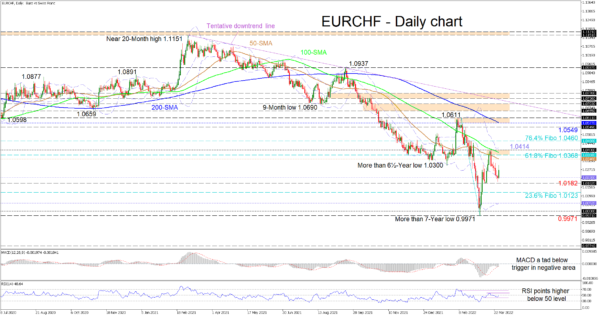

EURCHF forms a foothold off the mid-Bollinger band at 1.0220 after the rally from the more than 7-year low of 0.9971 was curbed by the 1.0400 handle, and the 100-day simple moving average (SMA). Nevertheless, the descending SMAs continue to sponsor the bearish outlook in the pair.

The short-term oscillators are transmitting conflicting signals in directional momentum. The MACD, in the negative region, is holding slightly underneath its red trigger line, while the improving RSI is about to test the 50 neutral threshold.

In the negative scenario, sellers could engage an initial support zone from the mid-Bollinger band at 1.0220 until the mid-March low of 1.0182. Diving past this obstacle, the 1.0123 level, which is the 23.6% Fibonacci retracement of the down leg from 1.0611 until the multi-year low of 0.9971, may try to deter the bears from steering the price towards the lower Bollinger band at 1.0052. Meanwhile, should the price eventually sink deeper, the support zone from the more than 7-year trough of 0.9971 until the 1.0000 handle could draw traders’ attention.

If the pair builds more positive traction off the mid-Bollinger band, resistance could originate at the 50-day SMA at 1.0340 prior to the resistance band between the 61.8% Fibo of 1.0368 and the 1.0400 barricade. Overrunning these barriers and the upper Bollinger band, which is marginally overhead at 1.0414, the bulls could meet the 76.4% Fibo at 1.0460. Should buying interest endure, the price may then confront the 1.0549 high before challenging the 1.0577-1.0611 resistance border, moulded by the 200-day SMA and the February high of 1.0611.

Summarizing, EURCHF’s fresh increase in positive forces has yet to dent the predominant bearish outlook in the pair. In order for upside momentum to gain an edge, the price would need to improve beyond the 1.0400 mark.