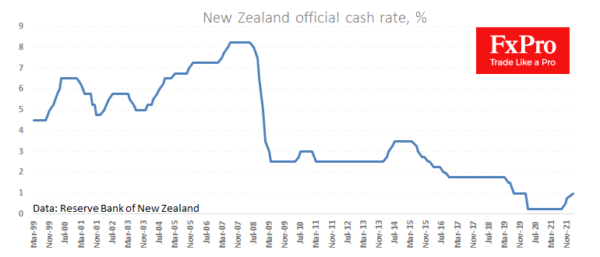

The New Zealand dollar has been adding around 1% since the start of the day following the third key rate hike of 0.25 percentage points to 1.0% and comments from the RBNZ on the need for further policy tightening. Wednesday also saw the announcement of the start of a balance sheet reduction, including via active selling.

The central bank points to employment above the maximum sustained level and the overall economic performance above its potential, all with elevated inflation. The RBNZ also says further tightening is needed, pointing to upside risks to inflation.

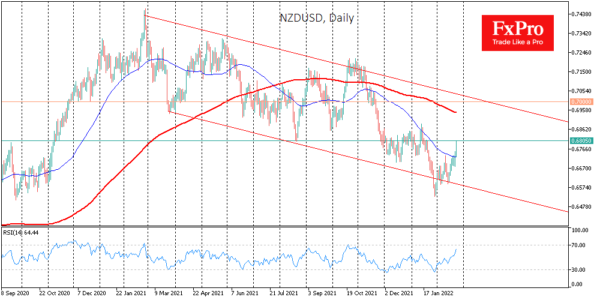

NZDUSD is testing 0.6800, as it did just over a month ago. The Kiwi came under pressure in the previous month due to a general risk bias in global markets. However, the paths of the NZDUSD and international markets diverged in February.

The steady demand of the New Zealand currency, which gained nearly 4% from the lows of late January, contrasts with the S&P500, which lost its rising momentum about a fortnight ago and is again near the lows of the year.

The main reason for that divergence is monetary policy – current and expected. The Reserve Bank of New Zealand has maintained the momentum of tightening for the third time in the last six months and promises further rises later in the year.

New Zealand has also found itself far removed from the worst geopolitical tensions in Europe of recent decades, continuing to benefit from record-breaking commodity prices.

In this environment, it would not be surprising to see the NZDUSD rise as far as 0.7000 by the end of next month, in a break from last year’s downward trend. Although, it would be too naive to expect an easy up ride for the Kiwi, as the US Fed is also signalling a very hawkish stance.