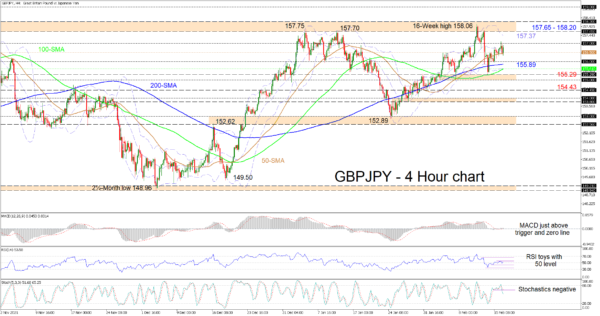

GBPJPY buyers have re-emerged around the 50-period simple moving average (SMA), shortly after the withdrawal of the pair from the 157.00 price vicinity. The gradual positive incline in the SMAs is underpinning upside moves in the pair.

The short-term oscillators are transmitting weak and conflicting messages in directional momentum. The MACD has flatlined and is marginally above its red trigger and zero lines. The RSI is fluctuating around the 50 neutral threshold but is currently pointing north a tad in the bullish region. That said, the negatively charged stochastic oscillator is reflecting the latest dip in the price and has yet to indicate that downside pressures have calmed.

If buying interest increases, immediate upside constraints could transpire from the 157.00 border and the intraday high of 157.10 before the bulls aim for the upper Bollinger band at 157.37. Looming overhead is the crucial 157.65-158.20 resistance section that has held since October 2020, which has been reinforced by multiple rally peaks over the last couple of months. A definitive climb north of this boundary could boost upside momentum, encouraging the price to propel towards the 159.00 barrier.

Alternatively, if the retraction in the price from the intraday high of 157.10 extends below the mid-Bollinger band and 50-period SMA at 156.50, sellers may then encounter a fortified region of support between the 156.00 mark and the 100-period SMA at 155.61. In the event this zone fails to dismiss downward forces, the bears may attempt to reinforce a negative trajectory with a break beneath the 155.00-155.29 support base, which could then turn the spotlight towards the 154.43 barrier.

Summarizing, GBPJPY’s neutral-to-bullish mood is intact above the SMAs and the 155.00-155.29 support base. A break above the four-month ceiling of 157.65-158.20 could boost optimism in the pair.