Dollar stays soft in early US session after mixed job data as the post FOMC minutes selloff might extend. Initial jobless claims dropped 28k to 235k in the week ended December 31, much lower than expectation of 260k. That’s also just 2k above the 43 year low of 233k made back in November. In addition, initial claims stayed below 300k for 96 straight weeks, the longest since 1970. Continuing claims rose 16k to 2.11m in the week ended December 24. ADP report showed 153k growth in private sector jobs in December, missing expectation of 175k. Challenger report showed 42.4% yoy rise in planned layoffs in December. Also release in US session, Canada IPPI rose 0.3% mom in November. RMPI dropped -2.0% mom.

UK data continues to beat market expectations. PMI services rose to 56.2 in December, up from 55.2, above consensus of 54.7. That;s also the highest level in 17 months. Markit noted that "the UK economy continues to defy widely held expectations of a Brexit-driven slowdown." Meanwhile, the all-sector PMI, including services, manufacturing and construction survey findings, also rose to 17-month high at 56.4, up from 55.1. Markit noted this points to GDP growth of 0.5% in Q4, just slightly lower than Q3 reading of 0.6%. However, it’s also cautioned that inflationary pressures are building through the supply chain and could drag down growth in 2017.

From Eurozone, PPI rose 0.3% mom, 0.1% yoy in November, better than expectation of 0.2% mom, -0.1% yoy. Retail PMI rose to 50.4 in December, up from 48.6. Elsewhere, Swiss CPI dropped -0.1% mom, 0.0% Yoy in December. China Caixin PMI services rose to 53.4 in December. Japan monetary base rose 23.1% yoy in December.

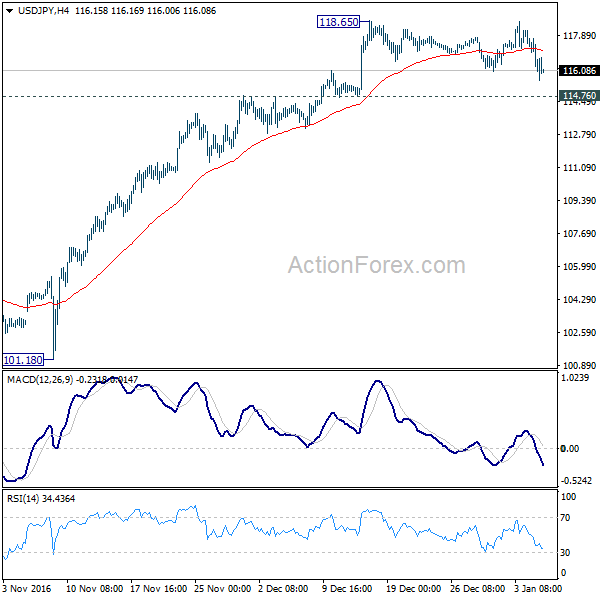

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 116.79; (P) 117.48; (R1) 117.92; More…

USD/JPY is still bounded in the consolidation from 118.65 and intraday bias remains neutral. At this point, we’d continue to expect downside to be contained by 114.76 support and bring rally resumption finally. Above 118.65 will extend the whole rise from 98.97 to 125.85 key resistance next. However, sustained break of 114.76 will confirm short term topping and bring deeper pull back to 55 day EMA (now at 112.67) and possibly below.

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. The impulsive structure of the rise from 98.97 suggests that the corrective is completed and larger up trend is resuming. Decisive break of 125.85 will confirm and target 61.8% projection of 75.56 to 125.85 from 98.97 at 130.04 and then 135.20 long term resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Dec | 23.10% | 22.30% | 21.50% | |

| 01:45 | CNY | Caixin PMI Services Dec | 53.4 | 53.3 | 53.1 | |

| 08:15 | CHF | CPI M/M Dec | -0.10% | -0.10% | -0.20% | |

| 08:15 | CHF | CPI Y/Y Dec | 0.00% | 0.00% | -0.30% | |

| 09:10 | EUR | Eurozone Retail PMI Dec | 50.4 | 48.6 | ||

| 09:30 | GBP | Services PMI Dec | 56.2 | 54.7 | 55.2 | |

| 10:00 | EUR | Eurozone PPI M/M Nov | 0.30% | 0.20% | 0.80% | |

| 10:00 | EUR | Eurozone PPI Y/Y Nov | 0.10% | -0.10% | -0.40% | |

| 12:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 12:30 | USD | Challenger Job Cuts Y/Y Dec | 42.40% | -13.00% | ||

| 13:15 | USD | ADP Employment Change Dec | 153K | 175k | 216k | 215K |

| 13:30 | USD | Initial Jobless Claims (DEC 31) | 235K | 260k | 265k | 263K |

| 13:30 | CAD | Industrial Product Price M/M Nov | 0.30% | 0.20% | 0.70% | |

| 13:30 | CAD | Raw Materials Price Index M/M Nov | -2.00% | -1.60% | 3.30% | |

| 15:00 | USD | ISM Non-Manufacutring Composite Dec | 56.7 | 57.2 | ||

| 15:30 | USD | Natural Gas Storage | -237B | |||

| 15:30 | USD | Crude Oil Inventories | 0.6M |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box