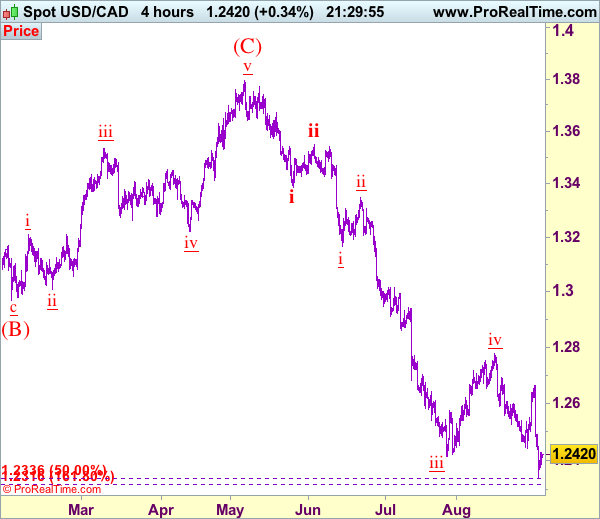

USD/CAD – 1.2419

New strategy :

Sell at 1.2500, Target: 1.2340, Stop: 1.2560

Position: –

Target: –

Stop:-

As the greenback has recovered after falling to 1.2340 on Friday, suggesting minor consolidation would be seen and recovery to 1.2450-55 is likely, however, as last week’s breach of previous support at 1.2414 confirms recent decline has resumed in wave v, reckon upside would be limited to 1.2500 and bring another decline to 1.2335-40, then 1.2310-15, having said that, oversold condition should limit downside and reckon current wave v would be limited to 1.2250-60 and price should stay above 1.2200-10. We are keeping our count that wave v as well as wave (C) ended at 1.3794 and impulsive wave (i ii, i ii) is now unfolding with minor wave iii ended at 1.2414, followed by wave iv correction possibly ended at 1.2778, wave v should extend towards 1.2200.

In view o this, would not chase this fall here and would be prudent to sell on recovery as 1.2500-10 should limit upside. Above 1.2550 would suggest a temporary low is formed instead, bring a stronger rebound to 1.2575-80 but indicated resistance at 1.2663 should remain intact.

To recap, wave B from 1.3066 is unfolding as an a-b-c and is sub-divided as a: 1.2192, b: 1.2716 and wave c is a 5-waver with i: 1.1983, ii: 1.2506, extended wave iii with minor iii at 1.0206, wave iv ended at 1.0781 and wave v as well as wave iii has ended at 0.9931, hence the subsequent choppy trading is the wave iv which is unfolding as (a)-(b)-(c) with (a) leg of iv ended at 1.0854, followed by (b) leg at 1.0108 and (c) leg as well as the wave iv ended at 1.0674. The wave v is sub-divided by minor wave (i): 0.9980, (ii): 1.0374, (iii): 0.9446, (iv): 0.9913 and (v) as well as v has possibly ended at 0.9407, therefore, consolidation with upside bias is seen for major correction, indicated target at 1.3700 and 1.4000 had been met and further gain to 1.4700 would be seen later.