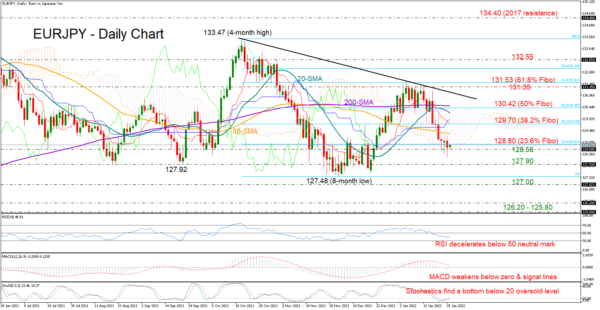

EURJPY slid to a one-month low of 128.23 on Tuesday but managed to close the day within the 128.80- 128.58 tight support area, clinging to a ray of hope that a bullish reversal could develop in the short term.

While the Stochastics are pivoting below 20, flashing oversold conditions, the RSI and the MACD continue to trend downwards within the bearish territory, suggesting the three-week-old sell-off could gain extra legs before the bulls come into play. The recent negative intersection between the red Tenkan-sen and Kijun-sen lines is backing this narrative as well.

If the 128.58 floor cracks, the price could initially pause within the August-September support region of 127.92 before it tests the 127.48 bottom. Crossing below the 127.00 level, the bears may next target the 126.20 – 125.80 restrictive zone, last active during the December 2020 – January 2021 period.

On the upside, if the price crawls above the nearby 128.80 resistance, which represents the 23.6% Fibonacci retracement of the 133.47 – 127.48 down leg, the 50-day simple moving average (SMA) could immediately block the way towards the 38.2% Fibonacci of 129.70. Running higher, the pair may seek a close above the 50% Fibonacci and the 200-day SMA both near 130.42, though a decisive rally above the tough descending trendline at 131.14 would be more meaningful, especially if that is followed by a break above the 61.8% Fibonacci of 131.53 and the previous peak of 131.59.

In brief, EURJPY is in bearish mode in the short-term picture. A close below the 128.58 bar could bolster selling forces.