US stocks dropped sharply overnight following surprisingly hawkish comments from Fed Chair Jerome Powell. In short, he said that “the threat of persistently higher inflation has grown”. More importantly, Fed is “going to have a conversation at our next meeting about accelerating the taper and ending our asset purchases a few months early”.

More on Fed: Hawkish Powell Expects Fed to End QE Tapering a Few Months Earlier than Previously Anticipated

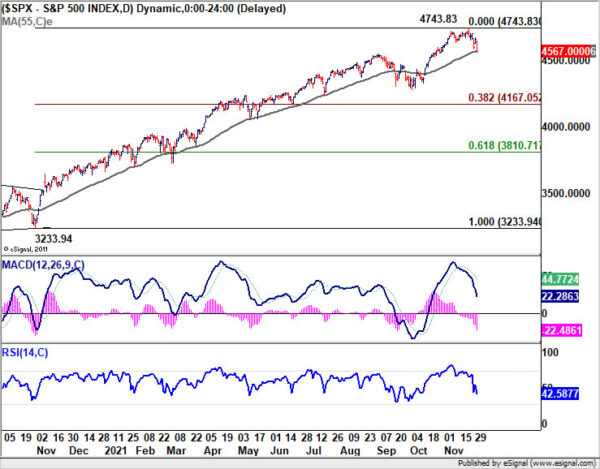

S&P 500 dropped -1.90% to close at 4567.0 and it’s now pressing 55 day EMA (now at 4564.0). Sustained break there will align the outlook with DOW, and indicates that 4743.83 is a medium term top.

In this case, SPX could have already started a correction to whole up trend from 3233.94. Deeper decline could then be seen back to 38.2% retracement of 3233.94 to 4743.83 at 4167.05. For now, risk will stay on the downside as long as 4743.83 resistance holds, in case of recovery.