The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.1682

Prev Close: 1.1596

% chg. over the last day: -0.74%

The EUR/USD exchange rate decreased to its lowest level in 14 months as the energy crisis in Europe, caused by a sharp increase in natural gas prices, raises concerns about the strength of the economic recovery in the Eurozone and increases negative pressure on the currency.

Trading recommendations

Support levels: 1.1564, 1.1453

Resistance levels: 1.1671, 1.1717, 1.1772, 1.1802, 1.1835

From the technical point of view, the EUR/USD trend has changed to bearish. On the background of the weakness of the European currency, the quotes went down sharply. The price has broken through and consolidated below the priority change level. Under such market conditions, traders should consider sell deals from the resistance levels near the moving average, as the price has deviated strongly from the middle line. Buy trades should be considered only from the support levels with additional confirmation in the form of a buyers’ initiative.

Alternative scenario: if the price breaks out through the 1.1717 resistance level and fixes above, the mid-term uptrend will likely resume.

News feed for 2021.09.30:

- German Unemployment Rate (m/m) at 10:55 (GMT+3);

- Eurozone Unemployment Rate (m/m) at 12:00 (GMT+3);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

- US GDP (q/q) at 15:30 (GMT+3);

- US Chicago PMI (m/m) at 16:45 (GMT+3);

- US FOMC Member Williams’s Speech at 17:00 (GMT+3);

- US FOMC Member Bostic’s Speech at 18:00 (GMT+3).

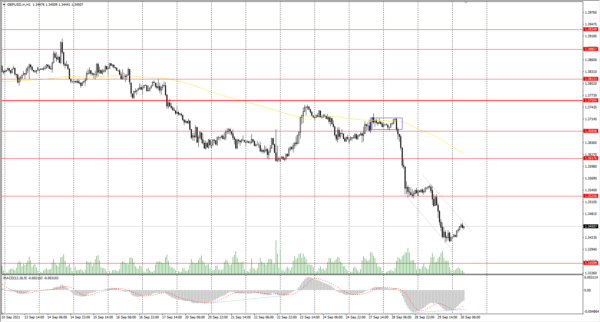

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.3527

Prev Close: 1.3425

% chg. over the last day: -0.75%

The British pound is also rapidly losing its position amid the dollar index rising. In addition to problems with getting food to the store shelves and fuel to the gas stations, energy problems have also been added. Three more power suppliers in the UK have stopped working.

Trading recommendations

Support levels: 1.3360, 1.3282

Resistance levels: 1.3525, 1.3617, 1.3685, 1.3759, 1.3812, 1.3886

On the hourly time frame, the GBP/USD trend is bearish. The MACD indicator is negative, but there are signs of overselling and divergence. Buy trades should be considered only throughout the day and only with short targets from the support levels after the buyer’s initiative. Sell trades can be found at the resistance levels near the moving average line, as the price has deviated from the average values.

Alternative scenario: if the price breaks out through the 1.3759 resistance level and consolidates above, the bullish scenario will likely resume.

News feed for 2021.09.30:

- UK GDP (q/q) at 09:00 (GMT+3).

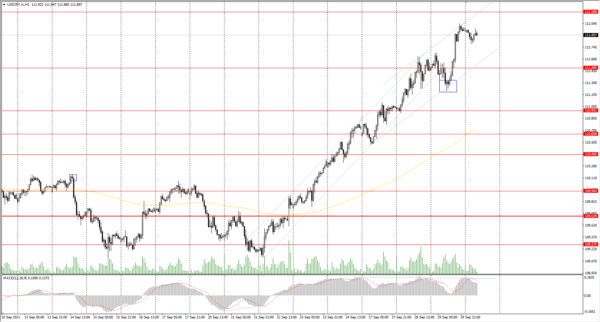

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 111.46

Prev Close: 111.97

% chg. over the last day: +0.46%

The Japanese Yen futures continue to decline as a result of the strengthening dollar index and a slowdown in the economic recovery in Japan. Japan’s industrial production fell by 3.2% month-on-month in August due to the weak automotive production against the background of a global shortage of chips and failures in supply chains.

Trading recommendations

Support levels: 111.49, 110.95, 110.65, 110.40, 109.95, 109.63, 109.27

Resistance levels: 112.19

The main trend of the USD/JPY currency pair is bullish. Against the background of the Japanese Yen weakness and strengthening of the dollar index, the USD/JPY quotes continue to grow. The angle of the ascending channel has decreased, while the MACD indicator continues to signal overbuying and divergence. All these are signs of the buyer’s weakness. Under such market conditions, it’s better to look for buy positions from the support levels after a small pullback. The price has deviated strongly from the moving average, and now there is a high probability of decline. Sell positions should be considered only throughout the day from the resistance levels in conjunction with the sellers’ initiative.

Alternative scenario: if the price falls below 110.45, the uptrend is likely to be broken.

News feed for 2021.09.30:

- Japan Industrial Production (m/m) at 02:50 (GMT+3);

- Japan Retail Sales (m/m) at 02:50 (GMT+3);

- Japan BoJ Gov Haruhiko Kuroda’s Speech at 10:10 (GMT+3).

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.2686

Prev Close: 1.2754

% chg. over the last day: +0.53%

The Canadian dollar is a commodity currency, so USD/CAD is highly dependent on the dynamics of the dollar index and oil prices. The dollar index sharply jumped yesterday, while oil prices remained unchanged. As a result, the USD/CAD quotes increased due to the weakness of the Canadian currency.

Trading recommendations

Support levels: 1.2701, 1.2611, 1.2565, 1.2518, 1.2425

Resistance levels: 1.2774, 1.2891

From the technical point of view, the trend on the USD/CAD currency pair is bearish. But the local trend is bullish and the price has approached the priority change level. The MACD indicator has returned to the positive zone, there are signs of buyers. Under such market conditions, it is better to look for buy deals from the support levels, but only with short targets. It is best to look for sell deals from the resistance levels after the sellers’ initiative in the form of an impulse movement.

Alternative scenario: if the price breaks out through the 1.2774 resistance level and fixes above, the uptrend will likely resume.