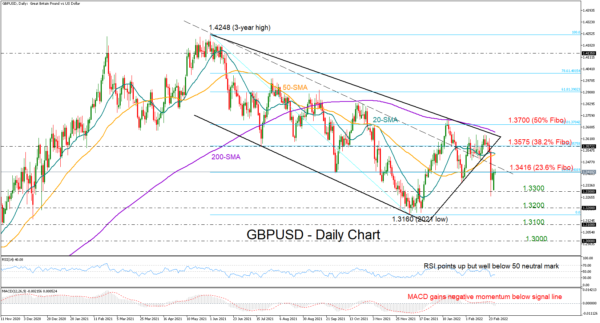

GBPUSD switched to a bullish mode after last week’s crash ceased at a two-month low of 1.3279. That said, the pair is still some way below February’s highs and downside risks keep lingering in the background as the MACD is strengthening its negative momentum below its zero and signal lines, and the RSI, although pushing for some recovery, is still comfortably dipped beneath its 50 neutral mark.

The 23.6% Fibonacci retracement of the 1.4248 – 1.3160 downleg continues to block upside movements for the third consecutive day at 1.3416, while within breathing distance, the (dashed) descending trendline, which has been acting both as support and resistance since mid-2021, will also be closely watched around 1.3450 in the coming sessions. If the bulls violate those boundaries, the rally could pick up steam towards the 38.2% Fibonacci and the broken supportive trendline, both around 1.3578, while slightly lower, the 20- and 50-day simple moving averages (SMAs) could be another hurdle. Yet, a tougher battle could take place somewhere between the 200-day SMA, which overlaps with the tentative descending trendline drawn from the 1.4248 top, and the 50% Fibonacci of 1.3700.

Alternatively, a resumption of the latest downfall beneath 1.3300 may motivate fresh selling towards the 1.3200 round level and the 2021 low of 1.3160. Failure to bounce above the latter could initially test the 1.3100 mark and then the 1.3000 number.

In brief, GBPUSD remains exposed to bearish reversals despite its bounce off from recent lows. A clear close above 1.3450 could activate another bullish round, while a drop below 1.3300 is expected to trigger the next selling phase.