As Dollar is digesting this week’s yield supported rally today, selling focus is turning to Euro, in particular in crosses. Meanwhile, firmer overall risk sentiment is supporting commodity currencies and Sterling, with Aussie being the stronger one. Yen and Swiss Franc are generally softer on stable risk sentiment.

Technically, as Euro turns weaker, we’ll pay attention to 1.0811 temporary low in EUR/CHF. Break there will resume the fall form 1.0936 towards 1.0694 low. Also, break of 129.36 minor support in EUR/JPY will align the outlook with GBP/JPY. That is, rebound from 127.91 has completed at 130.45 and deeper fall could be seen back to retest 127.91 low. We’d see if Euro’s selloff would accelerate and spread.

In Europe, at the time of writing, FTSE is up 0.20%. DAX is down -0.20%. CAC is up 0.05%. Germany 10-year yield is up 0.021 at -0.187. Earlier in Asia, Nikkei dropped -0.31%. Hong Kong HSI dropped -0.36%. China Shanghai SSE rose 0.90%. Singapore Strait Times rose 0.40%. Japan 10-year JGB yield rose 0.0008 to 0.070.

US initial jobless claims rose to 362k, above expectation

US initial jobless claims rose 11k to 262k in the week ending September 25, above expectation of 321k. Four-week moving average of initial claims rose 4k to 340k.

Continuing claims dropped -18k to 2802 in the week ending September 18. Four-week moving average of continuing claims dropped -750 to 2797k, lowest since March 21, 2020.

US Q2 GDP growth finalized at 6.7% annualized

US Q2 GDP growth was finalized at 6.7% annualized, revised up from 6.6%. Upward revisions to personal consumption expenditures (PCE), exports, and private inventory investment were partly offset by an upward revision to imports, which are a subtraction in the calculation of GDP.

Eurozone unemployment rate dropped to 7.5% in Aug, EU dropped to 6.8%

Eurozone unemployment rate dropped from 7.6% to 7.5% in August, versus expectation of 7.6%. EU unemployment rate dropped from 6.9% to 6.8%.

Eurostat estimates that 14.469 million men and women in the EU, of whom 12.162 million in the euro area, were unemployed in August 2021. Compared with July 2021, the number of persons unemployed decreased by 224 000 in the EU and by 261 000 in the euro area.

Also released, Germany unemployment dropped -30k in September, versus expectation of -40k. Unemployment rate was unchanged at 5.5%. Germany CPI accelerated to 4.1% yoy in September, above expectation of 3.9% yoy. Italy unemployment rate was unchanged at 9.3%. France consumer spending rose 1.0% mom in August, versus expectation of 0.1% mom.

Swiss KOF dropped to 110.6 in Sep, slowdown likely to continue in coming months

Swiss KOF Economic Barometer dropped from 113.5 to 110.6 in September, slightly above expectation of 110.3. That’s the fourth decline in a row. The index remains above its long-term average, but the slowing in recovery is “likely to continue in the coming months”.

KOF also said: “The recurring decline is primarily attributable to bundles of indicators concerning foreign demand. Indicators of the manufacturing sector send an additional negative signal, followed by indicators of the economic sector other services. By contrast, indicators from the finance and insurance sector are providing slightly positive impulses.”

UK Q2 GDP growth finalized at 5.5% qoq, still -3.3% below pre-pandemic level

UK Q2 GDP growth was finalized at 5.5% qoq, revised up from 4.8% qoq. GDP remained -3.3% below the pre-pandemic level at Q4 2019.

In output terms, the largest contributors to this increase were from wholesale and retail trade, accommodation and food service activities, education and human health, and social work activities. There were increases in all main components of expenditure, with the largest contribution from household consumption.

Also from UK, current account deficit narrowed to GBP -8.6B in Q2.

BoJ Kuroda: Timing and pace of recovery in consumption remains highly uncertain

BoJ Governor Haruhiko Kuroda reiterated in a speech that “consumption is expected to pick up if further progress in vaccinations allow society to curb infections, while resuming economic activity.”

“But the timing and pace of recovery in consumption remains highly uncertain and could change depending on how the pandemic unfolds,” he added.

“We will scrutinise the impact of the pandemic on the economy and take additional easing steps without hesitation if needed,” he pledged again.

Japan industrial production dropped -3.2% mom in Aug, auto production shrank

Japan industrial production dropped -3.2% mom in August, worse than expectation of -0.5% mom. Production in auto dropped -15.2% mom as affected by global semiconductor shortage and factory shutdowns in Southeast Asia. Output of electrical machinery and information and communication electronics equipment also dropped -10.6% mom.

The Ministry of Economy, Trade and Industry downgraded the assessment of industrial production, and said recovery “has paused. Nevertheless, based on a poll of manufacturers, production is expected to rise 0.2% mom in September and then 6.8% mom in October.

Also released, retail sales dropped -3.2% yoy in August, versus expectation of -1.3% yoy. That’s the first decline in six months. Housing starts rose 7.5% yoy in August, versus expectation of 9.6% yoy.

China Caixin PMI manufacturing rose to 50, pandemic impacts demand, supply and circulation

China Caixin PMI Manufacturing rose from 49.2 to 50.0 in September, above expectation of 49.6. Caixin said new orders returned to growth. Output fell at softer pace. Inflation pressures picked up amid material shortages.

Wang Zhe, Senior Economist at Caixin Insight Group said: “On the one hand, the epidemic continued to impact demand, supply, and circulation in the manufacturing sector. The state of the epidemic overseas and the shortage of shipping capacity also dragged down total demand. Epidemic control measures have clearly impacted the logistics industry.”

Also released, the official NBS PMI Manufacturing dropped from 50.1 to 49.6 in September, versus expectation of 50.2. PMI Non-Manufacturing rose from 47.5 to 53.2, above expectation of 50.8.

New Zealand ANZ business confidence rose to -7.2, activity dropped to 18.2

New Zealand ANZ Business Confidence rose to -7.2 in September, up from August’s -14.5. Own Activity Outlook dropped to 18.2, down from 20.2. Looking at some details, export intentions dropped from 8.4 to 7.4. Investment intentions dropped from 15.4 to 9.2. Cost expectations dropped from 85.0 to 84.2. Employment intentions dropped from 17.9 to 14.1. Inflation expectations ticked down from 3.06% to 3.02%.

ANZ said: “The Auckland COVID outbreak drags on but businesses so far appear to be keeping their eyes on the prize. Spending has already bounced back quite a lot, particularly outside Auckland, and experience has shown momentum tends to recover quickly. In that context, interest rate increases may well prove more of a challenge. The housing market is vulnerable, with headwinds gathering, and there’s no question the housing market and construction more generally have been key drivers of growth over the past 18 months – for what’s definitely been a mix of better and worse.

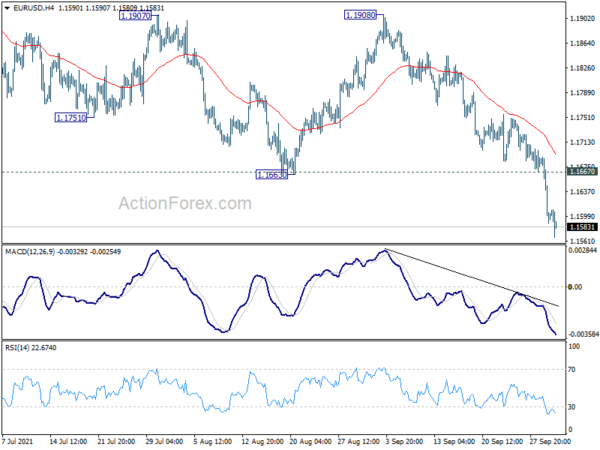

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1560; (P) 1.1625; (R1) 1.1661; More…

Intraday bias in EUR/USD remains on the downside at this point. It’s now in a deeper correction to whole rise from 1.0634. Next target is 1.1289 medium term fibonacci level. On the upside, above 1.1667 minor resistance will turn intraday bias neutral and bring consolidations first. But risk will stay on the downside as long as 1.1908 resistance holds.

In the bigger picture, sustained break of 1.1602 will argue that rise from 1.0635 (2020 low) has completed at 1.2348. Deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289. Note also that the firm break of 55 week EMA (1.1830) also carries medium term bearish implication. Firm break of 1.1289 will pave the way to retest 1.0635 low. On the upside, though, break of 1.1908 resistance will revive medium term bullishness and turn focus back to 1.2348 high.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M Aug P | -3.20% | -0.50% | -1.50% | |

| 23:50 | JPY | Retail Trade Y/Y Jul | -3.20% | -1.30% | 2.40% | |

| 01:00 | CNY | NBS Manufacturing PMI Sep | 49.6 | 50.2 | 50.1 | |

| 01:00 | CNY | Non-Manufacturing PMI Sep | 53.2 | 50.8 | 47.5 | |

| 01:30 | AUD | Private Sector Credit M/M Aug | 0.60% | 0.50% | 0.70% | |

| 01:45 | CNY | Caixin Manufacturing PMI Sep | 50 | 49.6 | 49.2 | |

| 05:00 | JPY | Housing Starts Y/Y Aug | 7.50% | 9.60% | 9.90% | |

| 06:00 | GBP | GDP Q/Q Q2 F | 5.50% | 4.80% | 4.80% | |

| 06:00 | GBP | Current Account (GBP) Q2 | -8.6B | -16.6B | -12.8B | |

| 06:45 | EUR | France Consumer Spending M/M Aug | 1.00% | 0.10% | -2.20% | -2.40% |

| 07:00 | CHF | KOF Leading Indicator Sep | 110.6 | 110.3 | 113.5 | |

| 07:55 | EUR | Germany Unemployment Change Sep | -30K | -40K | -53K | |

| 07:55 | EUR | Germany Unemployment Rate Sep | 5.50% | 5.60% | 5.50% | |

| 08:00 | EUR | Italy Unemployment Aug | 9.30% | 9.20% | 9.30% | |

| 09:00 | EUR | Eurozone Unemployment Rate Aug | 7.50% | 7.60% | 7.60% | |

| 12:00 | EUR | Germany CPI M/M Sep P | 0.00% | 0.10% | 0.00% | |

| 12:00 | EUR | Germany CPI Y/Y Sep P | 4.10% | 3.90% | 3.90% | |

| 12:30 | USD | Initial Jobless Claims (Sep 24) | 362K | 321K | 351K | |

| 12:30 | USD | GDP Annualized Q2 F | 6.70% | 6.70% | 6.60% | |

| 12:30 | USD | GDP Price Index Q2 F | 6.10% | 6.10% | 6.20% | |

| 13:45 | USD | Chicago PMI Sep | 66.7 | 66.8 | ||

| 14:30 | USD | Natural Gas Storage | 86B | 76B |