- Stocks under pressure as investors grapple with ‘mini stagflation’

- Yen and gold shine amid flight to safety, dollar stays elevated

- ISM manufacturing survey and Fed speakers in focus today

Wall Street bleeds

Worsening supply chain disruptions and a raging energy crisis have joined forces lately to reawaken fears of a stagflationary blow to the global economy. Stagflation refers to a situation where growth slows down but inflation remains hot, a combination that hasn’t emerged since the 1970s.

With energy bills skyrocketing, the risk is that companies will see their profit margins get squeezed and pass those costs down to consumers, at a time when supply bottlenecks are already restraining growth and central banks are moving towards higher rates. Of course, this is not the 1970s – workers don’t have nearly as much bargaining power to enable the vicious price-wage growth spiral that dominated back then.

Still, this could be a much smaller modern version of that, let’s call it ‘stagflation light’. Central banks can’t do much about cost-push inflation, so it’s a lose-lose situation. If they raise rates to fight supply-powered inflation, that might do more harm than good by unnecessarily cooling demand and growth.

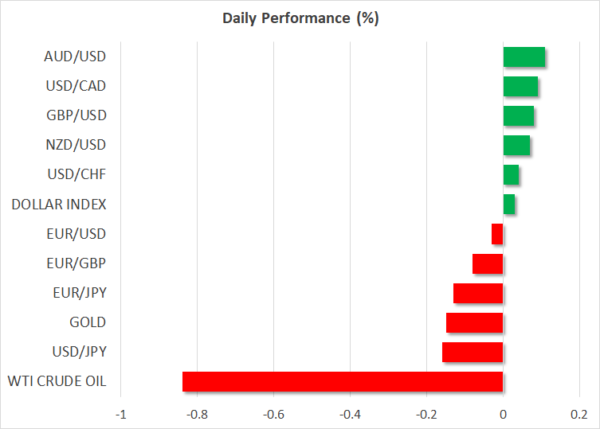

This threat seems responsible for the latest round of selling in stock markets. The S&P 500 lost 1.2% yesterday and futures point to more losses today after the index sliced through a crucial support region. The twist is that the roles have reversed and tech stocks have been more resilient lately as the risk aversion has also started to infect bond markets, pushing yields back down a touch.

While ‘stagflation light’ worries could continue to torment markets for now as these risks get priced in and valuations correct back to earth, this is unlikely to evolve into full-blown panic either. This is a temporary shock that’s more likely to leave a scratch instead of deep wounds, so it could turn into a buying opportunity before very long. After all, there is still no real alternative to equities.

Safe havens back in fashion

With stocks under fire and investors running for cover, defensive assets are back in vogue. We have reached the point where traders are willing to rotate back into bonds for safety, cooling yields and breathing new life into the yen and gold, which are highly sensitive to any moves in interest rates.

The untold story in the FX arena is that the US dollar is the most insulated major currency from the unfolding energy crisis – along with the Canadian dollar – as North America is essentially self-sufficient in power. Rising power prices globally will inevitably hit the US too, but mainly through spillover effects, in contrast to Europe and Asia. This implies less pain for the American economy from this whole ordeal.

In politics, a US government shutdown has been averted for now, with Congress passing a bill that will ensure funding until early December. However, the debt ceiling hasn’t been raised, which means either a bipartisan agreement has to be reached by October 18 or the Democrats have to do it alone through the budget reconciliation process. Either way, this isn’t a real risk. Neither party is interested in engineering the first default in the nation’s history.

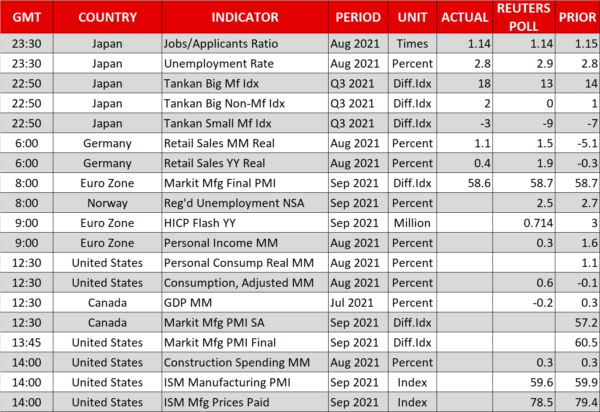

Key data and Fed speakers

As for today, all eyes will be on the ISM manufacturing PMI from America. It will reveal whether supply chains worsened further in September and provide some early clues around next week’s employment report. There’s also a batch of US data releases for August, but that’s ‘old news’ at this point.

Finally, we will hear from the Fed’s Harker (15:00 GMT) and Mester (17:00 GMT). Looking into next week, besides the latest edition of nonfarm payrolls, there are also central bank meetings in Australia and New Zealand, as well as an OPEC+ gathering.