central Bank Interest Rate Decision (today; 11:45 GMT), as well as the expected Initial jobless claims for the U.S. (today; 12:30 GMT).

USD/JPY

The test of the resistance zone at 125.75 was not successful and the currency pair consolidated around the current level at 125.32. A new attack on the mentioned resistance is a highly probable scenario, but only a violation of the mentioned level could continue the rally and lead to new gains for the USD against the JPY. If the bears prevail, then a breach of the close support at 124.74 could deepen the sell-off for the dollar and easily lead the Ninja towards the important zone at 124.00.

GBP/USD

The positive sentiment remained and the pound continued to gain ground against the dollar. The pair breached the resistance at 1.3105, and during the time of writing this analysis, the Cable is headed for a test of the upper target at 1.3165. A violation of the mentioned zone would strengthen the positive expectations for the future path of the pair and could easily lead to a rally towards the level at around 1.3217. If the bullish momentum fades and this proves to be a corrective move, then the first level of support would be the zone at 1.3105, followed by the lower level at 1.3048.

EUGERMANY40

The support zone at 14051 successfully withheld the bearish attack, and during the early hours of today`s trading, the German index is hovering above the mentioned level. If the bulls prevail, then a violation of the resistance zone at 14304 could easily pave the way for a test of the target at 14562 and could lead to a change in the current sentiment of the market participants. On the other hand, if a new successful test of the support at 14051 becomes the case, then the sell-off will most likely continue towards the lower zone at 13884. Volatility can be expected around the ECB interest rate decision and the follow-up press conference.

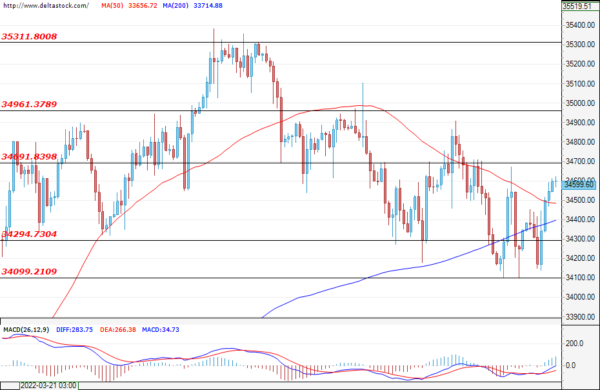

US30

Yesterday, the bears did not gain enough momentum for a successful breach of the support zone at 34100 and the bulls prevailed. The U.S. blue-chip-index appreciated and the expectations are for a test of the close resistance at 34691. А breach here could continue the recovery and could easily lead to an attempt at violating the major level at 34961. If the bears re-enter the market, then their first target would still be the mentioned zone at 34294, followed by the lower support at 34099. An increase in volatility can be expected today around the announcement of the European Central Bank Decision (11:45 GMT) and the Initial jobless claims data (12:30 GMT).