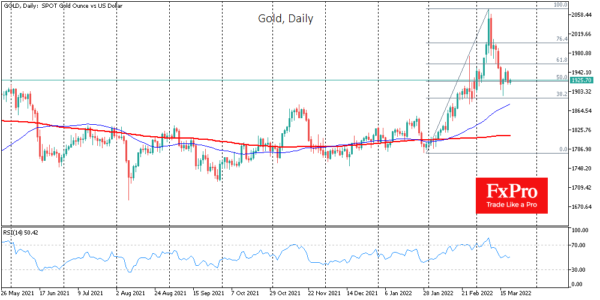

Gold has remained in a one-and-a-half per cent range since last Thursday. The correction from a peak of $2070 to values below $1900 caused a brief aftershock, but it was not sustained. Gold has now stabilised above the peaks of May and June last year and is currently searching for further meaningful momentum.

For short-term traders, gold has taken a back seat as markets try to assess the impact of disrupted supply chains and the amount of supply shortfall in raw materials and food. At the same time, medium-term traders should not lose sight of the fact that the current situation will not allow central banks to act adequately. As a result, the supply of fiat money will increase faster than the supply of commodities. In other words, we should expect greater tolerance for higher inflation from the CBs.

In addition, governments should also be expected to provide financial support to the economy. In practice, that means more money supply and a higher level of public debt to GDP. And that is another disincentive for monetary policy, which is negative for the currency. It is also favourable for gold, which is used as protection against capital depreciation.

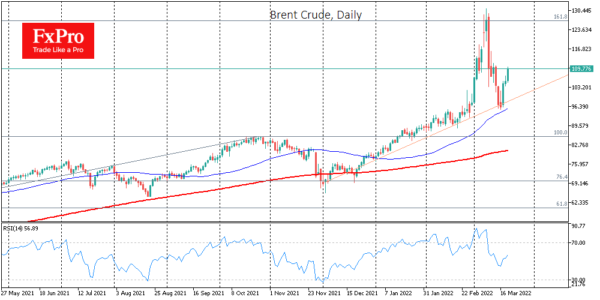

Oil is gradually becoming the opposite of gold. After bouncing back to the trend support level of the last four months, Brent got back above $100 reasonably quickly and is adding 4% on Monday, trading at $109.

Speculative demand for oil is picking up again amid discussions of a Russian energy divestment, which could be the agenda for the EU leaders and Biden meeting later this week. In addition, the US oil supply has been slow to rise, with data on Friday showing that the number of working oil drilling rigs declined a week earlier.

Oil producers appear to be cautious about demand prospects with record fuel prices and are in no hurry to flood the market. This will fuel prices in the short term but is becoming an increasing drag on the economy in the medium term.

Locally, we also risk suggesting that Europe will once again make it clear that it cannot substitute Russian energy, preferring to focus on sanctions against other sectors. And that could prove to be a dampening factor for oil later in the week. Oil prices above $110 still look unsustainably high, and a range with support at $85 looks more adequate for the coming months.