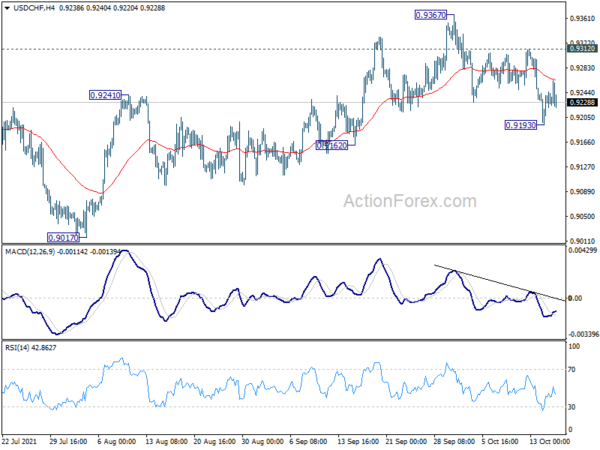

USD/CHF dropped to 0.9193 last week and the development suggests that a short term top is formed at 0.9367. But as a temporary low was formed, initial bias is neutral this week first. On the downside below 0.9193 will target 0.9162 support first. Considering bearish divergence condition in daily MACD, firm break of 0.9162 will argue that whole rise from 0.8925 has completed and target this support. On the upside, break of 0.9312 support will bring retest of 0.9367 resistance instead.

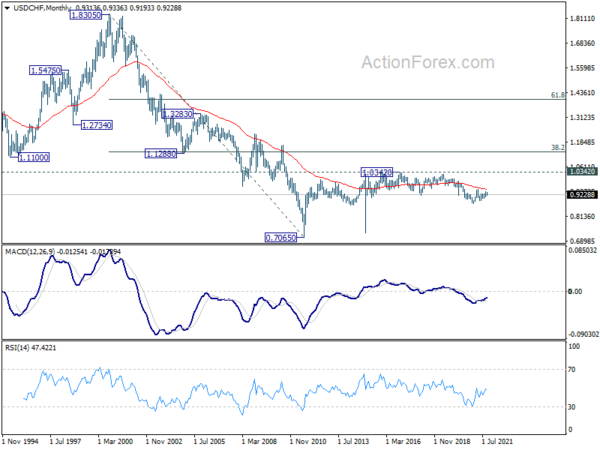

In the bigger picture, the corrective structure of the rebound from 0.8925 argues that fall from 0.9471 is not completed yet. It could either be the second leg of pattern from 0.8756 (2021 low), or resuming larger down trend from 1.0237 (2018 high). We’d pay attention to the downside momentum of assess the odds later. But for now, medium term outlook will be neutral at best as long as 0.9471 resistance holds.

In the long term picture, price actions from 0.7065 (2011 low) are currently seen as developing into a long term corrective pattern, at least until a firm break of 1.0342 resistance.