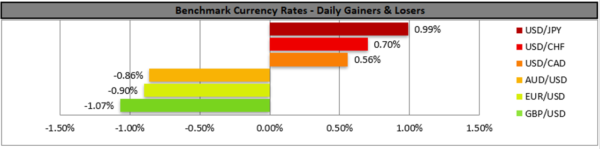

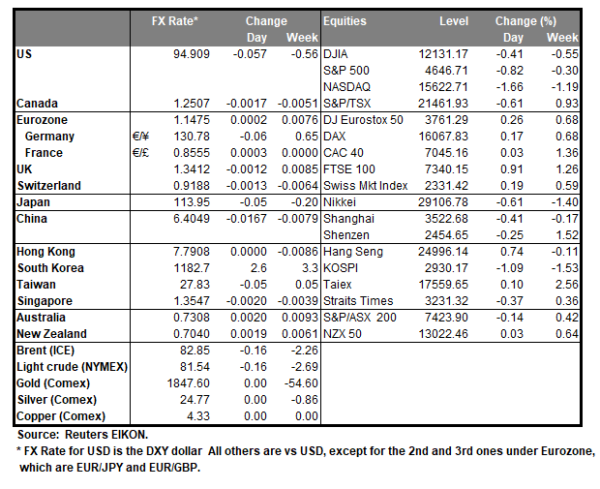

The USD rallied against a number of its counterparts yesterday and the USD Index reached levels not seen since July last year, as October’s CPI rates accelerated beyond the market’s expectations. On a monthly level the headline CPI rate reached 0.9% mom, while on a yearly level it reached 6.2% yoy, a level not seen since November 1990 underscoring the inflationary pressures the US economy is going through currently. Also the weekly initial jobless claims figure dropped to a new post pandemic low, underscoring the tightening of the US employment market. Market pressure intensified on the Fed to tighten its monetary policy at a faster pace in order to curb the red hot inflation. San Francisco Fed President Daly had stated earlier in the week that she expects supply chain constraints to be maintained yet price pressures to moderate as we get through the pandemic, yet the Fed’s perception of the “temporary” nature of inflation seems to weaken. US Stockmarkets retreated also highlighting market expectations for the Fed to act. On the other hand, gold prices also gained substantially as the precious metal is used for hedging purposes against high inflation.

Gold’s price jumped yesterday breaking the 1833 (S1) and the 1851 (R1) at some point aiming for the 1870 level at some point, before correcting lower and stabilising somewhat during today’s Asian session. We tend to maintain a bullish outlook for the precious metal, given also that the RSI indicator below our 4-hour chart is at the reading of 70 confirming the bullish sentiment of the market, yet may also imply that gold is overbought and a correction lower may take place. Should the shiny metal find fresh new buying orders along its path, we may see it breaking the 1851 (R1) resistance line and aim for the 1870 (R2) level. Should a correction lower take place, we may see gold’s price aiming if not breaking the 1833 (S1) support line.

Pound traders eye GDP release today

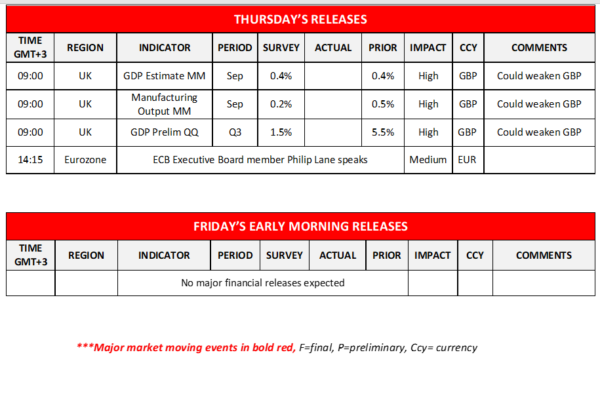

The pound retreated against the USD yesterday but also against EUR, JPY and CHF in a sign of the sterling’s weakness. On the monetary level, there seem to be expectations by the market for the BoE to maintain rates unchanged in its next meeting which could weigh on the pound, yet the majority of the market seems to price in that the bank will actually proceed with a rate hike. On a fundamental level, the tensions in the relationship of the UK with the EU could weigh on the pound should they escalate further. As for financial releases today, we highlight the release of the GDP rates for Q3 and September. The month-on-month rate is expected to remain unchanged at 0.4% mom if compared to August’s reading, while on a quarter-on-quarter level the rate is expected to slow down to 1.5% qoq in Q3, if compared to Q2’s 5.5% qoq. Both rates could weigh on the pound as in September the growth of the UK economy seemed to have failed to accelerate while on a quarterly level the UK economy has performed even worse, slowing the pace of growing. On a second note the manufacturing output growth rate is expected to slow down and reach 0.2% mom if compared to August’s 0.5%mom, intensifying worries for the UK economy.

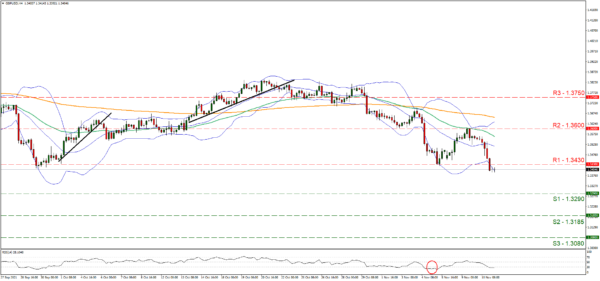

GBP/USD dropped yesterday breaking just below the 1.3430 (R1) support line, now turned to resistance . We tend to maintain a bearish outlook for the pair given also that the RSI indicator below our 4-hour chart is at the reading 30 which on the one hand confirms the bearish sentiment yet please note that a correction higher could be performed as the pair is near oversold levels. Should the bears actually maintain control over the pair we may see cable aiming if not breaching the 1.3290 (S1) support line. Should a correction higher be actually performed and the bulls take over, we may see the pair breaking the 1.3430 (R1) resistance line and take aim of the 1.3600 (R2) resistance level.

Support: 1833 (S1), 1808 (S2), 1786 (S3)

Resistance: 1851 (R1), 1870 (R2), 1887 (R3)

Support: 1.3290 (S1), 1.3185 (S2), 1.3080 (S3)

Resistance: 1.3430 (R1), 1.3600 (R2), 1.3750 (R3)