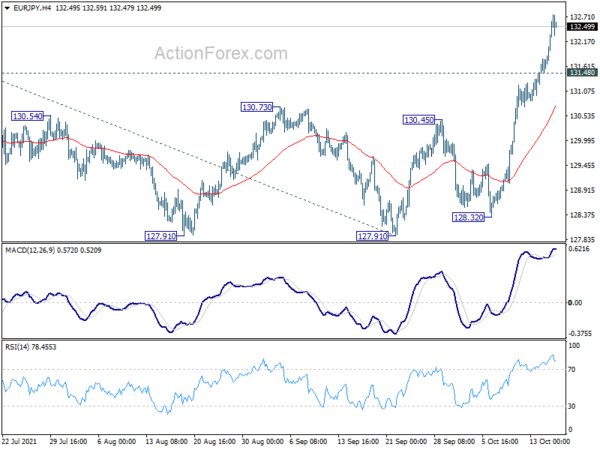

EUR/JPY’s strong rally and break of 130.45 resistance last week suggest that corrective fall from 134.11 is complete at 127.91 already. Initial bias stays on the upside this week for retesting 134.11 high first. Firm break there will resume larger up trend from 114.42. Next target is 61.8% projection of 121.63 to 134.11 from 127.91 at 135.62. On the downside, below 131.48 minor support will turn turn intraday bias neutral and bring consolidation first, before staging another rally.

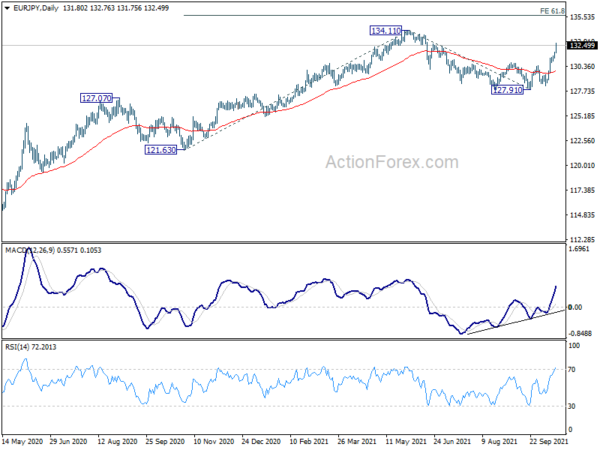

In the bigger picture, rise from 114.42 (2020 low) is still in progress and the strong support support from 55 week EMA affirms medium term bullishness. Further rise would be seen to retest 137.49 (2018 high). Decisive break there will resume the whole long term rise from 109.03 (2016 low). Next target will be 100% projection of 109.03 to 137.49 from 114.42 at 142.88. This will now remain the favored case as long as 127.91 support holds.

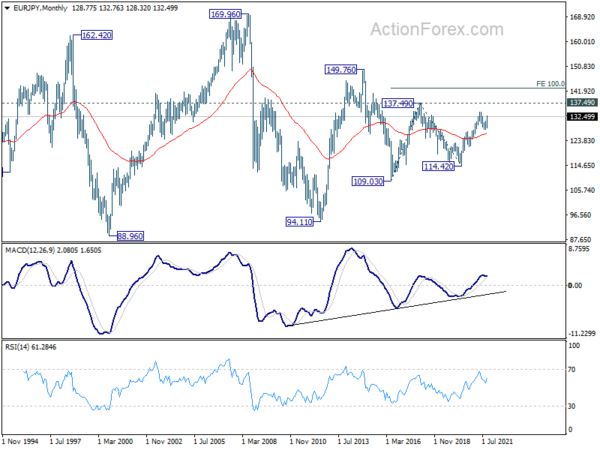

In the long term picture, EUR/JPY is staying in long term sideway pattern, established since 2000. Another rising leg in progress for 137.49 resistance and above.