Dollar remains overwhelmingly the worst performer today, as selloff extends. There is little support from hawkish Fedspeaks, with some officials expressing openness to four rate hikes this year. Commodity currencies continue to be the biggest winners, as supported by resilient risk sentiment. In particular, US futures are pointing to higher open, and further rally could intensify the current moves. European majors are mixed, with Sterling’s rally in crosses slowing.

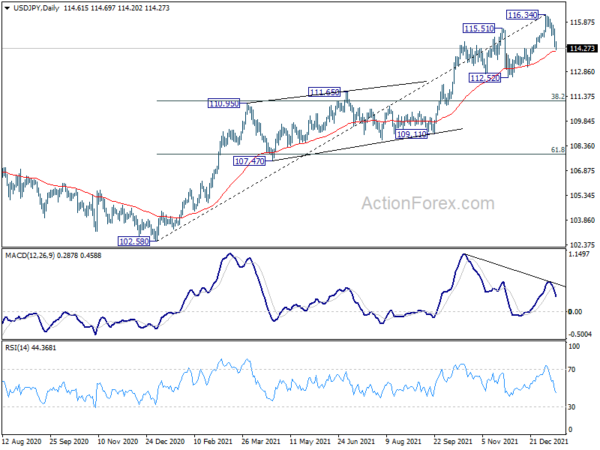

Technically, USD/JPY’s extended decline is a rather bad sign for the greenback. Sustained break of 55 day EMA (now at 114.10), with bearish divergence condition in daily MACD, will raise the chance that it’s already in medium term correction. Deeper fall could then be seen through 112.52 support ahead. That could be accompanied by EUR/USD’s break of 1.1598 fibonacci resistance.

In Europe, at the time of writing, FTSE is up 0.07%. DAX is up 0.25%. CAC is down -0.43%. Germany 10-year yield is down -0.0128 at -0.071. Earlier in Asia, Nikkei dropped -0.96%. Hong Kong HSI rose 0.11%. China Shanghai SSE dropped -1.17%. Singapore Strait Times rose 0.07%. Japan 10-year JGB yield rose 0.0021 to 0.131.

US initial jobless claims rose to 239k, continuing claims dropped to 1.56m

US initial jobless claims rose 23k to 230k in the week ending January 8, above expectation of 213k. Four-week moving average rose 6k to 211k. Continuing claims dropped -194k to 1559k in the week ending January 1, lowest since June 2 1973. Four-week moving averages of continuing claims dropped -77k to 1722k, lowest since March 7, 2020.

US PPI rose 0.2% mom, 9.7% yoy in Dec

US PPI for final demand rose 0.2% mom in December, below expectation of 0.4% mom. Over the year, PPI accelerated to 9.7% yoy, up from 9.6% yoy, below expectation of 9.8% yoy. PPI core rose 0.5% mom versus expectation of 0.4% mom. Over the year, PPI core accelerated to 8.3% yoy, up from 7.7% yoy, above expectation of 8.0% yoy.

Fed Harker open to more than three hikes if required

Philadelphia Fed President Patrick Harker said in an FT interview, “I currently have three increases in for this year, and I’d be very open to starting in March. I’d be open to more if that’s required.”

“We don’t want to put the brakes on completely, but we do need to slow down some of the demand,” he said. “We can do something… by raising the fed funds rate.”

“Ultimately, what we worry about is that people start to think, ‘Well, inflation is just not going to be at 2 per cent, it’s going to be at 2.5 per cent or 3 per cent going forward’,” he said.

As for the balance sheet run-off, Harker said if could start once interest rates were “sufficiently away” from zero. “I am very much in the camp of communicating over and over how we’re going to do this and then being methodical,” he said.

ECB bulletin: Eurozone output to exceed pre-pandemic level in Q1

In the monthly economic bulletin, ECB said, “the global economy remains on a recovery path, although persisting supply bottlenecks, rising commodity prices and the emergence of the Omicron variant of the coronavirus (COVID-19) continue to weigh on the near-term growth prospects.”

“Supply bottlenecks are expected to start easing from the second quarter of 2022 and to fully unwind by 2023.” But “the future course of the pandemic remains the key risk affecting the baseline projections for the global economy.” Risk to growth outlook are “tilted to the downside” and balance of risks to global inflation is “more uncertain”.

Eurozone growth is “moderating” but “activity is expected to pick up again strongly in the course of this year.” Output is expected to exceed pre-pandemic level in Q1 of 2022. However, as some Eurozone countries have reintroduced tighter restrictions, “this could delay the recovery, especially in travel, tourism, hospitality and entertainment”.

ECB de Guindos: Inflation not going to be as transitory as expected

ECB Vice President Luis de Guindos said, “inflation is not going to be as transitory as forecast only some months ago. The assessment of risk for inflation is moderately tilted to the upside over the next 12 months.”

“And the reasons are quite simple. First, supply side bottlenecks are going to be there and are more persistent than we and many expected in the past,” de Guindos said. “And energy costs are going to remain quite elevated.”

Nevertheless, over the longer term, risks to inflation outlook are still balanced. Inflation are projected to fall back below ECB’s target of 2% in 2023 and 2024.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3646; (P) 1.3680; (R1) 1.3737; More…

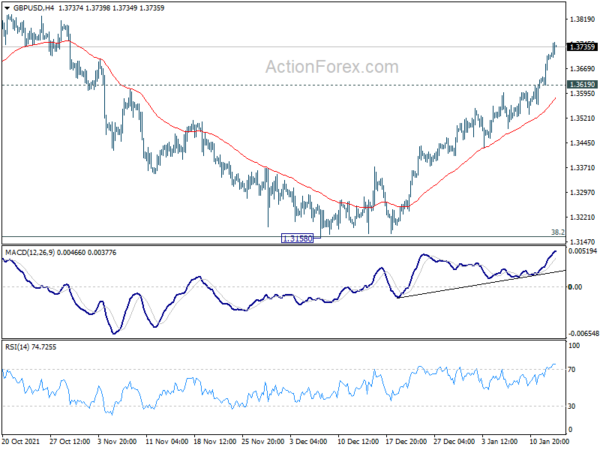

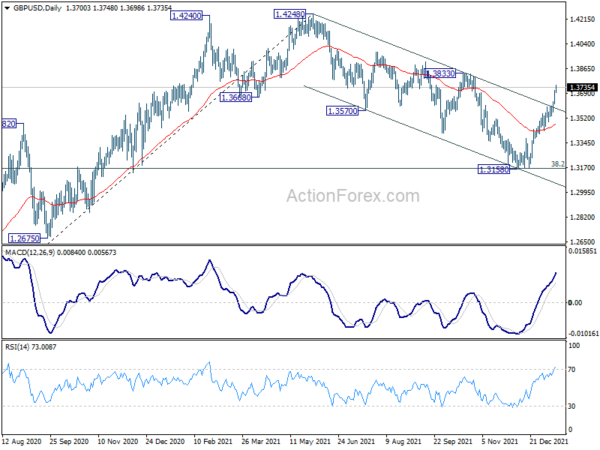

GBP/USD’s rise from 1.3158 is in progress and hits as high as 1.3746 so far. Intraday bias remains on the upside for 1.3833 resistance first. As noted before, corrective fall from 1.4282 should have completed with three waves down to 1.3158, after hitting 1.3164 medium term fibonacci level. Sustained break of 1.3833 will pave the way back to retest 1.4248 high. On the downside, below 1.3619 minor support will turn intraday bias neutral first. But further rise will remain in favor as long as 55 day EMA (now at 1.3479) holds.

In the bigger picture, strong support was seen from 38.2% retracement of 1.1409 to 1.4248 at 1.3164. The development suggests that up trend from 1.1409 (2020 low) is still in progress. On resumption, next target will be 38.2% retracement of 2.1161 to 1.1409 at 1.5134. Nevertheless sustained break of 1.3164 will argue that whole rise from 1.1409 has completed and bring deeper fall to 61.8% retracement at 1.2493.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Nov | 0.60% | -2.00% | -2.10% | |

| 23:50 | JPY | Money Supply M2+CD Y/Y Dec | 3.70% | 3.90% | 4.00% | |

| 06:00 | JPY | Machine Tool Orders Y/Y Dec P | 40.50% | 64.00% | ||

| 09:00 | EUR | ECB Economic Bulletin | ||||

| 13:30 | USD | PPI M/M Dec | 0.20% | 0.40% | 0.80% | 1.00% |

| 13:30 | USD | PPI Y/Y Dec | 9.70% | 9.80% | 9.60% | |

| 13:30 | USD | PPI Core M/M Dec | 0.50% | 0.40% | 0.70% | 0.90% |

| 13:30 | USD | PPI Core Y/Y Dec | 8.30% | 8.00% | 7.70% | |

| 13:30 | USD | Initial Jobless Claims (Jan 7) | 230K | 213K | 207K | |

| 15:30 | USD | Natural Gas Storage | -175B | -31B |