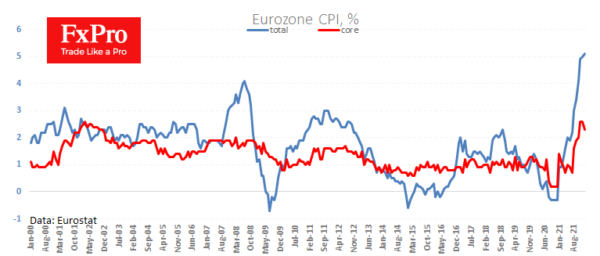

In Europe, inflation accelerates, contrary to forecasts that the peak has passed. First estimates just released noted an acceleration in CPI from 5.0% to 5.1% y/y against average estimates of a slowdown to 4.4%.

An inflation rate creeping above 5% might wake the ECB from its slumber and put a suppression of inflation on its agenda, following such peers as the Fed and the Bank of England.

We must say that the ECB has enormous potential for advancement on this issue. Right now, the markets are laying down a slight chance of one rate hike before the end of the year, while the regulator’s representatives so far remain in the position that there will be no hikes this year.

On the hawkish stance of the Fed, EURUSD fell to 1.1122 at the end of January. However, the pair moved above 1.1300 on German and Eurozone inflation data.

With the higher inflation, there are growing expectations that the ECB will make an equally sharp U-turn to suppress inflation as the Fed have. We might hear more about that tomorrow after the next meeting, and then the euro recovery could be on firmer footing.