US non-farm payrolls report is the major focus for today. Markets are expecting 500k job growth in September. Unemployment rate is expected to tick down from 5.2% to 5.1%. Average hourly earnings are expected to have risen 0.4% mom.

Looking at related job data, ADP report showed 568k growth in private sector jobs in the month. ISM manufacturing employment ticked up from 49.0 to 50.2. ISM services employment dipped slightly from 53.6 to 53.0. Four-week moving average of initial jobless claims dropped from 355k to 344k. Overall, the data support solid, but not spectacular, job growth in September.

- Roaring Dollar Turns To Nonfarm Payrolls

- NFP Preview: Fed Locked in to Tapering Starting Next Month Unless NFP Bombs?

- NFP Early Insight: COVID Waning, Employees’ Negotiating Power Waxing?

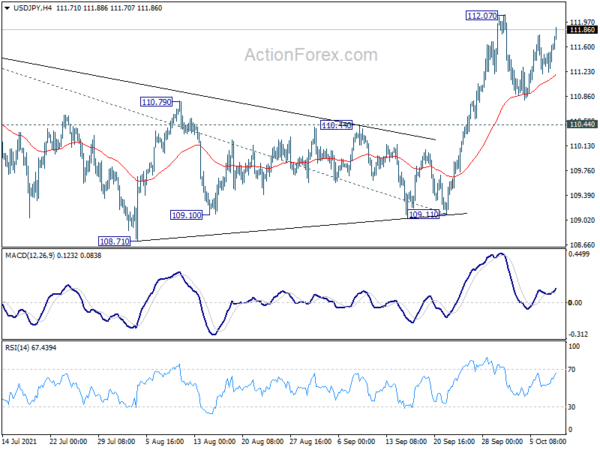

Bond market reactions to NFP today would be worth a watch. 10-year yield closed up 0.047 at 1.571 overnight, close to day high at 1.573. The development also indicates resumption of whole rise from 1.128. Positive reaction in yield to NFP would extend the rally, probably with upside acceleration, towards 1.1765 high. Such development could also lift USD/JPY through 112.07 near term resistance.