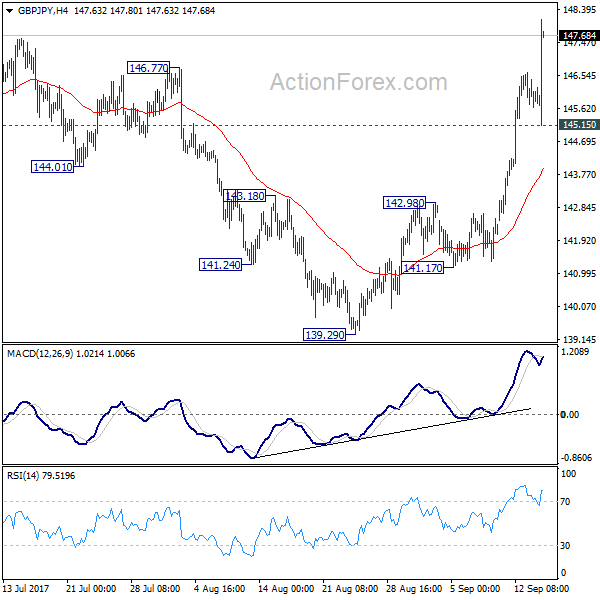

Daily Pivots: (S1) 145.49; (P) 146.08; (R1) 146.51; More

GBP/JPY’s rise from 139.29 extends to as high as 148.11 so far and it’s testing 147/76/42 resistance zone. Intraday bias remains on the upside for the moment. Firm break of 148.42 will confirm resumption of medium term rebound from 122.36. GBP/JPY should then target 150.43 fibonacci level next. On the downside, break of 145.15 support is needed to indicate short term topping. Otherwise, further rise is expected even in case of retreat.

In the bigger picture, the sideway pattern from 148.42 is still unfolding. In case of deeper fall, we’d expect strong support from 135.58 and 50% retracement of 122.36 to 148.42 at 135.39 to contain downside. Medium term rise from 122.36 is expected to resume later. And break of 38.2% retracement of 196.85 to 122.36 at 150.43 will carry long term bullish implications. However, firm break of 135.58/39 will dampen the bullish view and turn focus back to 122.36 low.