OPEC and its allies will gather on Wednesday in a scheduled meeting to assess conditions in the oil market and decide on further supply increases. Crude prices are pinned at the highest in more than seven years and the roaring start to 2022 is definitely captivating enough for producers to raise output at a faster pace. Despite that, producers may stick to their initial plan, delivering only a modest boost as doubts remain about whether spare capacity will be enough to commit to meaningful increases.

Oil prices attractive for a sharper output hike

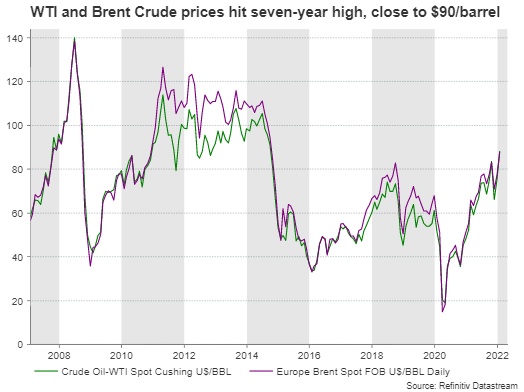

OPEC+ oil exporters are expected to follow the script and raise their output by 400,000 barrels a day for March as part of a plan which aims to gradually recover the lost supply of 9.7 million bpd or 10% of global demand that was removed two years ago in the face of the Covid-19 crisis. But producers may have every reason to ramp up their output faster than previously proposed. Unlike other covid variants, omicron did little to dent energy demand, while heavy snowfalls around the globe further bolstered the need for fuel, sending the international benchmark Brent price above the $90.00/barrel and the West Texas Intermediate (WTI) as high as $88.81/barrel.

With oil prices driving the inflation storm and central banks seeking adjustments in their policies to cool the price acceleration before it permanently spreads to other sectors and ruins the economic recovery, oil exporters could ideally fill the excess demand and contribute to the inflation fight by raising their production volumes.

OPEC+ to stick to initial plan

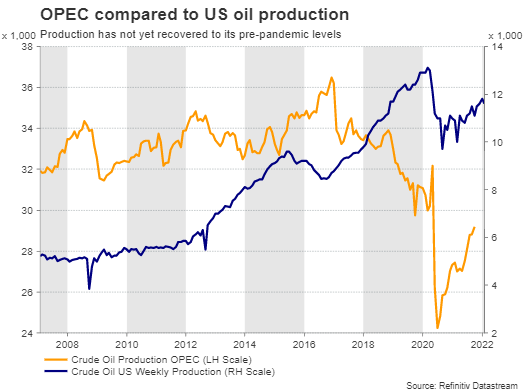

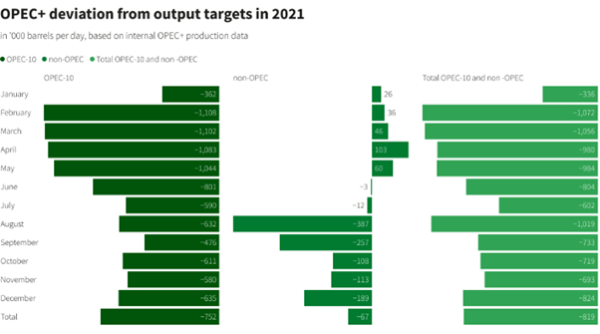

Yet, the decision could be more complicated than it seems. Although the omicron wave proved less deadly, it is still transmitting more rapidly than others, forcing a bulk of workers to isolate themselves. As a result, key OPEC+ countries such as Russia and Nigeria have been struggling to keep pace with their allowed increases, delivering output below-target over the past few months. Specifically, analysts believe that Russia’s monthly increases will not be able to exceed 60,000 bpd in the first half of 2022 due to a decline in drilling compared to its required amount of 100,000 bpd. Technical issues and the lack of investment have been a headache as well, while local military attacks in Libya further tightened OPEC+ deliveries.

Reuters’ data have recently shown that the OPEC+ group was 800,000 bpd below its quota target last year, missing billions of dollars in revenue, which could otherwise be distributed to the less fortunate members for investment. January’s miss was even larger than the one in December, a survey indicated.

Hence, although the attractive prices and the rosy 2022 outlook from several financial institutions, which foresee crude prices surging to $100/barrel, would theoretically induce OPEC producers to open their taps so as to also limit competition from US shales, the tight spare capacity could play down the scenario of higher production increases for now, especially as the boiling political tensions across the Ukrainian border are currently threatening even existing supply arrangements.

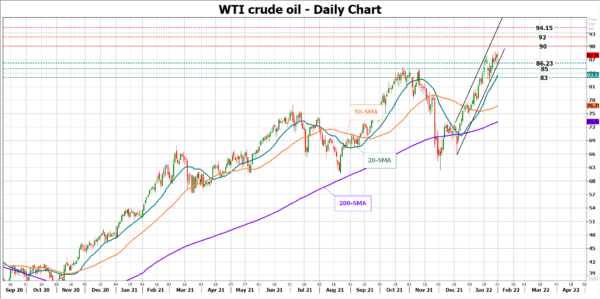

WTI crude

If OPEC+ oil exporters repeat the gradual increase of 400,000 bpd at a time when global economic activity asks for a stronger boost, WTI crude could crawl up to $90.00/barrel. A sharper ascend could stabilize around the resistance line at $92.00 before the $94.15 barrier comes on the radar.

In the event oil producers stress the need for a sharper increase, WTI could initially seek support around the nearby floor of $86.23. Failure to rebound here and an extension below the $85.00 round level would question the bullish trend in the market, bringing the $83.00 – $82.00 territory next on the radar. Yet, in the broad picture, the positive trajectory may stay in place as long as the price trades above the $62.00 level.