Sterling continues to shine today as firmly boosted by BoE rate hike in near term, possibly in November. The Pound also takes other European majors higher with it, including the Swiss Franc. On the other hand, Yen is sold off deeply against others and it seems market’s theme is back on global monetary stimulus exit. Dollar initially yawned at news of North Korea firing another missiles over Japan. But the greenback gives way to European majors and pares back much of its gain. Mixed economic data released in US session also provide little support to the greenback.

US headline retail sales dropped -0.2% in August, below expectation of 0.1%. Ex-auto sales rose 0.2% in August, below expectation of 0.5%. Empire state manufacturing index to 24.4 in September, but beat expectation of 18.0. Released earlier today, Eurozone trade surplus narrowed to EUR 18.6b in July. New Zealand business manufacturing index rose to 57.9 in August.

ECB hawks push for scaling back stimulus

ECB Executive Board member Sabine Lautenschlaeger, a known hawk, said that "it is time to take a decision now on scaling back our bond purchases at the beginning of next year." She noted that "the buoyant growth coupled with the monetary accommodation will take us back to an inflation rate which is in line with our goal." And, "there’s little doubt about that". She still believe that inflation was "taking a bit longer than usual to pick up". But in her view, the EUR 2b worth of bonds bought by ECB and the "standard monetary policy measures" are already enough accommodation. Bundesbank head Jens Weidmann also said that ECB should "ease up on the accelerator" even though accommodation is still needed.

However, chief economist Peter Praet sounded cautious and said that the central bank needs to be persistent in keep up the massive monetary stimulus. He noted that "we are undoubtedly experiencing a solid, broad-based and resilient economic recovery that is contributing to a narrowing of the output and unemployment gaps, but a seeming disconnect between growth and inflation remains." And he emphasized that "the baseline scenario for inflation going forward remains crucially contingent on very easy financing conditions which, to a large extent, depend on the current accommodative monetary policy stance."

Ex-BoJ economists said rates could rise in fiscal 2019

In Japan, a former BoJ economist, Hideo Hayakawa said that the core-core consumer inflation could accelerate to 1% in the fiscal year ending March 2019. And by that time, BoJ could adjust the long term rate target and let it rise. Nonetheless, it would still take several more years before hitting the 2% inflation target. Meanwhile, Hayakawa criticized the Yield Curve Control framework and said it "doesn’t have the power to dramatically boost inflation." And he warned that "if the BOJ fails to hit its price target during the current economic expansion, it’s left with a pretty bad situation."

GBP/USD Mid-Day Outlook

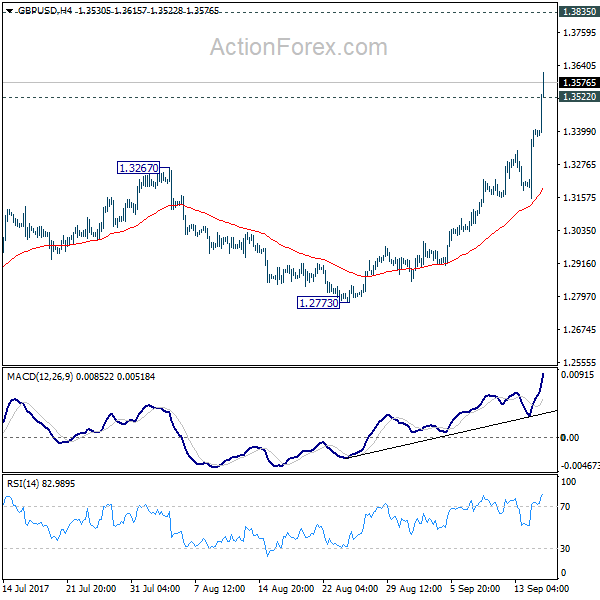

Daily Pivots: (S1) 1.3224; (P) 1.3315; (R1) 1.3485; More…

GBP/USD’s rally accelerates to as high as 1.3615 so far and intraday bias remains on the upside. Current rally should now target 1.3835 medium support turned resistance next. On the downside, below 1.3522 minor support will turn intraday bias neutral and bring consolidations, before staging another rally.

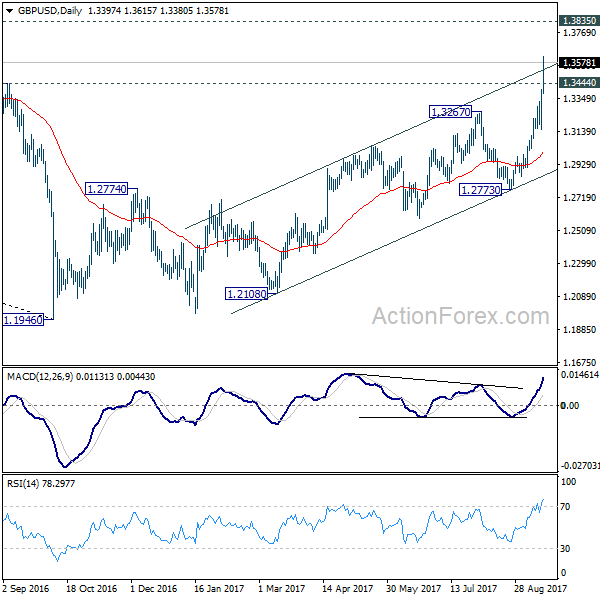

In the bigger picture, the strong break of 1.3444 key resistance now argues that the long term trend in GBP/USD has reversed. That is a key bottom was formed back in 1.1946 on bullish convergence condition in monthly MACD. Current rise from 1.1946 will target 38.2% retracement of 2.1161 to 1.1946 at 1.5466 next. In any case, medium term outlook will now stay bullish as long as 1.2773 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ Manufacturing Index Aug | 57.9 | 55.4 | 55.5 | |

| 09:00 | EUR | Eurozone Trade Balance (EUR) Jul | 18.6B | 22.1B | 22.3B | 21.7B |

| 12:30 | USD | Empire State Manufacturing Sep | 24.4 | 18 | 25.2 | |

| 12:30 | USD | Advance Retail Sales Aug | -0.20% | 0.10% | 0.60% | 0.30% |

| 12:30 | USD | Retail Sales Less Autos Aug | 0.20% | 0.50% | 0.50% | 0.40% |

| 13:15 | USD | Industrial Production Aug | 0.10% | 0.20% | ||

| 13:15 | USD | Capacity Utilization Aug | 76.80% | 76.70% | ||

| 14:00 | USD | U. of Michigan Confidence Sep P | 95.6 | 96.8 | ||

| 14:00 | USD | Business Inventories Jul | 0.20% | 0.50% |