Overall, the markets seem to have stabilized from the shocking invasion of Ukraine by Russia, for now at least. US stock markets staged a late and strong turnaround overnight while Asian markets also recovered. Gold is back pressing 1900 handle while WTI oil is trading around 96, after breaching 100 briefly. In the currency markets, Dollar turned softer with Swiss Franc while Aussie is up with Sterling today.

Technically, attention will be paid on Euro and Sterling for today. As long as 1.1287 minor resistance in EUR/USD and 1.3485 minor resistance in GBP/USD hold, risk stay on the downside for further fall. Similarly, as long as 130.03 minor resistance in EUR/JPY and 155.48 minor resistance in GBP/JPY hold, further declines are in favor. We’ll see what’s next.

In Asia, at the time of writing, Nikkei is up 1.88%. Hong Kong HSI is down -0.11%. China Shanghai SSE is up 0.71%. Singapore Strait Times is up 0.90%. Japan 10-year JGB yield is up 0.021 at 0.208. Overnight, DOW rose 0.28%. S&P 500 rose 1.50%. NASDAQ rose 3.34%. 10-year yield dropped -0.008 to 1.969.

Fed Waller prefers increasing rate by 100bps by middle of this year

Fed Governor Christopher Waller said in a speech that his preference is to “increase the target range 100 basis points by the middle of this year… appropriate interest rate policy brings the target range up to 1 to 1.25 percent early in the summer.” That would be “a bit below” pre-pandemic level when inflation was “considerably lower” and Fed’s balance sheet less than halved.

Nevertheless, he added, “of course, it is possible that the state of the world will be different in the wake of the Ukraine attack, and that may mean that a more modest tightening is appropriate.”

“I will continue to monitor the geopolitical situation to assess the appropriate timing of this near-term monetary policy tightening,” Waller said. “These actions will get us into the second half of the year, when we will have six months of inflation data, and we can assess what the appropriate path will be for the rest of 2022.”

Fed Bostic: Events today in the Ukraine are on all of our minds

Atlanta Fed bank President Raphael Bostic said, “events today in the Ukraine are on all of our minds. We’ll be watching this closely here in Atlanta and across the Federal Reserve system to assess the economic and financial impacts,”

He still thinks may need to hikes four or more times this year if high inflation persists. However, “I am really open to adjusting this as we get more clarity on how the economy is evolving…the data may come in perhaps more pessimistic in terms of how well we are doing on inflation and if it does I’m going to move my view, maybe 4 (hikes), and depending on how things go it may be more than that.”

RBNZ Orr: Raising rates sooner prevents the need for even higher rates

RBNZ Governor Adrian Orr said in a speech, “amongst many of our central bank peers, we were one of the first to begin removing monetary stimulus and start the tightening cycle”.

“Financial market pricing for future interest rate levels have been very responsive to our signalling,” he added. “Market pricing of future central bank policy rates continue to indicate that New Zealand is expected to tighten policy sooner than many other comparable economies.”

“By getting on top of inflation pressures quickly, by raising interest rates sooner, we aim to prevent the need for even higher rates in the future,” he said. “In other words, we are taking our foot off the accelerator now to minimise having to use the brakes harder in future.”

On the data front

New Zealand retail sales rose 8.6% qoq in Q4, above expectation of 6.2% qoq. Ex-auto sales rose 6.8% qoq, above expectation of 5.5% qoq. Tokyo CPI core rose from 0.2% yoy to 0.5% yoy in February, above expectation of 0.4% yoy. UK Gfk consumer confidence dropped from -19 to -26 in February, below expectation of -16.

Looking ahead, GDP data from Germany and France will be featured. Eurozone will release economic sentiment indicator. Later in the day, US will release personal income and spending with PCE inflation, durable goods orders and pending home sales.

EUR/CHF Daily Outlook

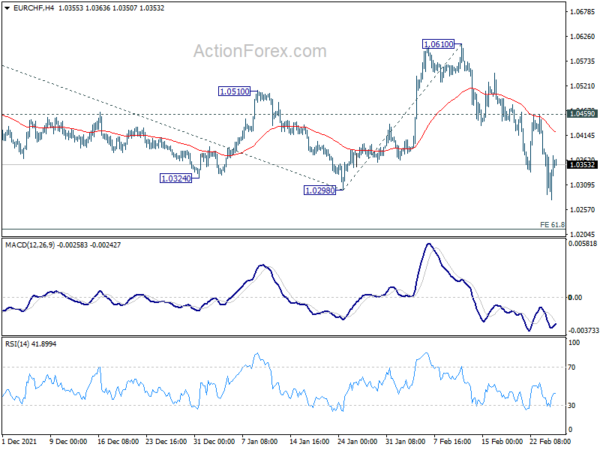

Daily Pivots: (S1) 1.0298; (P) 1.0340; (R1) 1.0402; More….

EUR/CHF recovers after diving to 1.0277. But still, with 1.0459 resistance intact, further decline is expected. The down larger down trend from 1.1149 should be resuming. Sustained trading below 1.0298 will target 61.8% projection of 1.0936 to 1.0298 from 1.0610 at 1.0216. However, strong break of 1.0459 will bring further rebound to 1.0610 resistance instead.

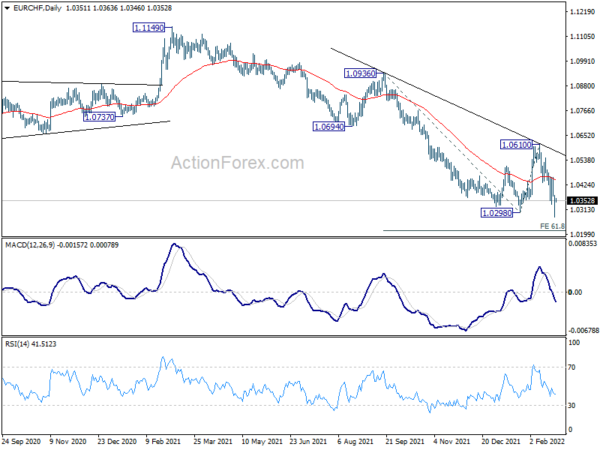

In the bigger picture, long term down trend from 1.2004 (2018 high) is still in progress. Next target is 61.8% projection of 1.2004 to 1.0505 to 1.1149 at 1.0223. Sustained break there will target 100% projection at 0.9650. In any case, break of 1.0610 resistance is needed to be the first sign of bottoming. Otherwise, outlook will remain bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Retail Sales Q/Q Q4 | 8.60% | 6.20% | -8.10% | -8.20% |

| 21:45 | NZD | Retail Sales ex Autos Q/Q Q4 | 6.80% | 5.50% | -6.70% | -6.80% |

| 23:30 | JPY | Tokyo CPI Core Y/Y Feb | 0.50% | 0.40% | 0.20% | |

| 00:01 | GBP | GfK Consumer Confidence Feb | -26 | -16 | -19 | |

| 07:00 | EUR | Germany Import Price Index M/M Jan | 0.20% | 0.10% | ||

| 07:00 | EUR | Germany GDP Q/Q Q4 F | -0.70% | -0.70% | ||

| 07:45 | EUR | France Consumer Spending M/M Jan | -0.30% | 0.20% | ||

| 07:45 | EUR | France GDP Q/Q Q4 | 0.70% | 0.70% | ||

| 09:00 | EUR | Eurozone M3 Money Supply Y/Y Jan | 6.70% | 6.90% | ||

| 10:00 | EUR | Eurozone Economic Sentiment Indicator Feb | 113 | 112.7 | ||

| 10:00 | EUR | Eurozone Services Sentiment Feb | 10.3 | 9.1 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Feb | 14.2 | 13.9 | ||

| 10:00 | EUR | Eurozone Consumer Confidence Feb F | -8.8 | -8.8 | ||

| 13:30 | USD | Personal Income M/M Jan | -0.30% | 0.30% | ||

| 13:30 | USD | Personal Spending Jan | 1.50% | -0.60% | ||

| 13:30 | USD | PCE Price Index M/M Jan | 0.30% | 0.40% | ||

| 13:30 | USD | PCE Price Index Y/Y Jan | 5.50% | 5.80% | ||

| 13:30 | USD | Core PCE Price Index M/M Jan | 0.50% | 0.50% | ||

| 13:30 | USD | Core PCE Price Index Y/Y Jan | 4.80% | 4.90% | ||

| 13:30 | USD | Durable Goods Orders Jan | 0.60% | -0.70% | ||

| 13:30 | USD | Durable Goods Orders ex Transportation Jan | 0.40% | 0.60% | ||

| 15:00 | USD | Pending Home Sales M/M Jan | -0.20% | -3.80% | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Feb F | 61.7 | 61.7 |