Quick update: Dollar regains some strength after better than expected data. Headline CPI rose 0.4% mom, 1.9% yoy in August, above expectation of 0.3% mom, 1.8% yoy. Core CPI rose 0.2% mom, 1.7% yoy versus expectation of 0.2% mom, 1.6% yoy. Initial jobless claims dropped to 284k in the week ended September 9. Also, Canada new housing price index rose 0.4% mom in July.

The British Pound surges sharply as markets perceive BoE announcement today as a hawkish ones. There is no surprise from the policy decision, nor the vote split. The key is that BoE now indicated that stimulus exit could start in the coming "months". Swiss Franc stays soft after SNB left interest rates unchanged and sounds less concerned with the exchange rate in the statement. Meanwhile, Dollar is struggling to extend yesterday’s tax reform new triggered gain after US President Donald Trump denied a DACA deal with Democrats. That raises the doubt again on whether Trump is working on bipartisan solutions with Democrats which leads to speedy approval of tax reforms.

BoE: Some withdrawal of monetary stimulus likely appropriate over the coming months

BoE left monetary policies unchanged today as widely expected. Bank rate is held at 0.25% by 7-2 vote with the usual hawks Ian McCafferty and Michael Saunders maintained their vote for a 25bps hike. Asset purchase target is kept at GBP 435b unanimously. Markets seen the announcement as a hawkish one though. The minutes noted that if the economy develops as expected, the majority believed "some withdrawal of monetary stimulus was likely to be appropriate over the coming months in order to return inflation sustainably to target." At the same time, BoE also reiterated the warning that policy tightening could happen "by a somewhat greater extent" than market rates imply. Nonetheless, such rate increases would be "at a gradual pace and to a limited extent."

PM May to deliver Brexit speech in Europe’s historical heart in Florence

UK Prime Minister Theresa May announced that she will deliver a speech in Florence on September 22 "to update on Brexit negotiations so far". That will be just a few days ahead of the fourth round of Brexit negotiation, which is postponed to the week of September 25. May’s spokesman said that "she will underline the government’s wish for a deep and special partnership with the European Union once the UK leaves the EU." And May "wanted to give a speech on the UK’s future relationship with Europe in its historical heart". UK also has had "deep cultural and economic ties spanning centuries with Florence, a city known for its historical trading power."

SNB Appears Less Concerned About CHF

As widely expected, SNB decided to keep the sight deposit rate unchanged at -0.75%, while the target range for the three-month Libor stayed at between -1.25% and -0.25%. The central bank also reiterated the pledge that it would intervene in the foreign exchange market if needed. Yet, SNB’s sight deposit and FX reserve data indicate that less intervention has been adopted recently. Also Swiss franc’s depreciation against the over the past few months has offered some reliefs to the policymakers. At the the members acknowledged the franc is not as overvalued as before. Nonetheless, weak economic and inflation have led the members to remain cautious and maintain the monetary policy unchanged. More in SNB Appears Less Concerned About CHF.

ECB Jazbec: More evidence needed before stimulus withdrawal

ECB governing council member Bostjan Jazbec said that more evidence is needed before the central bank decides to withdraw from the massive monetary stimulus. Jazbec noted that "we are still closely monitoring all developments, which are clearly going the way we expected." However, "the timing for the decision (on reducing bond purchases) has been postponed mainly because developments are in our view still not confirming the decision which will inevitably follow." And, "we need more data and more confirmation that what we are doing is in line with fulfilling our mandate." Strength of Euro is reported to be a major concerns among policy makers. But Jazbec sounded calm on it and note that the strong euro was a "a reflection of the robustness of growth development" in the euro zone.

Trump denied a DACA deal with Democrats

US President Donald Trump pushed back against claims from top Democrat lawmakers that a deal was made over the so called DACA (Deferred Action for Childhood Arrivals ) program. Trump tweeted that "no deal was made last night on DACA". And, massive border security would have to be agreed to in exchange for consent. Would be subject to vote."

Yesterday, Democrat leaders of the House and Senate, Nancy Pelosi and Chuck Schumer, said that yesterday that after a "very productive dinner" with Trump, "we agreed to enshrine the protections of DACA into law quickly and to work out a package of border security, excluding the wall, that’s acceptable to both sides".

The White House issued a statement yesterday that the topics at the dinner with Democrats include tax reform, border security, DACA, infrastructure and trade. And the statement noted that "this is a positive step toward the President’s strong commitment to bipartisan solutions for the issues most important to all Americans.

Also, House Ways and Means Committee Chairman Kevin Brady, the chief house tax writer, said the tax overhaul framework will be released in the week of September 25. Brady said that’s a "consensus" of the so called Big Six including Speaker Paul D. Ryan, Senate Majority Leader Mitch McConnell, Senate Finance Committee Chairman Orrin G. Hatch, Treasury Secretary Steven Mnuchin, and White House economic adviser Gary Cohn.

There was hopes that Trump’s change in his "strategy" in engaging the Democrats would speed up the progress to get tax reform through the Congress. Dollar surged as a result of this expectation. But markets will be cautious, at least until Trump delivers something concrete. And, time is needed to see whether Trump is really willing to work with the Democrats for so called "bipartisan solutions" for the good of Americans.

Aussie lifted mildly by strong job data

Australian job market expanded by 54.2k in August, nearly triple of expectation of 19.2k. That consists of decent growth in full-time jobs by 40.1k and part-time jobs by 14.1k. Unemployment rate was unchanged at 5.6%, in line with consensus. Participation rate also rose to 65.3%. There is slight change in expectation of RBA policies after the data. Markets are pricing in roughly 50% chance of a hike in June 2018.

RBA board member Ian Harper said yesterday that while there is "terrific" full time job growth, it’s a "concern" to see sluggishness in underemployment. And, the Australian economy is still "operating below its potential". And it cannot justify a rate hike yet. Nonetheless, improvements in the economy prompted market analysts to reverse their forecast of RBA rate path. National Australia Bank predicted two rate cuts by RBA in 2017 earlier this year. But now’s NAB is expecting a total for four rate hikes by RBA over the next two years. Stronger employment, GDP growth and investment are the main reasons for the change in NAB’s forecast.

Disappointing August Data Evidenced That Chinese Growth Peaked In 1H17

August data further evidenced that China’s economic growth has peaked in the first quarter. Following the sharper-than-expected slowdown in growth in July, the latest set of macroeconomic data also surprised to the downside. The moderation was a result of the government’s tighter monetary policy in an attempt to curb excessive investment in certain areas, such as real estate. Renminbi’s appreciation against US dollar since the beginning of the year probably has weighed on exports. This leads the PBOC to loosen capital control which has been adopted over the past years to prevent renminbi from severe depreciation. More in Disappointing August Data Evidenced That Chinese Growth Peaked In 1H17.

GBP/USD Mid-Day Outlook

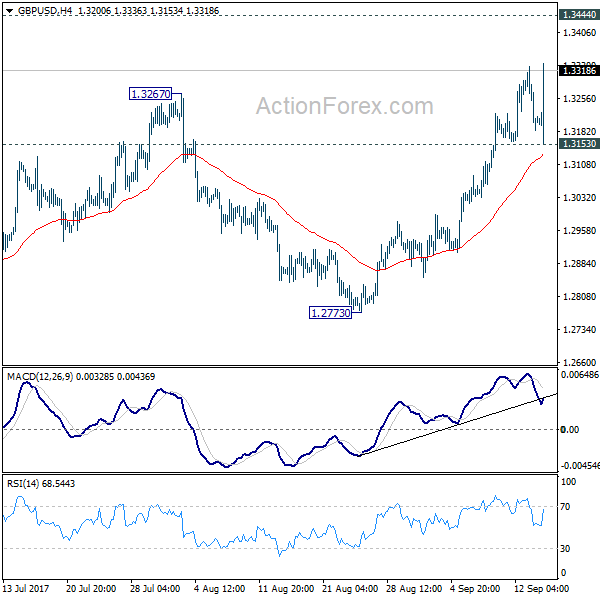

Daily Pivots: (S1) 1.3150; (P) 1.3240; (R1) 1.3297; More…

GBP/USD’s rally resumes after brief retreat, breaking 1.3328 to as high as 1.3336 so far. Intraday bias is back on the upside for 1.3444 key resistance next. Still, we’d maintain that price actions from 1.1946 are still seen as a corrective pattern. Hence, we’d expect strong resistance from 1.3444 to limit upside to bring larger down trend reversal eventually. Break of 1.3153 support will raise the chance of reversal and turn bias to the downside for 55 day EMA (now at 1.2987) first. However, on the upside, firm break of 1.3444 will carry larger bullish implication and target 1.3835/5016 resistance first zone next.

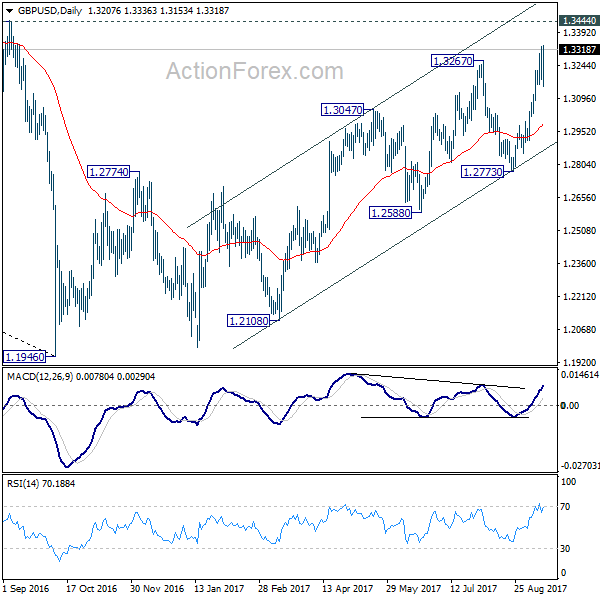

In the bigger picture, overall, price actions from 1.1946 medium term low are seen as a corrective pattern. While further rise cannot be ruled out, larger outlook remains bearish as long as 1.3444 key resistance holds. Down trend from 1.7190 (2014 high) is expected to resume later after the correction completes. And break of 1.2773 support will be the first sign that such down trend is resuming. However, considering bullish convergence condition in monthly MACD, firm break of 1.3444 will argue that whole down trend from 2.1161 (2007) has completed. And stronger rise would be seen back to 38.2% retracement of 2.1161 to 1.1946 at 1.5466.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS House Price Balance Aug | 6.00% | 0.00% | 1.00% | |

| 01:00 | AUD | Consumer Inflation Expectation Sep | 3.80% | 4.20% | ||

| 01:30 | AUD | Employment Change Aug | 54.2K | 19.2K | 27.9K | 29.3K |

| 01:30 | AUD | Unemployment Rate Aug | 5.60% | 5.60% | 5.60% | |

| 02:00 | CNY | Retail Sales Y/Y Aug | 10.10% | 10.50% | 10.40% | |

| 02:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Aug | 7.80% | 8.20% | 8.30% | |

| 02:00 | CNY | Industrial Production Y/Y Aug | 6.00% | 6.60% | 6.40% | |

| 04:30 | JPY | Industrial Production M/M Jul F | -0.80% | -0.80% | -0.80% | |

| 07:30 | CHF | SNB Sight Deposit Interest Rate | -0.75% | -0.75% | -0.75% | |

| 07:30 | CHF | SNB 3-Month Libor Upper Target Range | -0.20% | -0.25% | -0.25% | |

| 07:30 | CHF | SNB 3-Month Libor Lower Target Range | -1.25% | -1.25% | -1.25% | |

| 11:00 | GBP | BoE Rate Decision | 0.25% | 0.25% | 0.25% | |

| 11:00 | GBP | BoE Asset Purchase Target Sep | 435B | 435B | 435B | |

| 11:00 | GBP | MPC Official Bank Rate Votes | 2–0–7 | 2–0–7 | 2–0–6 | |

| 11:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | 0–0–8 | |

| 12:30 | CAD | New Housing Price Index M/M Jul | 0.40% | 0.30% | 0.20% | |

| 12:30 | USD | Initial Jobless Claims (SEP 09) | 284K | 300k | 298k | |

| 12:30 | USD | CPI M/M Aug | 0.40% | 0.30% | 0.10% | |

| 12:30 | USD | CPI Y/Y Aug | 1.90% | 1.80% | 1.70% | |

| 12:30 | USD | CPI Core M/M Aug | 0.20% | 0.20% | 0.10% | |

| 12:30 | USD | CPI Core Y/Y Aug | 1.70% | 1.60% | 1.70% | |

| 14:30 | USD | Natural Gas Storage | 80B | 65B |