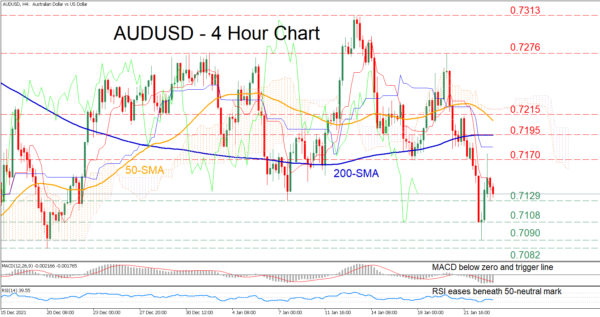

AUDUSD has experienced a sharp dip in the four-hour chart, crossing beneath both its 50- and 200-period simple moving averages (SMAs). However, the pair managed to partially bounce back after finding significant support at the 0.7090 level.

The ongoing rebound seems to be in danger as the short-term oscillators indicate that selling forces continue to have the upper hand. The MACD histogram remains below both zero and its red signal line, while the RSI is hovering in the negative zone. Moreover, the price is currently trading well beneath the Ichimoku cloud further endorsing the negative outlook.

Should the negative momentum intensify, the price might dip towards the recent low of 0.7129. Breaching this barrier, the bears could aim for the 0.7108 obstacle. Further downside pressure could send the price to test 0.7090.

On the flipside, if buyers manage to retake control, the price may meet initial resistance at the 0.7170 hurdle. Conquering this barricade, the spotlight would turn to the 0.7195 level, which overlaps with the 200-period SMA. Higher, the price might jump towards the 0.7215 region before it challenges 0.7276.

In brief, the outlook for AUDUSD remains negative despite the recent minor rebound. For that bearish tone to reverse, the price needs to profoundly cross above the 0.7276 region.