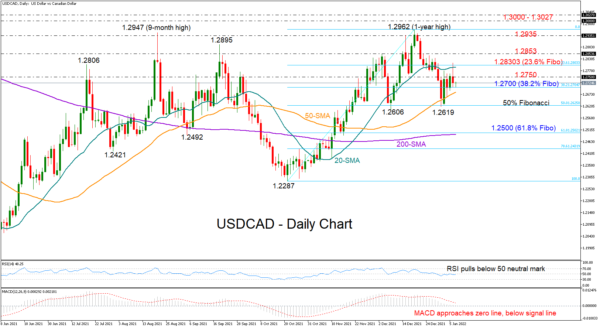

USDCAD is facing difficulties in extending Monday’s swift bullish correction, which helped the pair survive a trend deterioration below the previous low of 1.2606 in the short-term window.

Despite the flash pickup to 1.2812 yesterday, the price flipped back to maintain its weekly neutral trajectory within the 1.2700 – 1.2750 region, with the former representing the 38.2% Fibonacci retracement of the 1.2287 – 1.2962 upleg.

The technical signals are currently illustrating a gloomy mood among traders as the MACD has further distanced itself below its red signal line in the positive area and the RSI is looking powerless to cross above its 50 neutral mark.

Support at 1.2700 and the 50-day simple moving average (SMA) currently at 1.2685 are keeping some buying interest in play at the moment. If they fail to hold, all attention will shift back to the 1.2600 – 1.2619 floor, where any violation is expected to activate a sharp decline towards the 61.8% Fibonacci of 1.2500 and the 200-day SMA.

On the upside, a close above 1.2750 could bring the area around the 23.6% Fibonacci of 1.2800 back under examination. Climbing higher, the 1.2853 barrier could challenge the bulls ahead of the 1.2935 – 1.2962 resistance zone. Then, not far above, the 1.3000 – 1.3027 bar from August – November 2020 could be another tough obstacle.

In brief, although the short-term uptrend in USDCAD remains valid, negative risks continue to linger in the background. A clear move below 1.2700 – 1.2685 is expected to confirm a bearish bias.