It’s going to be a major week for central banks ahead of the long Easter weekend, with three meetings on the way and rate hikes looking almost certain to be the outcome of at least two of them. So the spotlight will fall on the Bank of Canada, Reserve Bank of New Zealand and European Central Bank for much of the week. Although economic data will also be ample – inflation numbers will be watched in China, the United States and United Kingdom, while French elections might rattle European markets.

Will the RBNZ get the 50-bps ball rolling?

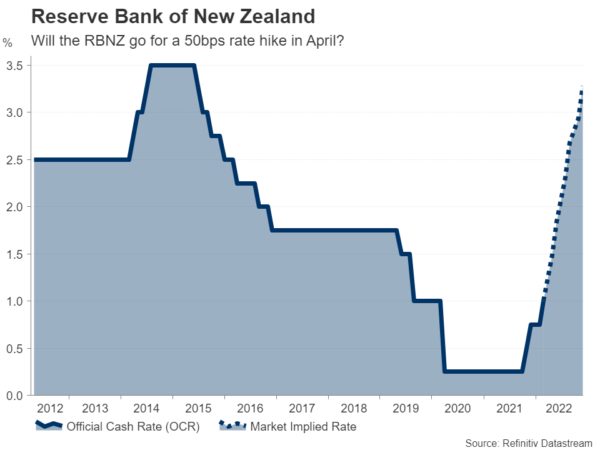

The Reserve Bank of New Zealand will kick off next week’s central bank meetings early on Wednesday but perhaps a more relevant point is that it could become the first to raise interest rates by a larger 50 basis points. Having lifted rates three times already, there’s a good chance the RBNZ will opt for a bolder increase in April.

New Zealand’s economic recovery has been bumpier than most thanks to snap lockdowns. And even though the country abandoned its zero-Covid policy following the emergence of the highly transmittable Omicron variant, some restrictions were re-imposed in January and February. That will probably weigh on economic growth in the first quarter. Monday’s electronic card sales will be monitored to see whether consumption bounced back in March. Overall, however, the economy is doing well. The unemployment rate has fallen to record lows and inflation hit 5.9% y/y in Q4.

Although there’s a risk that the jobless rate will rise a bit now that the government has reopened New Zealand’s borders to the rest of the world and growth might slow from the Ukraine crisis, inflation is predicted to keep rising in coming quarters. Hence, the expected 50-bps hike, which is about 90% priced in, could be the first of many.

The only problem for the New Zealand dollar is that the RBNZ’s hawkish stance might not provide much of a boost when other central banks are similarly hawkish. The kiwi has staged an impressive rally against the US dollar since late January, but a lot of that is attributed to the surge in commodity prices. Should the RBNZ disappoint and raise rates by only 25 bps, the kiwi could plunge.

Bank of Canada also poised for double rate hike

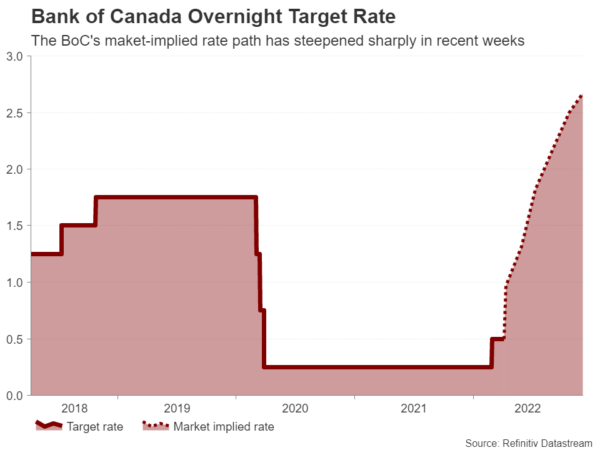

Over in Canada, it’s a similar economic picture of a tight labour market and soaring inflation. Despite taking the lead in initiating the normalization process after the pandemic began to ease, the Bank of Canada only began its rate hike cycle in March. But policymakers look set to take things into higher gear in April as the BoC is expected to raise its overnight rate from 0.5% to 1.0% on Wednesday.

The Canadian economy is not only likely to be little impacted from the West’s sanctions against Russia, it is also benefiting from higher oil prices. Moreover, with inflation at a more than 30-year high and signs of wage pressures building up, investors think the BoC will hike rates by 50 bps a few more times this year.

If the Bank signals as such in its updated quarterly forecasts, the Canadian dollar might make another run towards its recent five-month high versus the greenback. However, the loonie will also be guided by oil futures. Energy prices have retreated somewhat following the move by the US and a few other countries to release supply from their strategic oil reserves. If there’s a further pullback in oil next week, either by the efforts to rein in prices or because of any progress towards a ceasefire by Russia and Ukraine, the loonie may not gain much from a hawkish shift by the BoC.

ECB to mull timing of rate hike, French elections in focus

The European Central Bank is not expected to announce any changes to its policy on Thursday, having already outlined how it will taper its bond purchases at the last meeting. However, policymakers have yet to make up their minds on the precise date to terminate their quantitative easing programme, something which will ultimately decide the timing of the first interest rate rise.

The Bank will probably continue to keep its options open as it waits to see how the Ukraine war will unfold, so the odds for fixing an end date are low at the April meeting. The ECB is hoping that should the conflict de-escalate and the energy shock eases, it might be able to delay a decision on lifting rates from negative territory. However, this is looking increasingly unlikely as there doesn’t seem to be a quick end to the fighting on the EU’s border, while the inflation problem is only getting worse.

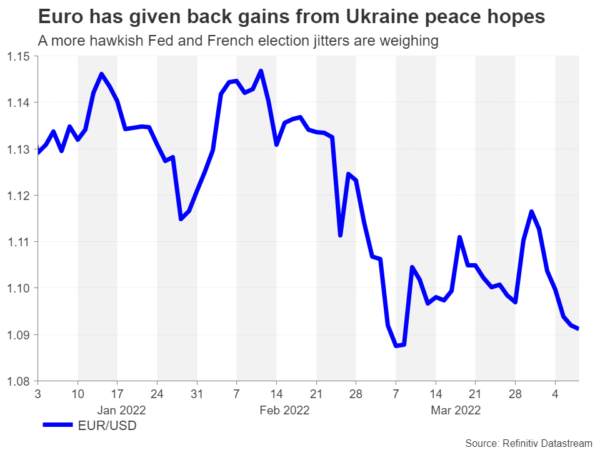

It’s possible therefore that policymakers will begin to pave the way for a rate increase at some point after the summer, either by altering their forward guidance or by hints from President Lagarde in her press briefing. The euro could edge higher if Lagarde explicitly flags an early liftoff. But aside from the ongoing geopolitical turmoil that’s weighing on the single currency, there is another risk that could potentially provide a fresh setback for euro bulls.

France holds the first round of the presidential election on Sunday and investors have started to get nervous as incumbent President Emmanuel Macron’s lead has narrowed recently. His main rival is far right leader Marine Le Pen. Although Macron is the favourite to win the first round, should he do so with a small margin, that would bolster the odds of a Le Pen victory in the second round.

A win for Le Pen would be seen as dealing a blow to the efforts for closer EU integration, something that would in turn damage the euro’s long-term prospects.

Pound may struggle to find much upside from UK data flurry

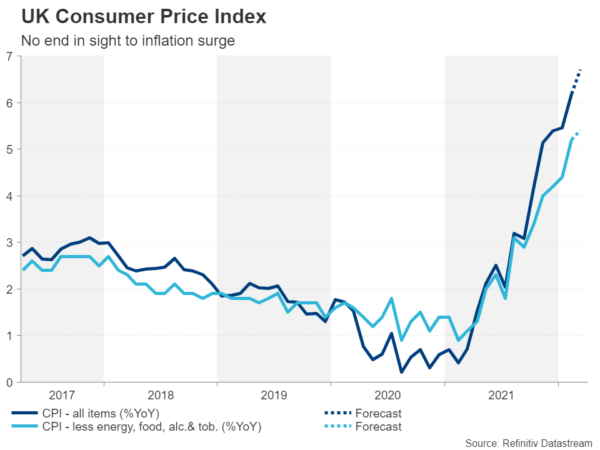

Across the channel, it’s a jam-packed week for UK economic indicators. The monthly data dump will begin on Monday with GDP, industrial production and trade figures for February. The employment report for the same period is out on Tuesday and March CPI numbers will follow on Thursday.

The UK economy likely grew at a healthy pace in February, while the labour market is expected to have tightened further. However, as it may take several months before the combined effect of the war and the squeeze on consumers from higher inflation and taxes start to drag on growth, it is the latest inflation numbers that can have the biggest short-term impact on monetary policy.

Britain’s consumer price index hit a three-decade high of 6.2% year-on-year in February. A further jump in March could add pressure on the Bank of England to act more swiftly in tightening monetary policy.

The pound could gain slightly on the back of stronger-than-expected readings, though, unless there is a massive beat, the market-implied rate path for the BoE won’t alter significantly.

Can US inflation and retail sales keep the dollar rally going?

The Federal Reserve is on a sure path to raise the fed funds rate by 50 bps in May, having well-telegraphed its intentions by now, most recently in the March meeting minutes. The dollar has appreciated on the back of these expectations, as well as on the signal for the pace of the balance sheet reduction, which has boosted long-term Treasury yields.

Next week’s data out of the US, which are mainly the March inflation and retail sales figures, will likely reinforce the view that the Fed is about to step a lot harder on the brakes to cool the red-hot economy.

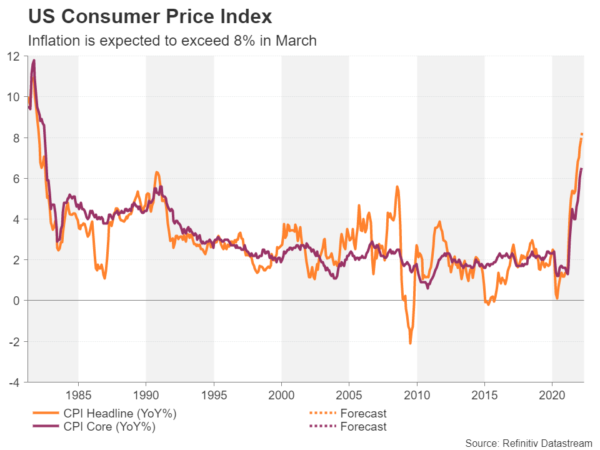

America’s headline CPI rate hit a fresh four-decade high of 8.3% y/y in February. It is expected to have risen again in March, to 8.3% when released on Tuesday, while the core rate is forecast to have inched up to 6.6%. The producer price index will follow on Wednesday.

The retail sales report comes out on Thursday and the projections are for a month-on-month increase of 0.6%. Also of importance will be the University of Michigan’s preliminary read on consumer sentiment for April and industrial production for March on Friday.

The dollar could firm a little from a solid set of numbers, but with markets already betting on a very aggressive Fed, it’s questionable how much further it can climb without the added safe-haven boost from any deterioration in the geopolitical landscape. That leaves the greenback slightly exposed to a small downside correction from any surprise softness in the data.

Aussie eyes Chinese inflation and Australian jobs

Lastly, inflation will also be at the forefront in China. The consumer and producer price indices for March are both due on Monday, and on Wednesday, the latest trade figures might attract some attention. There are worries that China is headed for a sharp slowdown from the recent lockdowns in Shanghai and several other cities so any signs from either the inflation or trade data that growth is weakening could dent risk sentiment.

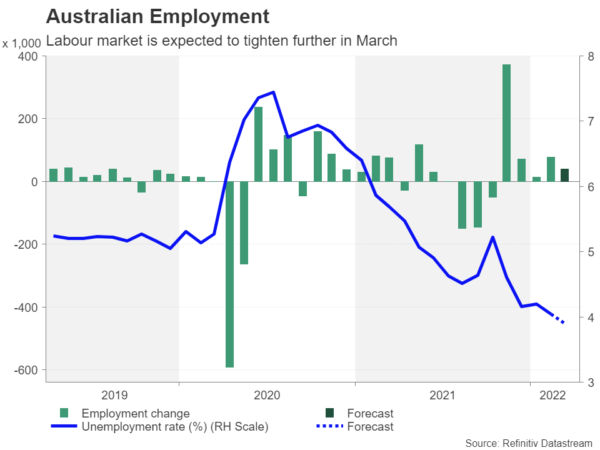

The Australian dollar, which often trades as a liquid proxy for the Chinese economy, has had a very strong bullish run since the start of February but a slowdown in China has the potential to halt the uptrend, even as the currency has managed to breeze through the Ukraine turmoil. On the other hand, Thursday’s labour market indicators out of Australia could provide plenty of support to the aussie if there was another big jump in employment in March.

The Reserve Bank of Australia is lagging other central banks in terms of the tightening cycle so any acceleration on that front would be positive for the local dollar.