- Wall Street bounces back as investors shrug off inflation and Omicron concerns

- US yields also rebound but dollar pressured by improved sentiment

- Aussie climbs on upbeat RBA, oil rally lifts loonie, BoE uncertainty caps pound’s gains

Risk appetite returns as Omicron gloom recedes further

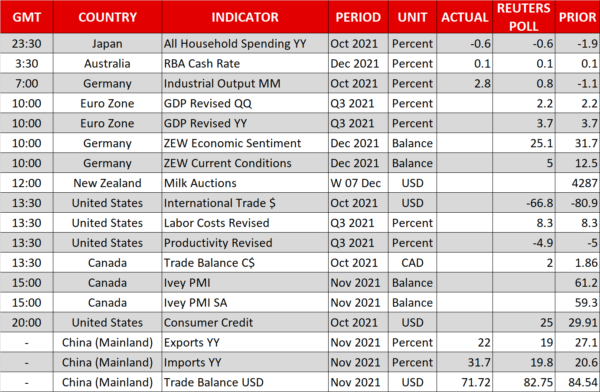

Equity markets were in a buoyant mood on Tuesday following a strong rebound on Wall Street yesterday. US stocks staged an impressive rally, with the Dow Jones gaining 1.9% and the S&P 500 1.2%, recouping last week’s losses. The Nasdaq Composite was a noticeable laggard, however, closing just 0.9% higher, as growth stocks were hit by a late selloff in long-dated Treasury notes. The yield on 10-year Treasuries jumped from around 1.35% to close above 1.43%.

With the evidence so far suggesting that the new Omicron variant causes only mild symptoms even if it is more transmissible than the Delta strain, investors are hoping that another winter of widespread economic shutdowns can be avoided this time. This is giving value stocks the edge as traditional sectors of the economy look poised to recover further while the hefty valuations of many growth stocks are coming into question as long-term borrowing costs begin to rise again.

Whilst there are still many unknowns about the Omicron variant and just how effective the current generation of vaccines will be in preventing a massive surge in hospitalizations, the inflation outlook is probably a bigger variable for investors in the medium term.

Most major central banks have begun to scale back their pandemic-era stimulus and are now pondering whether a faster withdrawal is warranted given the troubling inflation picture. There is a risk that policymakers overreact to the inflation threat and choke the economic recovery. But with some central banks such as the PBOC doing the opposite and announcing an easing of policy, markets are able to put those worries aside for now.

As expected, the PBOC cut the reserve requirement ratio for most commercial banks by 50 basis points on Monday. It followed it up today by lowering its relending rate for small and rural companies, raising speculation that the benchmark LPR rate could be cut next.

Chinese stocks rose but pared some of their earlier advances by the close. European bourses, however, posted solid gains in early trade, while US futures were also last up sharply.

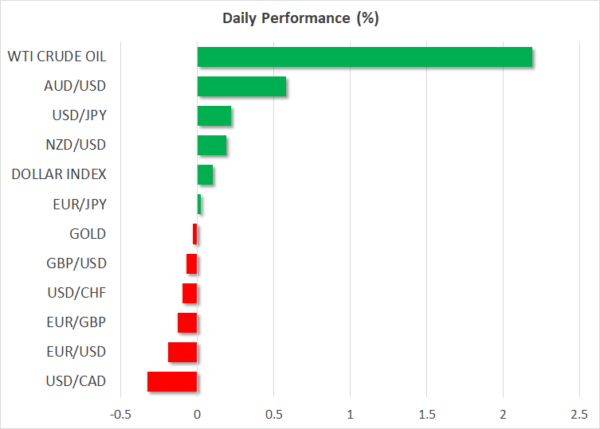

Aussie and loonie lead the pack as safe havens retreat

The improved risk tone weighed on safe haven currencies, with the yen and Swiss franc slipping against most of their peers. The US dollar started the day broadly weaker too but later stood flat against a basket of currencies as it got shored up by the climb in Treasury yields.

The Australian dollar was once again an outperformer, flirting with the $0.71 level, after the Reserve Bank of Australia kept policy unchanged earlier today, signalling that it will taper its bond purchases further in February.

The Australian economy is making a strong comeback after months of lockdown and unless the Omicron outbreak derails the recovery, which doesn’t seem likely at this point, there is a good chance the RBA will end its bond purchases early and bring forward the timing of its first rate hike.

The Canadian dollar extended its gains too, firming to more than one-week highs versus the greenback. The Bank of Canada is due to announce its latest policy decision tomorrow and might follow in the RBA’s footsteps and maintain its optimism about the outlook. However, the loonie’s gains this week are likely being led by the rebound in oil prices.

After plunging to more than three-month lows last week, WTI and Brent crude futures are rallying on dimming hopes of a breakthrough in the nuclear talks between Iran and the West. In addition, fading fears about the Omicron outbreak are also boosting oil and other commodities.

Pound and euro lag

The pound was struggling to build on yesterday’s advances, stalling around $1.3260, amid mixed messages by Bank of England policymakers. One of the BoE’s biggest hawks – Michael Saunders – struck a cautious note on Monday, worried about the possible impact of the Omicron variant. But Deputy Governor Ben Broadbent warned that inflation could exceed 5% in the coming months.

The euro, meanwhile, remained under pressure, drifting towards $1.1250, as the ECB is increasingly alone in being relaxed about the upward spiral in inflation. The ECB, Fed and BoE are all due to meet next week, and with the latter two likely taking another hawkish turn, the euro’s woes could get much worse.