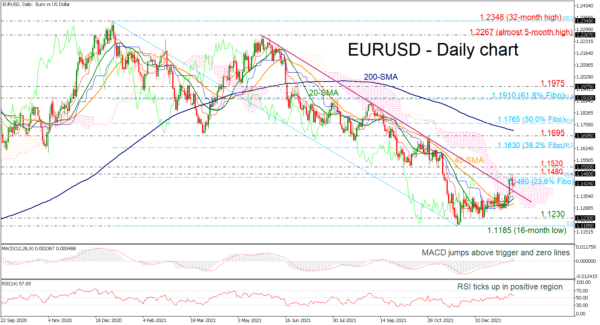

EURUSD is returning around the 1.1400 level and is flirting with the long-term descending trend line in the Ichimoku cloud. Also, the price is still hovering underneath the 23.6% Fibonacci retracement level of the down leg from 1.2348 to 1.1185 at 1.1460 and is trying to overcome the latest highs of the preceding week.

According to technical indicators, the MACD oscillator is holding above its trigger and zero lines, while the RSI is pointing slightly up in the positive region. The 20- and 40-day simple moving averages (SMAs) are following the current market action, confirming the recent bullish crossover.

Should buying forces strengthen, the 1.1480-1.1520 resistance area will come under the spotlight. The 38.2% Fibonacci of 1.1630 could initially be a tough resistance to the bias on the negative side. However, moving higher, the 1.1695 barrier and the 200-day SMA at 1.1725 could next add some footing ahead of the 50.0% Fibonacci of 1.1765.

Alternatively, a close below the Ichimoku cloud will turn the focus to the downside again, pushing the price towards the 1.1230 support level. Beyond that, the rally may gear down to the 16-month low of 1.1185 and the 1.1015 hurdle, taken from the inside swing high in April 2020.

In brief, EURUSD is facing a weakening bullish bias, where a drop below 1.1300 is expected to enhance selling interest again.