The currency pair edges higher and looks poised to approach and reach fresh new highs in the upcoming period. Right now is pressuring a dynamic resistance, could find temporary resistance at this level and could retreat a little to recapture more directional energy. Is trapped within an ascending channel, so the perspective remains bullish on the short term.

Is trading in the green and should approach the 1.1536 previous high, could be attracted also by a major dynamic resistance.

The Euro-zone and the Switzerland data could bring more action on this pair. The German Final CPI could increase by 0.1% in August, while the German WPI is expected to increase by 0.1% after the 0.1% drop i the former reading period. The Inflation Production may increase by 0.1%, while the Employment Change by 0.3%.

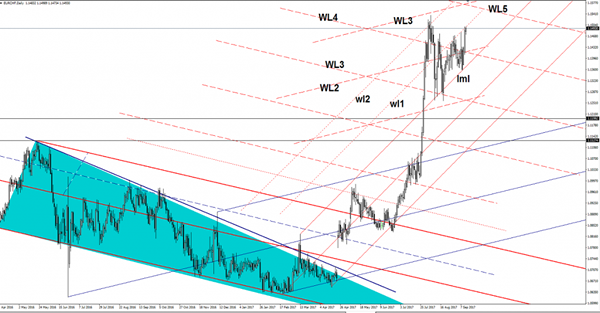

Price rallied aggressively after the retest of the upper median line (uml) of the minor ascending pitchfork and now is pressuring the first warning line (wl1). Is trapped within the upper median line (uml) and the warning line (wl1). Remains to see if we’ll have a breakout or a retreat towards the upper median line (uml).

You should know that the major upside target will be at the fifth warning line (WL5) of the major descending pitchfork. Resistance could be found also at the third warning line (WL3) of the major ascending pitchfork. I’ve said in the previous weeks that the perspective will remain bullish as long as the rate is trading above the upper median line (uml).