Brent Oil rallied and erased the last two day’s losses. Is strong bullish on the daily chart also because the USD/CAD has touched fresh new lows on Tuesday. Technically should climb much higher on the short term after a false breakdown.

Brent has taken advantage of a weaker USD, as you already know, a weaker greenback makes the oil much cheaper for the international customers from outside the United States. The USD/CAD drop helped the oil to climb much higher, but we still need a confirmation that will resume this upside momentum.

You should be careful in the afternoon during the Canadian data release, the Trade Balance could drop further to -3.8B, while the Labor Productivity could increase by 0.9%. The main event will be the release of the Overnight Rate, the BOC is expected to leave the monetary policy unchanged, only a surprise could shake the price.

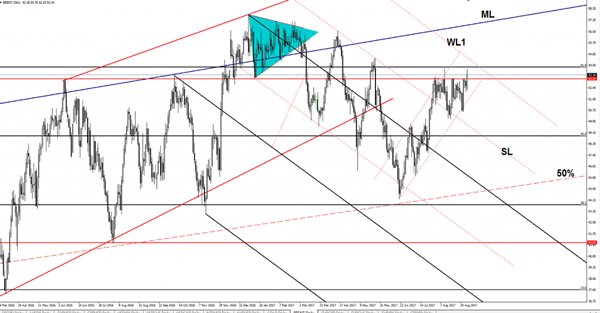

Price rallied and has managed to climb above the 53.03 major horizontal resistance, but failed once again to reach and retest the 61.8% retracement level. Now has retreated a little and could retest the broken static resistance before will climb much higher. Only a false breakout will signal a reversal on the short term.

Brent continues to move higher within the ascending channel, so it should climb towards new peaks in the upcoming period. However, only a valid breakout above the warning line (wl1) and above the 61.8% retracement level will confirm an increase towards the major upside target from the median line (ML).