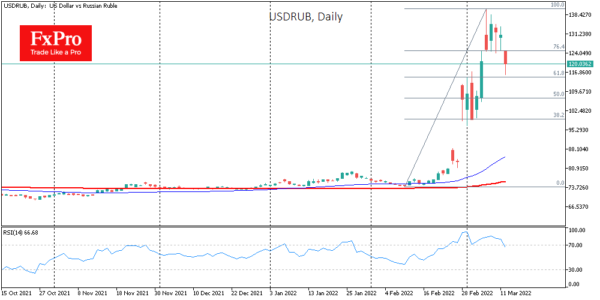

The Russian ruble is strengthening significantly, by 10%, to 118.8 on forex at the start of the new week. The growth momentum comes with signals from the presidents of Russia and Ukraine that negotiations are moving forward. In addition, the Russian Finance Ministry made it clear over the weekend that it does not intend to waive coupon payments on foreign currency bonds unilaterally. It would make payments for its part but that they might not technically pass, in which case payments would be made in rubles.

In addition, the central bank has eased its currency export restrictions somewhat.

As is often the case in emerging markets, relaxations and declarations of commitment strengthen the confidence in the financial system. As a result, we see a convergence of the USD exchange rates quoted on the Moscow Exchange and international forex.

However, the latest movements do not mean that the ruble has already passed its low point, as markets are still constantly reassessing the reality under new sanctions.

A technical view of USDRUB’s recent moves suggests that the pair could settle into a correction near 115 rubles after jumping from 74 in early February to 140 at one point last Tuesday. If we do not see a cardinal shift towards de-escalation in the coming days, the pressure on the Russian currency could return, albeit not with the same strength.