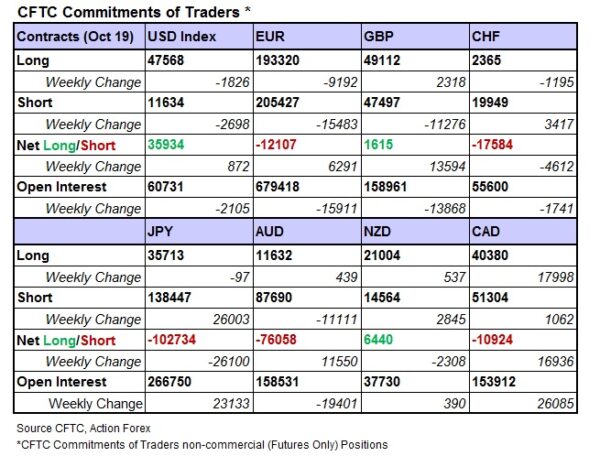

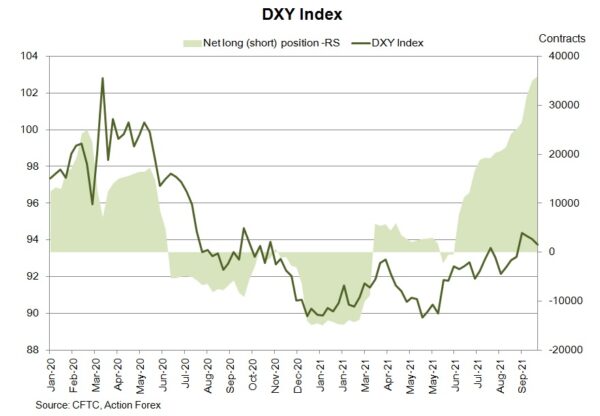

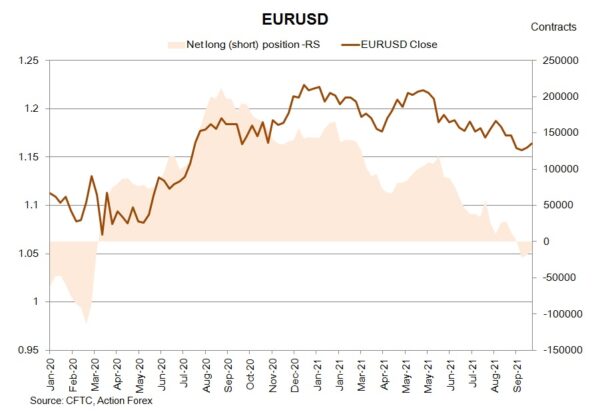

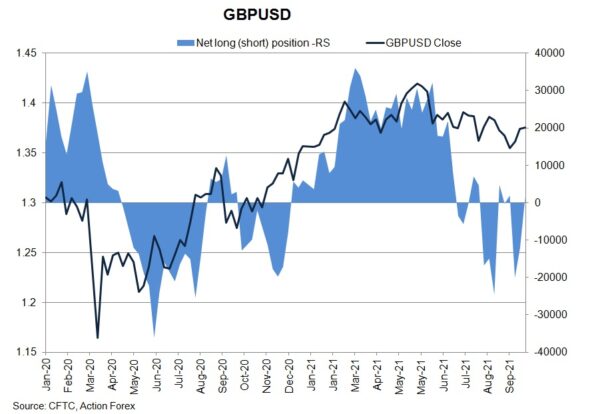

As suggested in the CFTC Commitments of Traders report in the week ended October 19, NET LENGTH of USD index futures added +872 contracts to 35 934. Bets decreased on both sides. Concerning European currencies, NET SHORT of EUR futures declined -6 291 contracts to 15 483. Speculative shorts fell -9 192 contract while shorts slumped -15 438. GBP futures switched to NET LENGTH of 1 615 as traders squared their short positions.

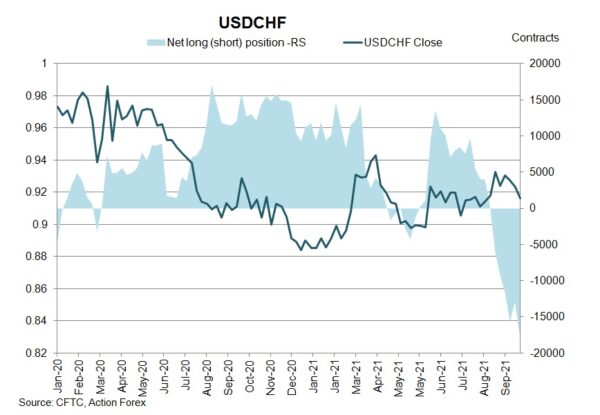

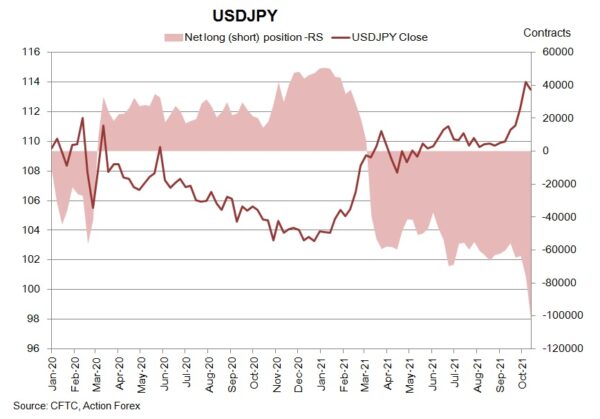

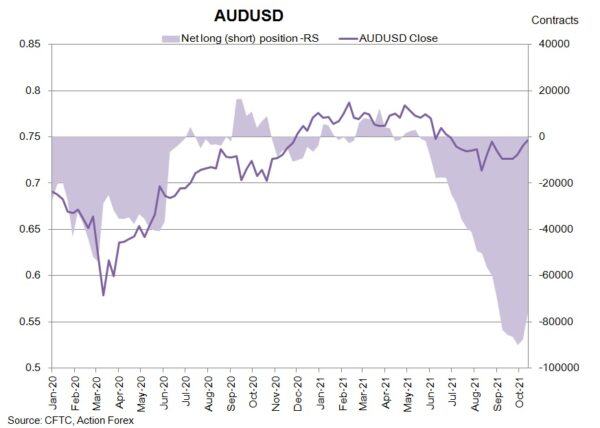

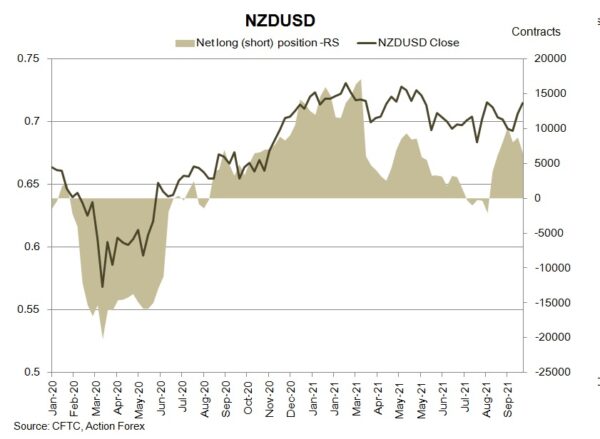

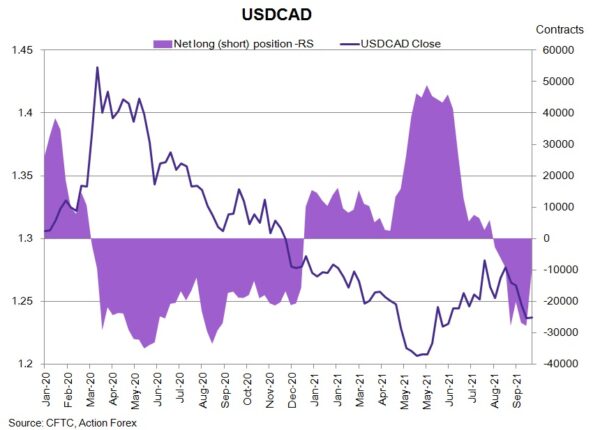

On safe-haven currencies, NET SHORT of CHF future gained +4 612 contracts to 17 584 while that of JPY futures soared +26 100 contracts to 102 734. Concerning commodity currencies, NET SHORT of AUD futures sank -11 550 contracts to 76 058. NET LENGTH for NZD futures dropped -2 308 contracts to 6 440 during the week. CAD futures’ NET SHORT slumped -16 936 contracts to 10 924.