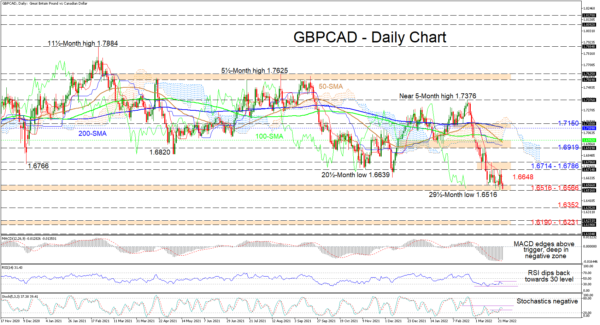

GBPCAD has touched a 29½-month low of 1.6516, subsequently shaping the 1.6516-1.6566 support border that encapsulates the March 2020 trough of the collapse from the 1.8045 high. The tempo of the pair’s descent from the recent 1.7376 high softened in the vicinity of the March 2020 bottom of 1.6536. Nonetheless, the simple moving averages (SMAs) continue to highlight downside risks.

The Ichimoku lines indicate a pause in bearish forces, while the short-term oscillators signal a pickup in negative momentum. The MACD is above its red trigger line but looks set to fall back beneath it, while the RSI is retesting the 30 oversold level. The negatively charged stochastic oscillator is hinting that downside price action may intensify.

If sellers drive the price underneath the critical 1.6516-1.6566 support, the broader bearish picture could significantly strengthen with the price sinking towards the 1.6352 barrier. Should the descent endure, the price may then target the 1.6190-1.6231 support barricade, linked to the troughs from September 2019.

On the other hand, if buyers find a foothold within the 1.6516-1.6566 support region, initial upside constraints could arise from the red Tenkan-sen line at 1.6648 ahead of the 1.6714-1.6786 resistance border. Gaining additional ground, the bulls could navigate towards the reinforced 1.6919-1.6992 resistance zone, which involves the 50- and 100-day SMAs as well as the blue Kijun-sen line. From here, the 1.7109-1.7150 resistance band could be the next obstacle impeding advances from accelerating beyond the 1.7376 high.

Summarizing, GBPCAD is exhibiting a bearish bias below the SMAs and the near five-month high of 1.7376.