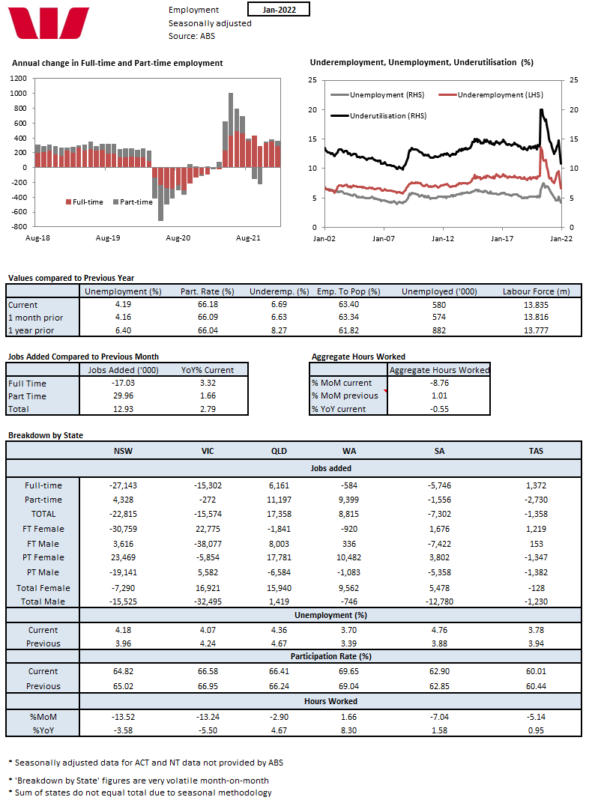

Omicron hit to hours worked but not so significant for employment. Total employment: 12.9k from 64.8k (unrevised from 64.8k) Unemployment rate: 4.2% from 4.2% (unrevised 4.2%) Participation rate: 66.2% from 66.1% (unrevised 66.1%)

January was the third consecutive upside surprise for employment. The very solid 366.1k gain in November was followed by a sound 64.8k gain December and now a softer, but still positive, 12.9k gain in January. The market had been expecting a flat print following a weak Weekly Payrolls update for January. Westpac left its January forecast at +30k as we did not know how much of the hit would come via hours worked rather than employment.

In January hours worked fell 8.8%.

The ABS noted that the large fall in hours worked reflected a greater than usual number taking annual and sick leave. Early January saw high numbers of cases associated with Omicron and considerable disruption across the labour market.

In January 2021 there was a 4.9% fall in hours worked mainly due to more people taking annual leave. At that time there were relatively low numbers of active Covid cases and only localised impact. January 2022 again saw a higher than usual number of people taking annual leave, even more so than last year, but the 8.8% fall in hours worked also reflected a much higher than usual number of people on sick leave.

The big hits occurred in NSW and Victoria where the number of people who worked reduced hours because they were sick was around three times the pre-pandemic average for January. In other states and territories, it was twice as many people. The number of people working no hours at all in a week because they were sick was particularly high at more than four times the pre-pandemic average.

It is also important to note that this was not simply because there was a larger than a normal season low in sick leave. January saw around 450k (3.4% of employed people) on sick leave, compared to the winter when sick leave usually peaks in August at around 140k to 170k.

Not surprising the fall in hours worked was greatest in NSW and Victoria (13.5% and 13.2% respectively) while WA was the only state to record an increase in hours worked (1.7%).

The other positive surprise was the relative strength in the labour force. Participation lifted from 66.09% to 66.18% representing a 0.1% rise in the labour force hence the 12.9k lift in employment was enough to hold the unemployment rate flat at 4.2%. The unemployment rate did rise slightly at two decimal places from 4.16% to 4.19%.

With all that was being thrown at Australians in January that participation held up should be seen as a positive for the Australian economy.

Looking at the states unemployment did rise in NSW from 4.0% to 4.2% with a 0.5% decline in employment (-22.8k) that was only partially offset by a 0.2ppt fall in participation to 64.8. Unemployment fell in Vic from 4.2% to 4.1% with falling participation more than offsetting the 0.4% fall in employment (-15.6k) while unemployment fell in Qld (4.7% to 4.4%) due to a solid 17.4k or 0.7% rise in employment. It does appear that Qld may have had a greater than usual summer holiday boost from escaping southerners.