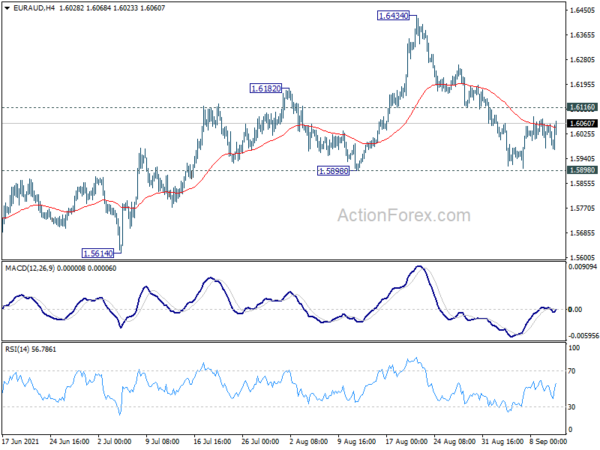

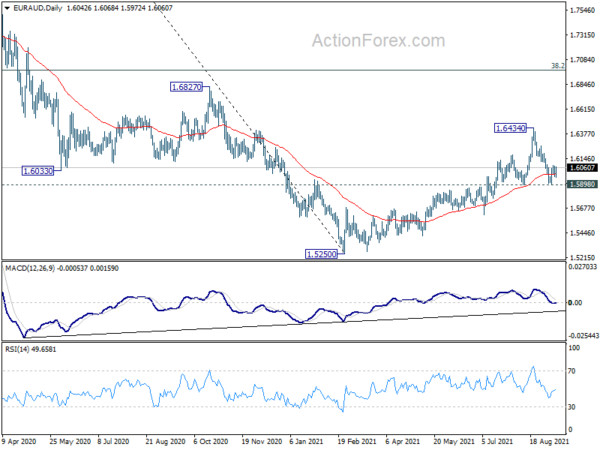

EUR/AUD recovered ahead of 1.5898 support last week, but upside is limited below 1.6116 resistance so far. Initial bias remains neutral this week first. On the upside, break of 1.6116 will argue that pull back from 1.6434 has completed after defending 1.5898 structural support. Larger rise from 15250 is still in progress. Intraday bias will be turned back to the upside for retesting 1.6434 first. On the downside, however, firm break of 1.5898 will argue that corrective rise from 1.5250 has already completed. Near term outlook will be turned bearish for 1.5614 support next.

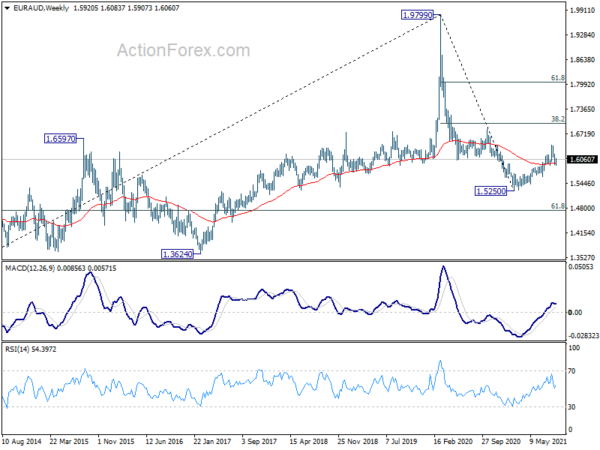

In the bigger picture, rise from 1.5250 medium term bottom is currently seen as a correction to the down trend from 1.9799 first. Stronger rise could be seen to 38.2% retracement of 1.9799 to 1.5250 at 1.6988 next. We’d tentatively expect strong resistance from there to limit upside, at least on first attempt. Meanwhile, break of 1.5898 support will indicate that the rebound has completed. Larger down trend from 1.9799 might be ready to resume through 1.5250 low.

In the longer term picture, rise from 1.1602 (2012 low) should have already completed with three waves up to 1.9799 (2020 high). Fall from there is seen as a medium term to long term down leg as a long term down trend, or a sideway pattern. We’ll assess the odds again at a later stage.