WTI crude oil is extends the near term rebound and is back above 108. It’s reported that OPEC+ missed its production target by slightly more than 1m barrels per day in February. At the same time, some Baltic countries are pushing EU for an oil embargo on Russia for its invasion of Ukraine.

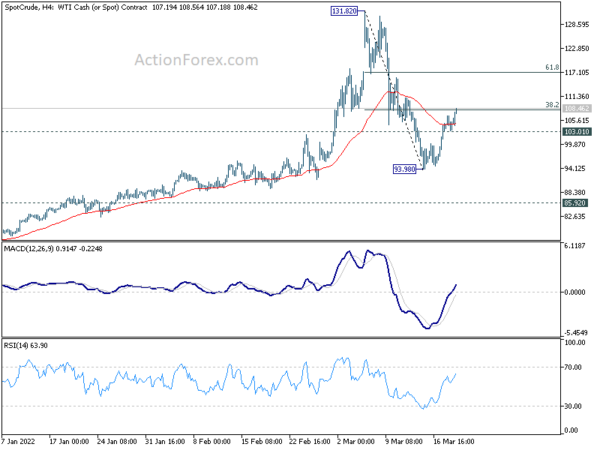

WTI is now pressing 38.2% retracement of 131.82 to 93.98 at 108.43. Sustained trading above there will pave the way to 61.8% retracement at 117.36 and above. Such development would also affirm the case that corrective pattern from 131.82 high is a sideway pattern. This is the preferred case given the notable support from 55 day EMA.

Nevertheless, rejection by 108.43, followed by break of 103.01 minor support will likely extend the fall from 131.82 through 93.98, and set up a deep correction instead.