It is a relatively calm week without any central bank meetings and just a handful of data points. The only event that could spark fireworks is the latest edition of US inflation, which will probably fire up further. If price pressures continue to broaden out into different sectors too, this could set off another cascade of worries around faster Fed rate increases and reignite the dollar’s rally.

Not so transitory

Will inflation fade away by itself? This question has tormented markets and central banks recently. It definitely seemed transitory early on. Enormous government spending, paralyzed supply chains, soaring shipping costs, energy prices going ballistic – all these factors can push inflation much higher, but their impact wears off after a while.

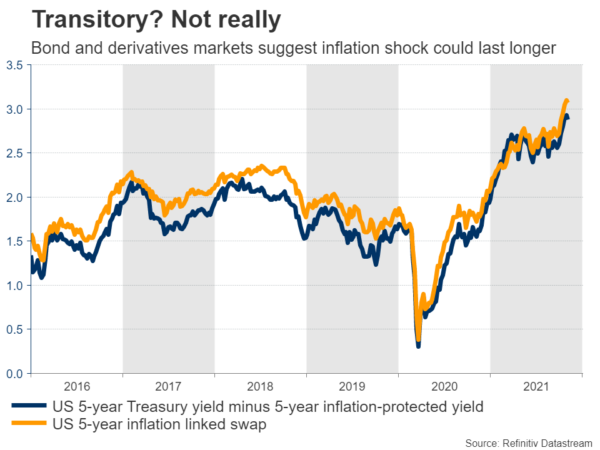

‘As long as inflation expectations aren’t rising, it’s all transitory’. This was the thinking among central bankers. Well, inflation expectations have finally stormed higher. Derivatives investors are now betting this shock will last much longer, so they are hedging their inflation exposure.

But it’s not just supply problems anymore. Wage growth is accelerating, rents have started playing catch-up with soaring house prices, and Congress is about to bring more spending to the party. This is precisely why the upcoming US inflation report on Wednesday will be so crucial. It will reveal whether inflationary pressures continue to broaden out.

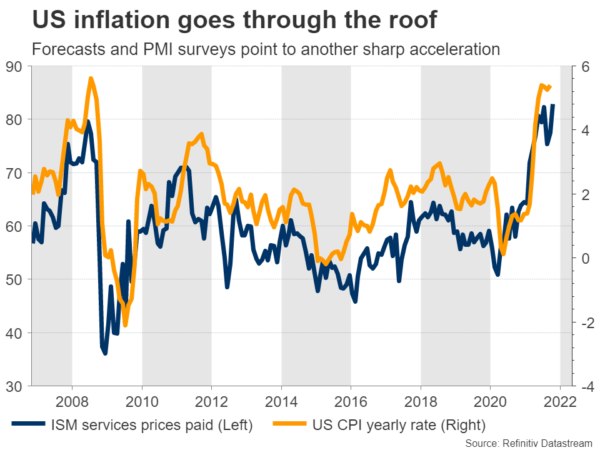

Forecasts suggest the yearly CPI rate will jump to 5.9% in October, from 5.4% previously. But considering the signals from various business surveys, the risks surrounding this forecast may even be tilted to the upside. The Markit PMIs showed companies raising their selling prices ‘at the fastest rate on record’, while the price indices in both the ISM surveys jumped sharply too.

Money markets are now pricing in two Fed rate increases for next year, in September and December. Asset purchases will end in June assuming the Fed maintains the current tapering pace. The risk is that markets could bring this entire timeline forward if inflation keeps rising. Tapering could be accelerated so that it ends in May, allowing scope for three rate hikes in June/July, September, and December.

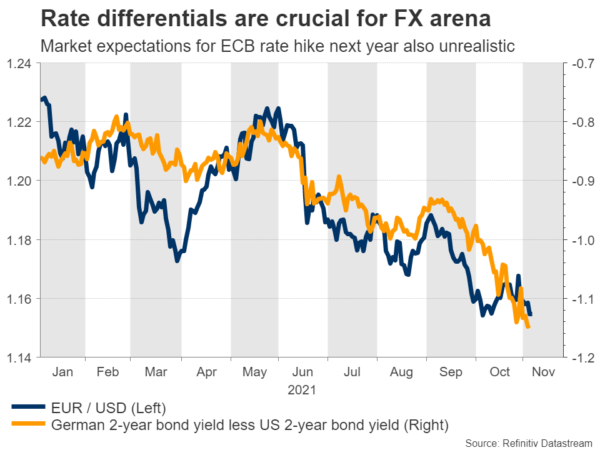

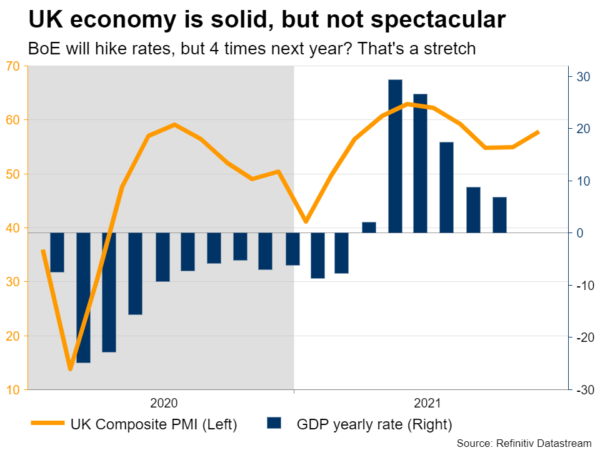

This spells upside risks for the dollar, especially against the currencies whose central banks could disappoint market expectations for aggressive rate hikes. Those are mainly the Australian dollar and British pound, although the euro falls in this category too. None of these economies are firing on all cylinders, so the current market pricing for three rate increases by the Reserve Bank of Australia next year and almost four hikes from the Bank of England seems unrealistic.

In contrast, the two central banks that could match or exceed the Fed in raising rates are the Bank of Canada and the Reserve Bank of New Zealand. The Canadian economy in particular is absolutely booming, so pairs like aussie/loonie or pound/loonie seem vulnerable moving forward – assuming oil prices hold up.

Australian jobs report eyed

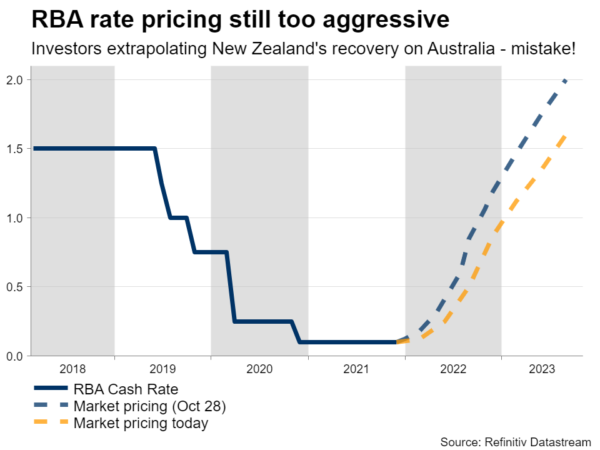

Speaking of Australia, the central bank did its best to push back against market pricing this week. Governor Lowe made it clear that rates won’t rise until 2023 at the earliest and that investors overreacted to the latest spike in inflation. But even after all that, markets continue to expect three hikes for next year.

Now to be clear, the Australian economy is not that strong. Sure, it remained resilient during the latest lockdown, but the labor market and consumption still took some damage. Meanwhile, iron ore prices are dropping like a rock and China is slowing down, which is a massive risk for the Australian economy that relies on China to absorb its exports.

It seems investors are using New Zealand’s powerful recovery as the model for how Australia will perform going forward. The two economies share similar characteristics and usually move in lockstep. This time though, it could be a mistake.

We will get some more clues on Thursday, when Australia’s jobs data for October are released. It will probably be a strong report thanks to the reopening of the economy, but is that enough to justify three rate hikes for next year? There’s plenty of scope for disappointment when markets are so hawkish.

Chinese and British data on the radar

The other events that could impact the Australian dollar and riskier assets like stocks are China’s upcoming trade numbers over the weekend and the inflation stats on Wednesday. The focus will probably fall on producer prices, which are expected to have accelerated to 12% in October from 10.7% previously on a yearly basis.

This metric will be crucial in settling the raging inflation debate. If Chinese factories keep exporting inflation abroad at an accelerating pace, it’s another factor arguing for persistent inflationary pressures.

And finally in the United Kingdom, the GDP stats for September and the entire third quarter will hit the markets on Thursday. The Bank of England took markets by storm this week after it held its fire on raising interest rates, sinking the pound. That said, investors remain confident this was only a delay, pricing in aggressive rate hikes over the next year.

As such, the risks surrounding the pound remain tilted to the downside. The UK economy is not overheating to the point where it needs dramatically higher rates. The BoE simply wants to keep inflation expectations in check, something it can achieve with far less tightening than what’s currently priced in.