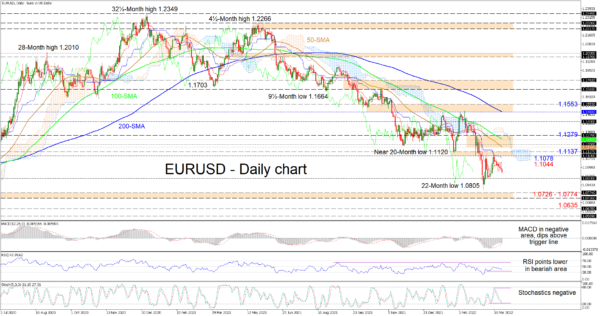

EURUSD is edging lower toward the 1.0900 handle after bullish developments in the pair were unable to overpower the 1.1100 hurdle. The falling simple moving averages (SMAs) are endorsing the 10-month bearish trend from the May 2021 high of 1.2266.

Currently, the Ichimoku lines indicate that bearish forces remain active, while the short-term oscillators are skewed to the downside. The MACD is south of the zero threshold and looks set to return beneath its red trigger line, while the RSI is gliding towards the 30 oversold level. Moreover, the negatively charged stochastic oscillator is promoting additional downward price action in the pair.

To the downside, preliminary support could occur at the 1.0900 border, while moving lower, the 22-month trough of 1.0805 may contest sellers’ efforts to uphold the decline. For sellers to resuscitate the broader descent, downward pressures would need to not only crush the key 1.0805 trough, but subsequently the 1.0726-1.0774 support barrier, linked to the April until mid-May 2020 area of lows. Should the pair surrender extra ground, the critical 1.0635 bottom resulting from the March 2020 collapse could then draw traders’ attention.

On the other hand, if buying interest picks up, resistance could originate from the nearby Ichimoku lines at 1.1044 and 1.1078, along with the neighbouring 1.1100-1.1137 resistance band. Nonetheless, should buyers’ triumph, a successive tough region of resistance from the 50-day SMA at 1.1174 until the 1.1279 obstacle may prove to be more challenging for buyers to surpass. However, successfully piloting above the cloud, the bulls could then jump towards the 1.1400 boundary before eyeing the 1.1484-1.1553 resistance border.

Summarizing, EURUSD is sustaining a sturdy bearish bias below the 1.1100-1.1137 hurdle and the SMAs. A dive beyond the 1.0726-1.0774 barricade is likely to renew strong negative tendencies. Meanwhile, a climb in the price extending past the 1.1279 barrier may inject some optimism in the pair.