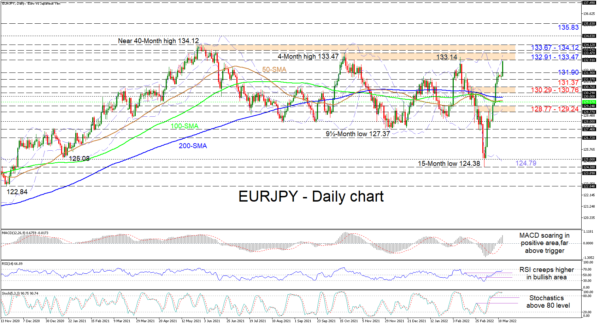

EURJPY has powered past the 131.90 mid-February high, a barrier which previously managed to pause the two-week aggressive rally that launched from a 15-month low of 124.38. The mostly horizontal simple moving averages (SMAs) continue to mirror the relatively neutral trend, which has governed the pair over the last six-months or so.

The short-term oscillators suggest sturdy positive momentum is intact. The MACD is strengthening far above the zero threshold and its red trigger line, while the RSI is eyeing the 70 overbought level. The stochastic lines are in overbought territory and the %K has not revealed any signs of waning in positive forces.

In the positive scenario, heavy resistance overshadows advances due to congested barriers. Currently, buyers are facing the 132.91-133.47 resistance band that is linked to the October 2021 and the February 2022 highs. Not too far overhead is the 133.67-134.12 resistance section that extends back to May of 2021. If buyers manage to overrun these obstacles and buying interest persists, the bulls may then meet the 134.83 border before pursuing the 135.83 high, identified in February 2018.

If upward pressures abate from the 132.91-133.47 boundary, preliminary support could occur at the 131.90 level ahead of the 131.37 low. If the price pulls below this low, downside constraints may then emanate from the 130.29-130.76 zone. Likewise, the negative price path is also crowded, as slightly lower, the region between the 130.00 handle and the 100-day SMA at 129.57 may prove tough to dive past. Should this fortified zone, which contains the SMAs, fail to provide buyers with a footing, the bears may then challenge the 128.77-129.24 support boundary, which encapsulates the lower Bollinger band.

Summarizing, EURJPY’s bullish bias remains robust and if the price manages to propel beyond the 40-month high of 134.12, upside impetus is likely to juice up significantly. Yet, a price retracement below 128.00 is needed to spark concerns about growing negative pressures.