EUR/USD

At the end of yesterday’s trading session, the bears managed to prevail and gained enough momentum, breaching the 1.1330 support area. At the time of writing, the currency pair is about to test the 1.1270 support level. If the single European currency continues to lose ground against the U.S. dollar, then we may see a successful breach of the mentioned support, which will most likely be followed by a further depreciation towards the next significant support zone at 1.1170. In the upward direction, the first important resistance zone is the level of 1.1400.

USD/JPY

The U.S. dollar continues to lose ground against the Japanese yen and at the time of writing the analysis, it is hovering above the now breached support area at 114.74 – a level that currently also plays the role of first important resistance. If the breach here is confirmed, then we could expect for the negative market sentiment to worsen, as well as an attack on the next support zone at 114.25.

GBP/USD

The U.S. dollar is losing ground against the British pound, with the bears currently successfully limiting the appreciation of the pound to the resistance level at 1.3613. However, the most likely scenario is for another attack on and a breach of the upper boundary of the formed range between the levels of 1.3500 – 1.3600. A breach of the aforementioned resistance could predetermine the future move for the Cable.

EUGERMANY40

The German index breached the important support at 14840, which gave the bears a serious advantage. They, in turn, led the trade towards the next support zone at 14410. Because of this, the EUGERMANY40 lost nearly 4% of its value in the last session alone. Rising inflation and escalating tensions between Russia and Ukraine could be the catalyst that could lead the German index towards a successful breach of the support area at 14410, and then depreciate it even further towards the zone at around 14000.

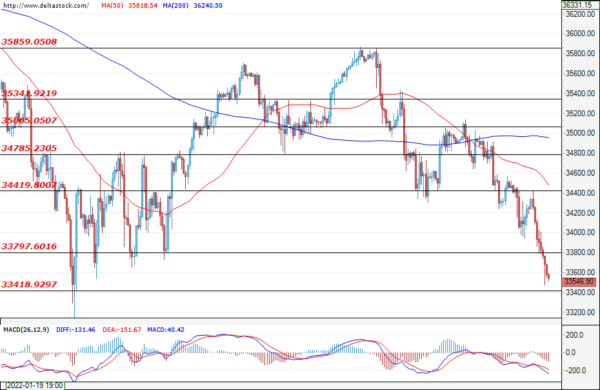

US30

The U.S. blue-chip stock index continues to lose ground from the beginning of this week as tensions between Russia and Ukraine continue to grow. The index lost about 1% of its value during the past session, with market sentiment remaining negative – for a test and breach of the support zone at 33418. In addition to the growing geopolitical tensions in Eastern Europe, investors are also monitoring the Federal Reserve’s decision to tighten the monetary policy through multiple interest rate hikes throughout the year, starting next month. This could mark the beginning of an extensive bearish presence on the market and lead to long-term sell-offs for the U.S. index.