Flash CPI inflation data for March will feature the Eurozone’s economic calendar on Friday at 10:00 GMT. The already boiling inflation is expected to heat up to a new record high, but the news may not shock investors as they are already expecting a second round of price increases in the face of the Ukrainian geopolitical crisis. Besides, with futures markets pricing a hawkish ECB at the end of the year, even as the growth outlook remains fragile, the euro could get little support from the data.

Eurozone CPI inflation to hit fresh record high

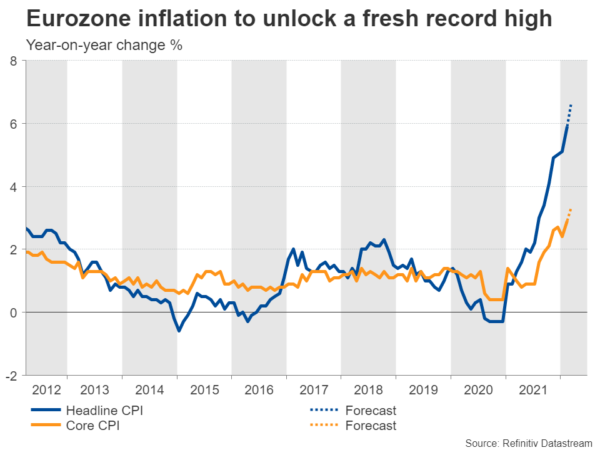

In February, the headline consumer price index rose faster than expected in the Eurozone at a record annual rate of 5.9%, mainly on the back of higher gas and electricity prices. The next CPI release for March may not be better as analysts estimate inflation to surge to a new all-time-high of 6.6% y/y, further deviating from the central bank’s average 2.0% target. The core measure, which excludes volatile food and energy prices, is expected to distance above that threshold as well, advancing from 2.9% to 3.3% y/y. Meanwhile, Spain and Germany have already reported much stronger-than-expected CPI data on Wednesday, therefore an upside surprise on Friday would not be very surprising.

ECB may not get surprised; growth outlook uncertain

Nevertheless, the European Central Bank (ECB) has already admitted that inflation will remain elevated at high rates over the course of the year. Perhaps, fading base effects may imply some declines in the second half of the year, though in the meantime, further increases cannot be ruled out either as the sanctions war against Russia and military conflicts in Ukraine keep feeding the advance in wholesale gas futures. Hence, businesses could gradually pass the extra production cost to consumers.

The question that arises at this point is how the central bank will handle the inflation situation if price growth holds stubbornly well above its target. Some policymakers have recently attempted to raise the stakes for a rate hike in the second half of the year, while futures markets are optimistic that the ECB will deliver around 65 bps of monetary tightening by the end of the year. That implies six 10bps rate hikes from June to December, which could drive the benchmark rate up to 0.1%.

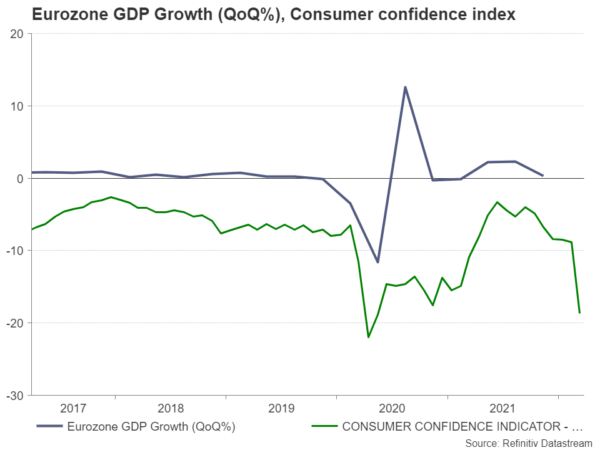

On the other hand, given the fragile and crucially Ukraine-dependent economic outlook in the region, the above rate hike scenario looks too aggressive, and the central bank can only act on the basis of incoming data. Household consumption could become more cautious in the face of higher commodity and electricity prices, which account for 90% of the processed food industry. Following a dip at the end of 2021, monthly retail sales did not grow as fast as analysts expected in January, mirroring careful spending tendencies. More recently, preliminary consumer confidence data out of the Eurozone slumped to the lowest since June 2020 in March, reflecting persisting caution among consumers.

Of note, as in the case of the US, the spread of the 10- and 2-year government bond yields has inverted but is still comfortably above the 2008 and 2020 lows. Therefore, in technical terms, a recession does not seem to be around the corner yet.

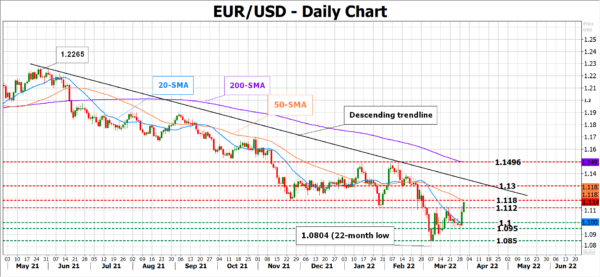

EUR/USD

Turning to FX markets, on Tuesday the euro cheered on news that Russia may reduce military activity near Kyiv and on hopes that ongoing peace talks may finally prepare the ground for a meeting between Putin and Zelensky. The Spanish and German CPI figures provided only a short-lived boost to the common currency despite flying well above forecasts. Hence, the bloc’s March inflation report is partially unencrypted, and Friday’s results may add nothing new to investors’ knowledge. Instead, the Ukrainian story could be a bigger challenge for the bloc’s outlook as ECB governing council member Gabriel Makhlouf said on Wednesday, and therefore a bigger market mover for the euro.

From a technical perspective, a close above the 1.1120 – 1.1180 resistance region could push for a trendline breakout above 1.1310. Alternatively, sellers may regain power if the price stays below the 50-day simple moving average (SMA) and particularly returns below 1.1120. In this case the 1.1000 – 1.0955 zone may come first into view, while lower the focus will turn to the 1.0850 number.

Note that US nonfarm payrolls are also on the agenda this Friday. Therefore, the next round of volatility could occur at the end of the week.