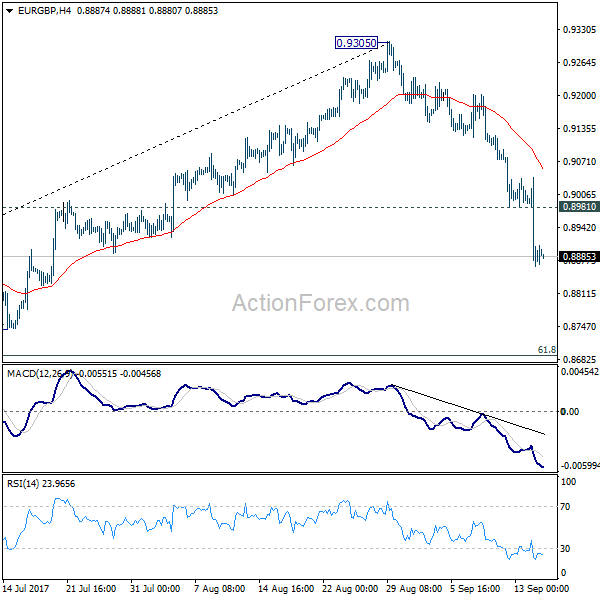

Daily Pivots: (S1) 0.8827; (P) 0.8935; (R1) 0.9003; More

Intraday bias in EUR/GBP remains on the downside as fall from 0.9305 is still in progress. Current decline is seen as the third leg of the consolidation pattern from 0.9304. Deeper fall should be seen to 61.8% retracement of 0.8312 to 0.9305 at 0.8691 and below. We’ll look for bottoming signal again at it approaches 0.8303 support. On the upside, above 0.8981 minor resistance will turn intraday bias neutral and bring recovery, before staging another fall.

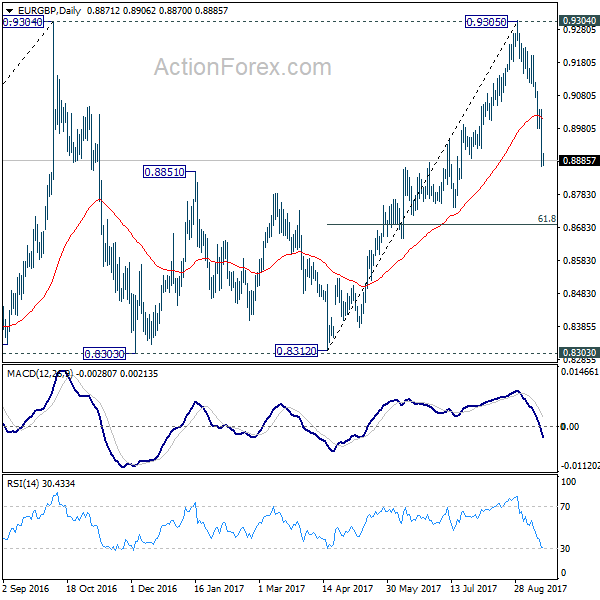

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. It’s uncertain whether it is finished yet. But in case of another fall, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside and bring rebound. Whole up trend from 0.6935 is expected to resume after consolidation from 0.9304 completes. Firm break of 0.9799 high will target 61.8% projection of 0.5680 to 0.9799 from 0.6935 at 1.1054.